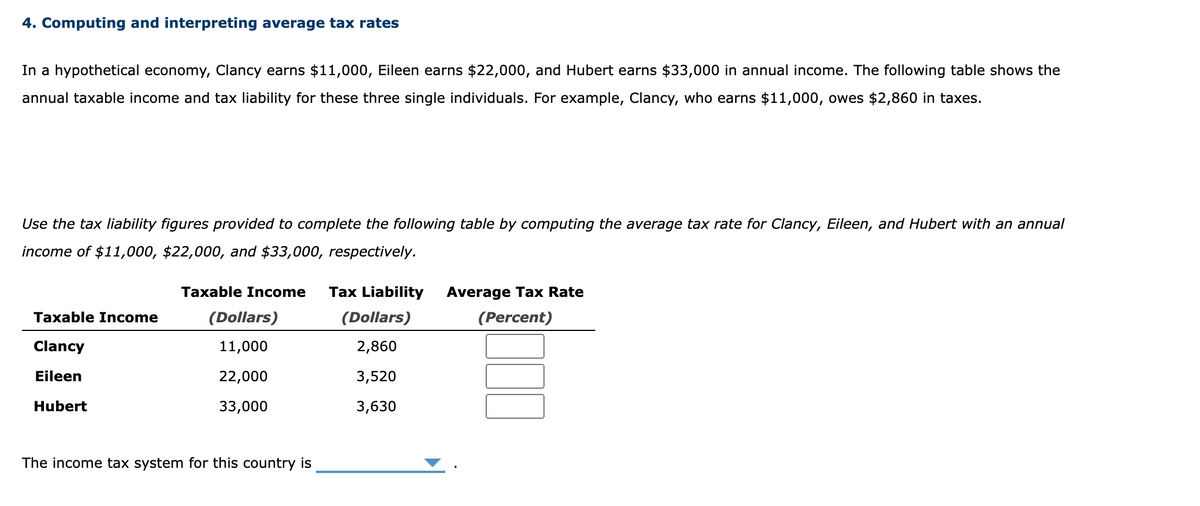

4. Computing and interpreting average tax rates In a hypothetical economy, Clancy earns $11,000, Eileen earns $22,000, and Hubert earns $33,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Clancy, who earns $11,000, owes $2,860 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Clancy, Eileen, and Hubert with an annual income of $11,000, $22,000, and $33,000, respectively. Taxable Income Tax Liability Average Tax Rate Taxable Income (Dollars) (Dollars) (Percent) Clancy 11,000 2,860 Eileen 22,000 3,520 Hubert 33,000 3,630 The income tax system for this country is

4. Computing and interpreting average tax rates In a hypothetical economy, Clancy earns $11,000, Eileen earns $22,000, and Hubert earns $33,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Clancy, who earns $11,000, owes $2,860 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Clancy, Eileen, and Hubert with an annual income of $11,000, $22,000, and $33,000, respectively. Taxable Income Tax Liability Average Tax Rate Taxable Income (Dollars) (Dollars) (Percent) Clancy 11,000 2,860 Eileen 22,000 3,520 Hubert 33,000 3,630 The income tax system for this country is

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: The Design Of The Tax System

Section: Chapter Questions

Problem 4PA

Related questions

Question

Transcribed Image Text:4. Computing and interpreting average tax rates

In a hypothetical economy, Clancy earns $11,000, Eileen earns $22,000, and Hubert earns $33,000 in annual income. The following table shows the

annual taxable income and tax liability for these three single individuals. For example, Clancy, who earns $11,000, owes $2,860 in taxes.

Use the tax liability figures provided to complete the following table by computing the average tax rate for Clancy, Eileen, and Hubert with an annual

income of $11,000, $22,000, and $33,000, respectively.

Taxable Income

Tax Liability

Average Tax Rate

Taxable Income

(Dollars)

(Dollars)

(Percent)

Clancy

11,000

2,860

Eileen

22,000

3,520

Hubert

33,000

3,630

The income tax system for this country is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning