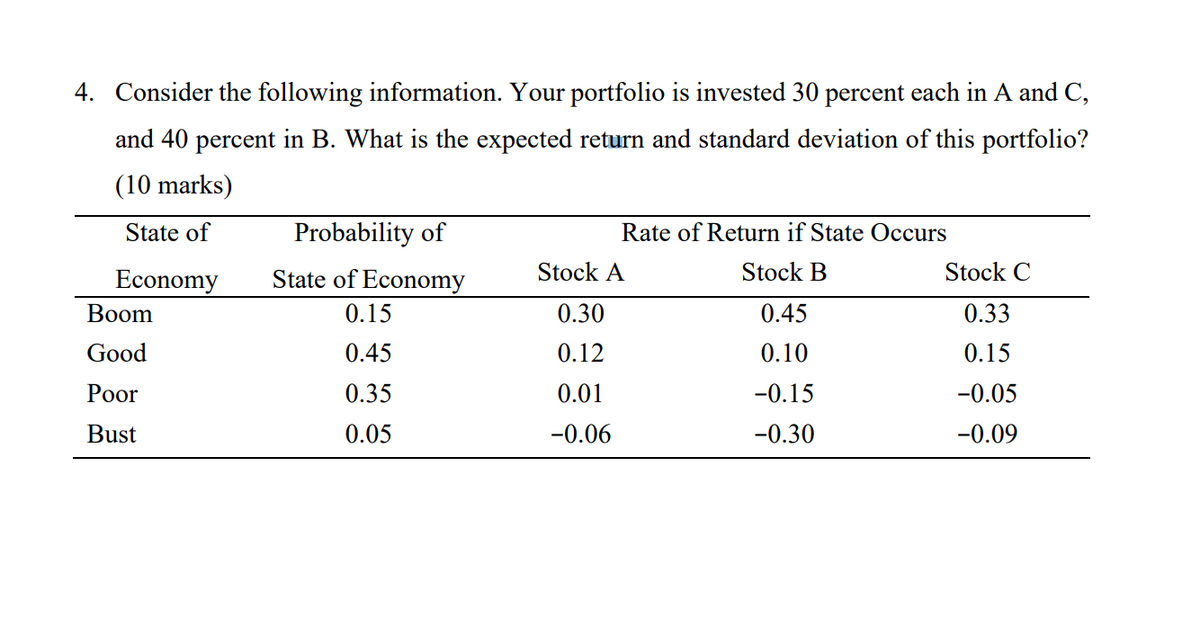

4. Consider the following information. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return and standard deviation of this portfolio? (10 marks) State of Probability of Rate of Return if State Occurs Economy State of Economy Stock A Stock B Stock C Boom 0.15 0.30 0.45 0.33 Good 0.45 0.12 0.10 0.15 Poor 0.35 0.01 -0.15 -0.05 Bust 0.05 -0.06 -0.30 -0.09

4. Consider the following information. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return and standard deviation of this portfolio? (10 marks) State of Probability of Rate of Return if State Occurs Economy State of Economy Stock A Stock B Stock C Boom 0.15 0.30 0.45 0.33 Good 0.45 0.12 0.10 0.15 Poor 0.35 0.01 -0.15 -0.05 Bust 0.05 -0.06 -0.30 -0.09

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter3: Risk And Return: Part Ii

Section: Chapter Questions

Problem 3P: Two-Asset Portfolio

Stock A has an expected return of 12% and a standard deviation of 40%. Stock B...

Related questions

Question

Transcribed Image Text:4. Consider the following information. Your portfolio is invested 30 percent each in A and C,

and 40 percent in B. What is the expected return and standard deviation of this portfolio?

(10 marks)

State of

Probability of

Rate of Return if State Occurs

Economy

State of Economy

Stock A

Stock B

Stock C

Boom

0.15

0.30

0.45

0.33

Good

0.45

0.12

0.10

0.15

Poor

0.35

0.01

-0.15

-0.05

Bust

0.05

-0.06

-0.30

-0.09

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT