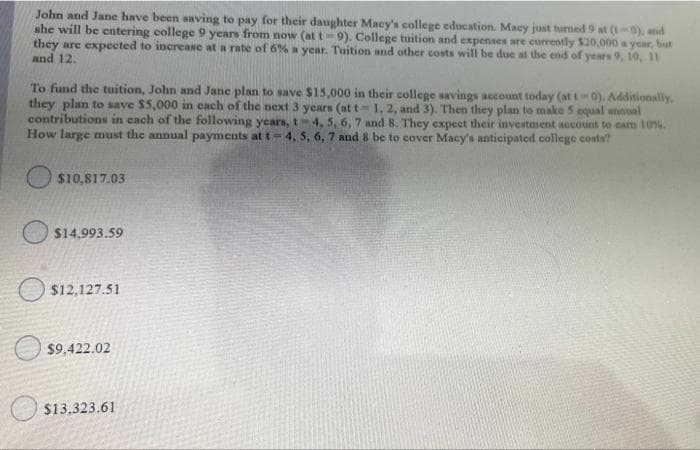

John and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 9 at (t-0), d she will be entering college 9 years from now (at t-9). College tuition and expenses are currently $20,000 a year, but they are expected to increase at a rate of 6% a year. Tuition and other costs will be due at the end of years 9, 10, 11 and 12. To fund the tuition, John and Jane plan to save $15,000 in their college savings account today (at t0). Additionally, they plan to save $5,000 in cach of the next 3 years (at t 1, 2, and 3). Then they plan to make S equal annual contributions in each of the following years, t4, 5, 6, 7 and 8. They expect their investment account to cam 10% How large must the annual payments at t-4, 5, 6, 7 and 8 be to cover Macy's anticipated college costa? $10,817.03

John and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 9 at (t-0), d she will be entering college 9 years from now (at t-9). College tuition and expenses are currently $20,000 a year, but they are expected to increase at a rate of 6% a year. Tuition and other costs will be due at the end of years 9, 10, 11 and 12. To fund the tuition, John and Jane plan to save $15,000 in their college savings account today (at t0). Additionally, they plan to save $5,000 in cach of the next 3 years (at t 1, 2, and 3). Then they plan to make S equal annual contributions in each of the following years, t4, 5, 6, 7 and 8. They expect their investment account to cam 10% How large must the annual payments at t-4, 5, 6, 7 and 8 be to cover Macy's anticipated college costa? $10,817.03

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:John and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 9 at (t-0), md

she will be entering college 9 years from now (at t-9). College tuition and expenses are currently $20,000 a year, but

they are expected to increase at a rate of 6% a year. Tuition and other costs will be due at the end of years 9, 10, 11

and 12.

To fund the tuition, John and Jane plan to save $15,000 in their college savings account today (att0). Additionally.

they plan to save $5,000 in cach of the next 3 years (at t-1, 2, and 3). Then they plan to make S equal annnal

contributions in each of the following years, t

How large must the annual payments att-4, 5, 6, 7 and 8 be to cover Macy's anticipated college conts?

4, 5, 6, 7 and 8. They expeet their investment account to cam 10%.

$10,817.03

$14,993.59

$12,127.51

$9,422.02

$13,323.61

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning