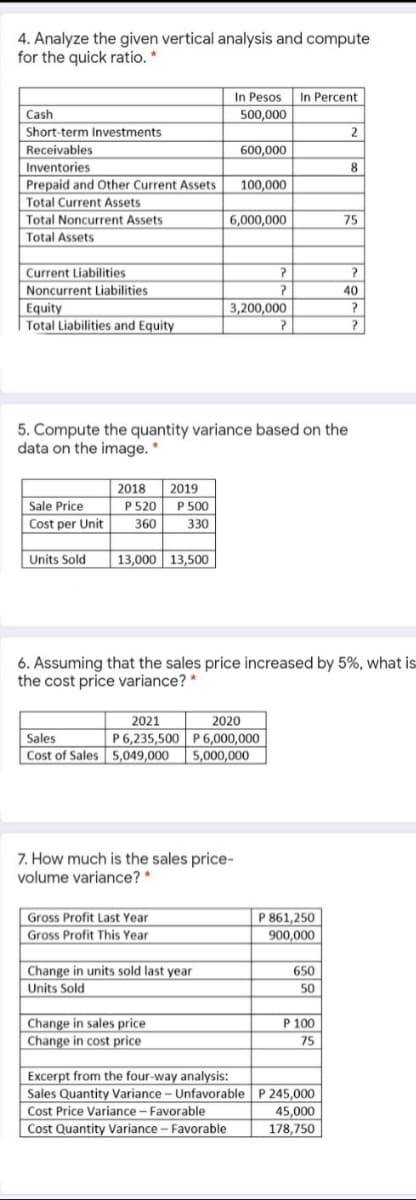

4. Analyze the given vertical analysis and compute for the quick ratio. * In Pesos In Percent 500,000 Cash Short-term Investments 2 Receivables Inventories 600,000 8. 100,000 Prepaid and Other Current Assets Total Current Assets Total Noncurrent Assets 6,000,000 75 Total Assets Current Liabilities Noncurrent Liabilities 40 3,200,000 Equity Total Liabilities and Equity

4. Analyze the given vertical analysis and compute for the quick ratio. * In Pesos In Percent 500,000 Cash Short-term Investments 2 Receivables Inventories 600,000 8. 100,000 Prepaid and Other Current Assets Total Current Assets Total Noncurrent Assets 6,000,000 75 Total Assets Current Liabilities Noncurrent Liabilities 40 3,200,000 Equity Total Liabilities and Equity

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 16P: Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for...

Related questions

Question

Practice Pack

Transcribed Image Text:4. Analyze the given vertical analysis and compute

for the quick ratio. *

In Pesos In Percent

500,000

Cash

Short-term Investments

2

Receivables

600,000

Inventories

8

Prepaid and Other Current Assets

100,000

Total Current Assets

Total Noncurrent Assets

6,000,000

75

Total Assets

Current Liabilities

?

Noncurrent Liabilities

Equity

Total Liabilities and Equity

40

3,200,000

5. Compute the quantity variance based on the

data on the image.

2018

Sale Price

Cost per Unit

2019

P 520 P 500

330

360

Units Sold

13,000 13,500

6. Assuming that the sales price increased by 5%, what is

the cost price variance? *

2021

P 6,235,500| P 6,000,000

Cost of Sales 5,049,000 5,000,000

2020

Sales

7. How much is the sales price-

volume variance? *

P 861,250

900,000

Gross Profit Last Year

Gross Profit This Year

Change in units sold last year

Units Sold

650

50

P 100

Change in sales price

Change in cost price

75

Excerpt from the four-way analysis:

Sales Quantity Variance - Unfavorable P 245,000

Cost Price Variance - Favorable

45,000

Cost Quantity Variance - Favorable

178,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning