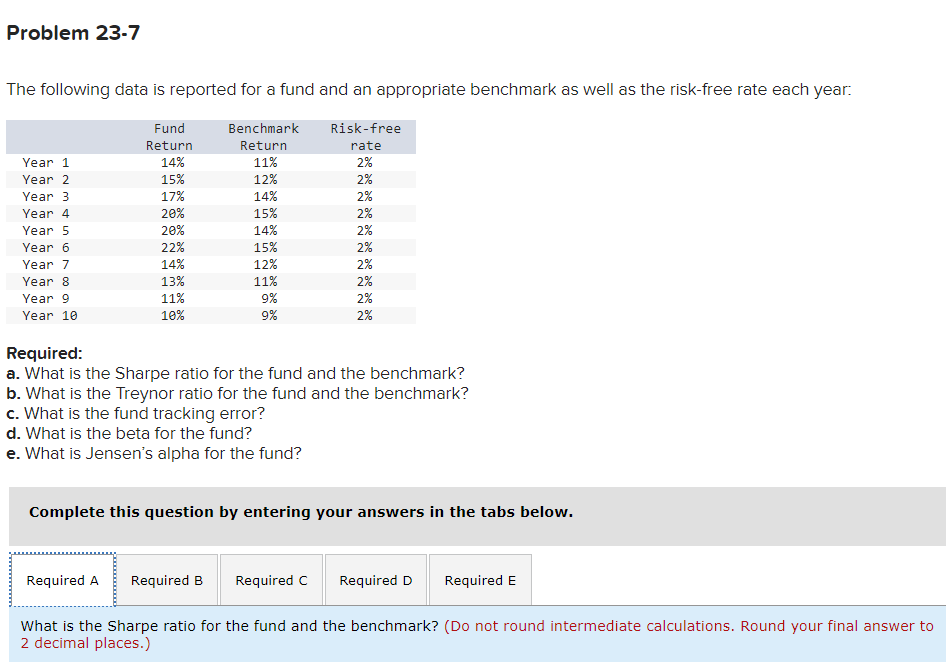

The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year: Risk-free Fund Return Benchmark Return rate 14% 11% 2% 15% 12% 2% 14% 2% 15% 2% 14% 2% 15% 2% 12% 2% 11% 2% Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 17% 20% 20% 22% 14% 13% 11% 10% 9% 9% 2% 2% Required: a. What is the Sharpe ratio for the fund and the benchmark? b. What is the Treynor ratio for the fund and the benchmark? c. What is the fund tracking error? d. What is the beta for the fund? e. What is Jensen's alpha for the fund?

The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year: Risk-free Fund Return Benchmark Return rate 14% 11% 2% 15% 12% 2% 14% 2% 15% 2% 14% 2% 15% 2% 12% 2% 11% 2% Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 17% 20% 20% 22% 14% 13% 11% 10% 9% 9% 2% 2% Required: a. What is the Sharpe ratio for the fund and the benchmark? b. What is the Treynor ratio for the fund and the benchmark? c. What is the fund tracking error? d. What is the beta for the fund? e. What is Jensen's alpha for the fund?

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Budgeting

Section: Chapter Questions

Problem 9DQ: A. Discuss the purpose of the cash budget. B. If the cash for the first quarter of the fiscal year...

Related questions

Question

Transcribed Image Text:Problem 23-7

The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year:

Benchmark

Risk-free

Fund

Return

Return

rate

14%

11%

2%

15%

12%

17%

14%

20%

15%

20%

14%

22%

15%

14%

13%

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

11%

10%

12%

11%

9%

9%

c. What is the fund tracking error?

d. What is the beta for the fund?

e. What is Jensen's alpha for the fund?

Required A

2%

2%

2%

2%

2%

2%

2%

Required:

a. What is the Sharpe ratio for the fund and the benchmark?

b. What is the Treynor ratio for the fund and the benchmark?

2%

2%

Complete this question by entering your answers in the tabs below.

Required B Required C

What is the Sharpe ratio for the fund and the benchmark? (Do not round intermediate calculations. Round your final answer to

2 decimal places.)

Required D Required E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning