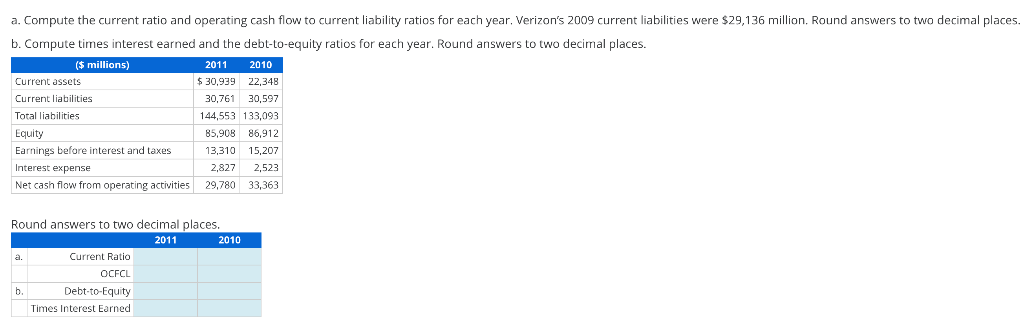

a. Compute the current ratio and operating cash flow to current liability ratios for each year. Verizon's 2009 current liabilities were $29,136 million. Round answers to two decimal places. b. Compute times interest earned and the debt-to-equity ratios for each year. Round answers to two decimal places. (S millions) 2011 2010 Current assets $ 30,939 22,348 Current liabilities 30,761 30,597 Total liabilities 144,553 133,093 Equity 85,908 86,912 Earnings before interest and taxes 13,310 15,207 Interest expense 2,827 2,523 Net cash flow from operating activities 29,780 33,363 Round answers to two decimal places. 2011 2010 a. Current Ratio OCFCL b. Debt-to-Equity Times Interest Earned

a. Compute the current ratio and operating cash flow to current liability ratios for each year. Verizon's 2009 current liabilities were $29,136 million. Round answers to two decimal places. b. Compute times interest earned and the debt-to-equity ratios for each year. Round answers to two decimal places. (S millions) 2011 2010 Current assets $ 30,939 22,348 Current liabilities 30,761 30,597 Total liabilities 144,553 133,093 Equity 85,908 86,912 Earnings before interest and taxes 13,310 15,207 Interest expense 2,827 2,523 Net cash flow from operating activities 29,780 33,363 Round answers to two decimal places. 2011 2010 a. Current Ratio OCFCL b. Debt-to-Equity Times Interest Earned

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 50E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Please answer both

Transcribed Image Text:a. Compute the current ratio and operating cash flow to current liability ratios for each year. Verizon's 2009 current liabilities were $29,136 million. Round answers to two decimal places.

b. Compute times interest earned and the debt-to-equity ratios for each year. Round answers to two decimal places.

($ millions)

2011

2010

Current assets

$ 30,939 22,348

Current liabilities

30,761

30,597

Total liabilities

144,553 133,093

Equity

85,908 86,912

Earnings before interest and taxes

13,310

15,207

Interest expense

2,827

2,523

Net cash flow from operating activities

29,780

33,363

Round answers to two decimal places.

2011

2010

a.

Current Ratio

OCFCL

b.

Debt-to-Equity

Times Interest Earned

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub