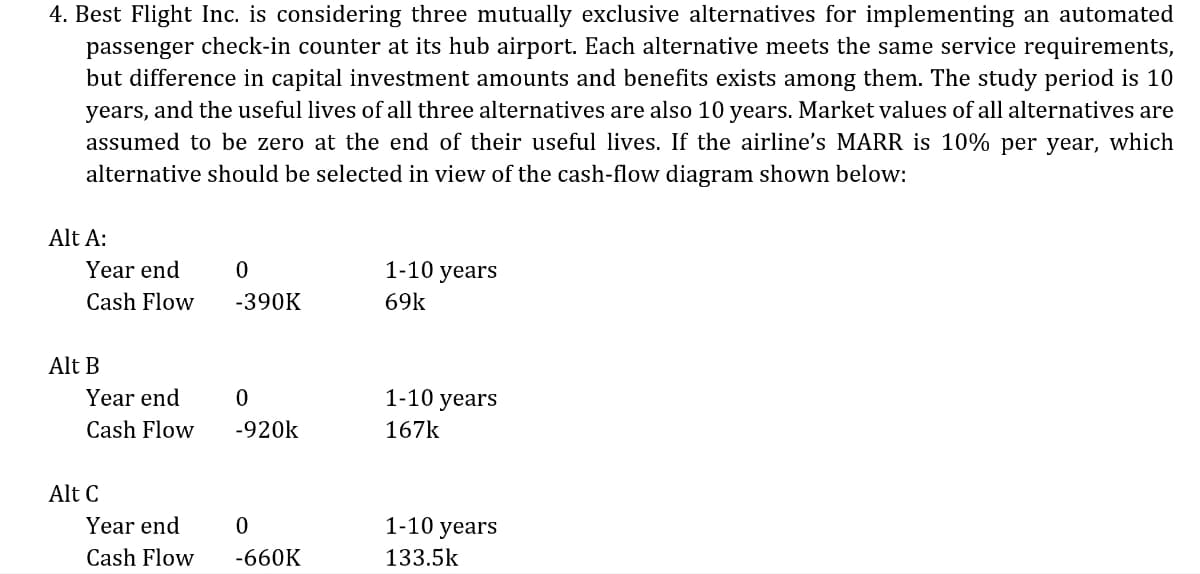

4. Best Flight Inc. is considering three mutually exclusive alternatives for implementing an automated passenger check-in counter at its hub airport. Each alternative meets the same service requirements, but difference in capital investment amounts and benefits exists among them. The study period is 10 years, and the useful lives of all three alternatives are also 10 years. Market values of all alternatives are assumed to be zero at the end of their useful lives. If the airline's MARR is 10% per year, which alternative should be selected in view of the cash-flow diagram shown below: Alt A: Year end 1-10 years Cash Flow -390K 69k Alt B Year end 1-10 years Cash Flow -920k 167k Alt C Year end 1-10 years Cash Flow -660K 133.5k

4. Best Flight Inc. is considering three mutually exclusive alternatives for implementing an automated passenger check-in counter at its hub airport. Each alternative meets the same service requirements, but difference in capital investment amounts and benefits exists among them. The study period is 10 years, and the useful lives of all three alternatives are also 10 years. Market values of all alternatives are assumed to be zero at the end of their useful lives. If the airline's MARR is 10% per year, which alternative should be selected in view of the cash-flow diagram shown below: Alt A: Year end 1-10 years Cash Flow -390K 69k Alt B Year end 1-10 years Cash Flow -920k 167k Alt C Year end 1-10 years Cash Flow -660K 133.5k

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

100%

Transcribed Image Text:4. Best Flight Inc. is considering three mutually exclusive alternatives for implementing an automated

passenger check-in counter at its hub airport. Each alternative meets the same service requirements,

but difference in capital investment amounts and benefits exists among them. The study period is 10

years, and the useful lives of all three alternatives are also 10 years. Market values of all alternatives are

assumed to be zero at the end of their useful lives. If the airline's MARR is 10% per year, which

alternative should be selected in view of the cash-flow diagram shown below:

Alt A:

Year end

1-10 years

Cash Flow

-390K

69k

Alt B

Year end

1-10 years

Cash Flow

-920k

167k

Alt C

Year end

1-10 years

Cash Flow

-660K

133.5k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning