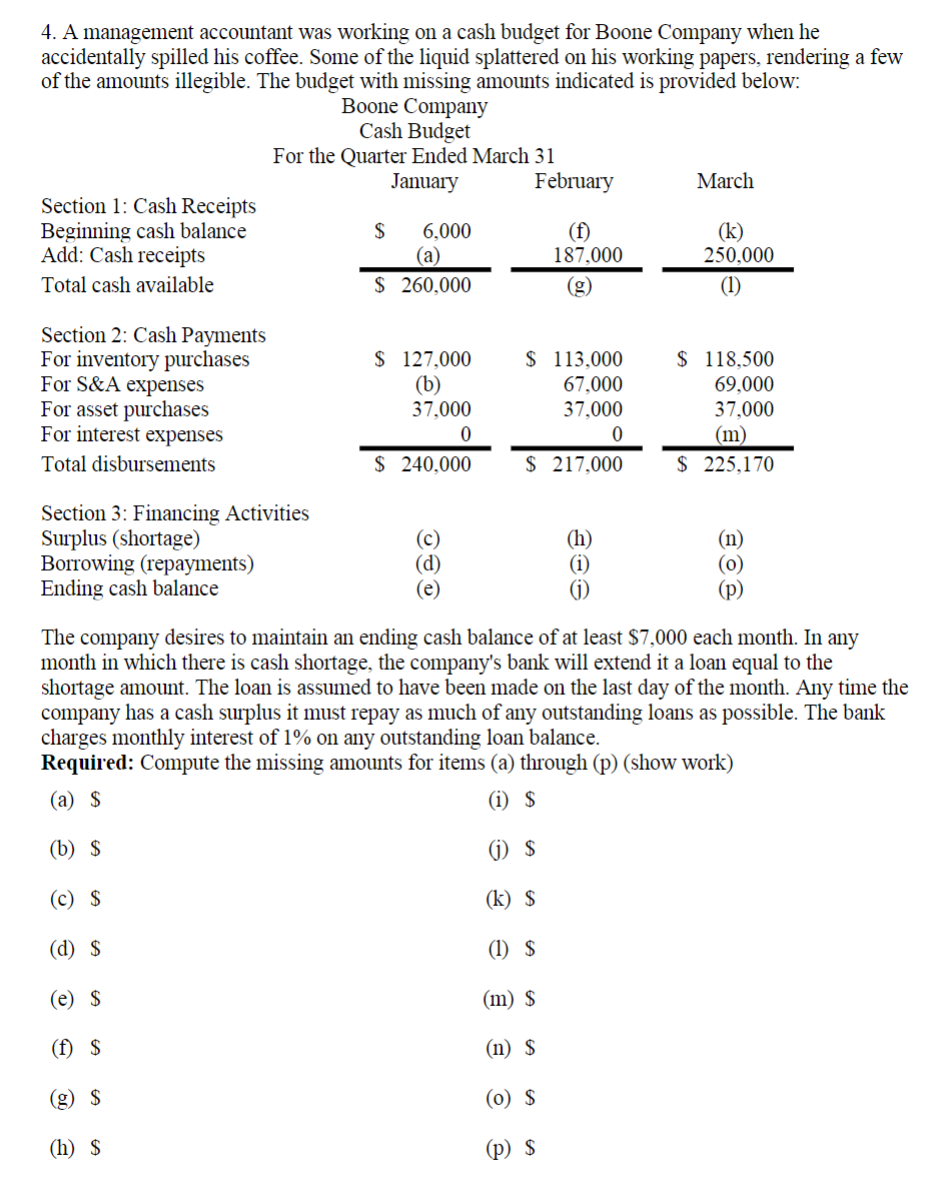

4. A management accountant was working on a cash budget for Boone Company when he accidentally spilled his coffee. Some of the liquid splattered on his working papers, rendering a few of the amounts illegible. The budget with missing amounts indicated is provided below: Boone Company Cash Budget For the Quarter Ended March 31 January February March Section 1: Cash Receipts Beginning cash balance Add: Cash receipts $ (a) (f) 187,000 6,000 (k) 250,000 Total cash available $ 260,000 (g) (1) Section 2: Cash Payments For inventory purchases For S&A expenses For asset purchases For interest expenses $ 127,000 (b) 37,000 $ 113,000 67,000 37,000 $ 118,500 69,000 37,000 (m) Total disbursements $ 240,000 217,000 $ 225,170 Section 3: Financing Activities Surplus (shortage) Borrowing (repayments) Ending cash balance (c) (h) (i) (n) (p) The company desires to maintain an ending cash balance of at least $7,000 each month. In any month in which there is cash shortage, the company's bank will extend it a loan equal to the shortage amount. The loan is assumed to have been made on the last day of the month. Any time the company has a cash surplus it must repay as much of any outstanding loans as possible. The bank charges monthly interest of 1% on any outstanding loan balance. Required: Compute the missing amounts for items (a) through (p) (show work) (a) $ (i) $ (b) $ (j) $ (c) $ (k) $ (d) $ (1) $ (e) $ (m) $ (f) $ (n) $ (g) $ (0) $ (h) $ (p) S

4. A management accountant was working on a cash budget for Boone Company when he accidentally spilled his coffee. Some of the liquid splattered on his working papers, rendering a few of the amounts illegible. The budget with missing amounts indicated is provided below: Boone Company Cash Budget For the Quarter Ended March 31 January February March Section 1: Cash Receipts Beginning cash balance Add: Cash receipts $ (a) (f) 187,000 6,000 (k) 250,000 Total cash available $ 260,000 (g) (1) Section 2: Cash Payments For inventory purchases For S&A expenses For asset purchases For interest expenses $ 127,000 (b) 37,000 $ 113,000 67,000 37,000 $ 118,500 69,000 37,000 (m) Total disbursements $ 240,000 217,000 $ 225,170 Section 3: Financing Activities Surplus (shortage) Borrowing (repayments) Ending cash balance (c) (h) (i) (n) (p) The company desires to maintain an ending cash balance of at least $7,000 each month. In any month in which there is cash shortage, the company's bank will extend it a loan equal to the shortage amount. The loan is assumed to have been made on the last day of the month. Any time the company has a cash surplus it must repay as much of any outstanding loans as possible. The bank charges monthly interest of 1% on any outstanding loan balance. Required: Compute the missing amounts for items (a) through (p) (show work) (a) $ (i) $ (b) $ (j) $ (c) $ (k) $ (d) $ (1) $ (e) $ (m) $ (f) $ (n) $ (g) $ (0) $ (h) $ (p) S

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 66.1C

Related questions

Question

Transcribed Image Text:4. A management accountant was working on a cash budget for Boone Company when he

accidentally spilled his coffee. Some of the liquid splattered on his working papers, rendering a few

of the amounts illegible. The budget with missing amounts indicated is provided below:

Boone Company

Cash Budget

For the Quarter Ended March 31

January

February

March

Section 1: Cash Receipts

Beginning cash balance

Add: Cash receipts

6,000

(f)

187,000

(k)

250,000

$

(а)

$ 260,000

Total cash available

(g)

(1)

Section 2: Cash Payments

For inventory purchases

For S&A expenses

For asset purchases

For interest expenses

$ 113,000

$ 127,000

(b)

$ 118,500

67,000

69,000

37,000

37,000

37,000

(m)

Total disbursements

$ 240,000

$ 217,000

$ 225,170

Section 3: Financing Activities

Surplus (shortage)

Borrowing (repayments)

Ending cash balance

(c)

(d)

(e)

(h)

(n)

(p)

The company desires to maintain an ending cash balance of at least $7,000 each month. In any

month in which there is cash shortage, the company's bank will extend it a loan equal to the

shortage amount. The loan is assumed to have been made on the last day of the month. Any time the

company has a cash surplus it must repay as much of any outstanding loans as possible. The bank

charges monthly interest of 1% on any outstanding loan balance.

Required: Compute the missing amounts for items (a) through (p) (show work)

(а) S

(i) $

(b) $

(j) $

(c) $

(k) $

(d) $

(1) $

(e) $

(m) $

(f) $

(n) $

(g) $

(0) $

(h) $

(p) $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning