4. Emma pays for fibre optic broadband to ensure a reliable internet connection for all of her classes. This is charged at a monthly rate of £40pcm, payable in the month it is incurred. However, she has been recently notified that this is likely to see a 5% increase from September onwards. 5. Earlier in the year, Emma engaged with a marketing agency to update her company webpage. The fee for this was £850. 20% was paid in May 2021. The balance is due in August. 6. Emma employs an administrative assistant to manage her membership records and perform her bookkeeping for her. She pays her assistant a wage of £1,000 per month. Emma takes a wage of £2,000 per month. Wages are paid in the month in which they are incurred. From October 2021, Emma intends to award her assistant a 5% pay rise. 7. Depreciation of all equipment is charged at £50 per month. 8. Opening cash balance on 1 July 2021 is expected to be £5,500. 9. Emma continues to pay Personal Trainer Insurance of £10 per month, payable annually in advance on 1 October 2021. 10. Other expenses, including utility bills relating to the business amount to £100 per month, paid for in the month in which they are incurred. 11. In February 2021, the company took on a £10,000 business loan at an annual interest rate of 6%. The annual interest payment is due in July 2021. Requirements: (i) Prepare a cash budget for July, August, September and October 2021 for Fit for the Future Limited. (ii) Analyse the budgeted figures and changes in the cash balance. In doing so, make any recommendations to Emma. (iii) Emma has stated that profits for the period should be more or less equal the net cash inflow for the period. Do you agree? Explain your reasoning.

4. Emma pays for fibre optic broadband to ensure a reliable internet connection for all of her classes. This is charged at a monthly rate of £40pcm, payable in the month it is incurred. However, she has been recently notified that this is likely to see a 5% increase from September onwards. 5. Earlier in the year, Emma engaged with a marketing agency to update her company webpage. The fee for this was £850. 20% was paid in May 2021. The balance is due in August. 6. Emma employs an administrative assistant to manage her membership records and perform her bookkeeping for her. She pays her assistant a wage of £1,000 per month. Emma takes a wage of £2,000 per month. Wages are paid in the month in which they are incurred. From October 2021, Emma intends to award her assistant a 5% pay rise. 7. Depreciation of all equipment is charged at £50 per month. 8. Opening cash balance on 1 July 2021 is expected to be £5,500. 9. Emma continues to pay Personal Trainer Insurance of £10 per month, payable annually in advance on 1 October 2021. 10. Other expenses, including utility bills relating to the business amount to £100 per month, paid for in the month in which they are incurred. 11. In February 2021, the company took on a £10,000 business loan at an annual interest rate of 6%. The annual interest payment is due in July 2021. Requirements: (i) Prepare a cash budget for July, August, September and October 2021 for Fit for the Future Limited. (ii) Analyse the budgeted figures and changes in the cash balance. In doing so, make any recommendations to Emma. (iii) Emma has stated that profits for the period should be more or less equal the net cash inflow for the period. Do you agree? Explain your reasoning.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter5: Product And Service Costing: Job-order System

Section: Chapter Questions

Problem 8E: Refer to the data in Exercise 5.7. Vince Melders, owner of EcoScape, noticed that the watering...

Related questions

Question

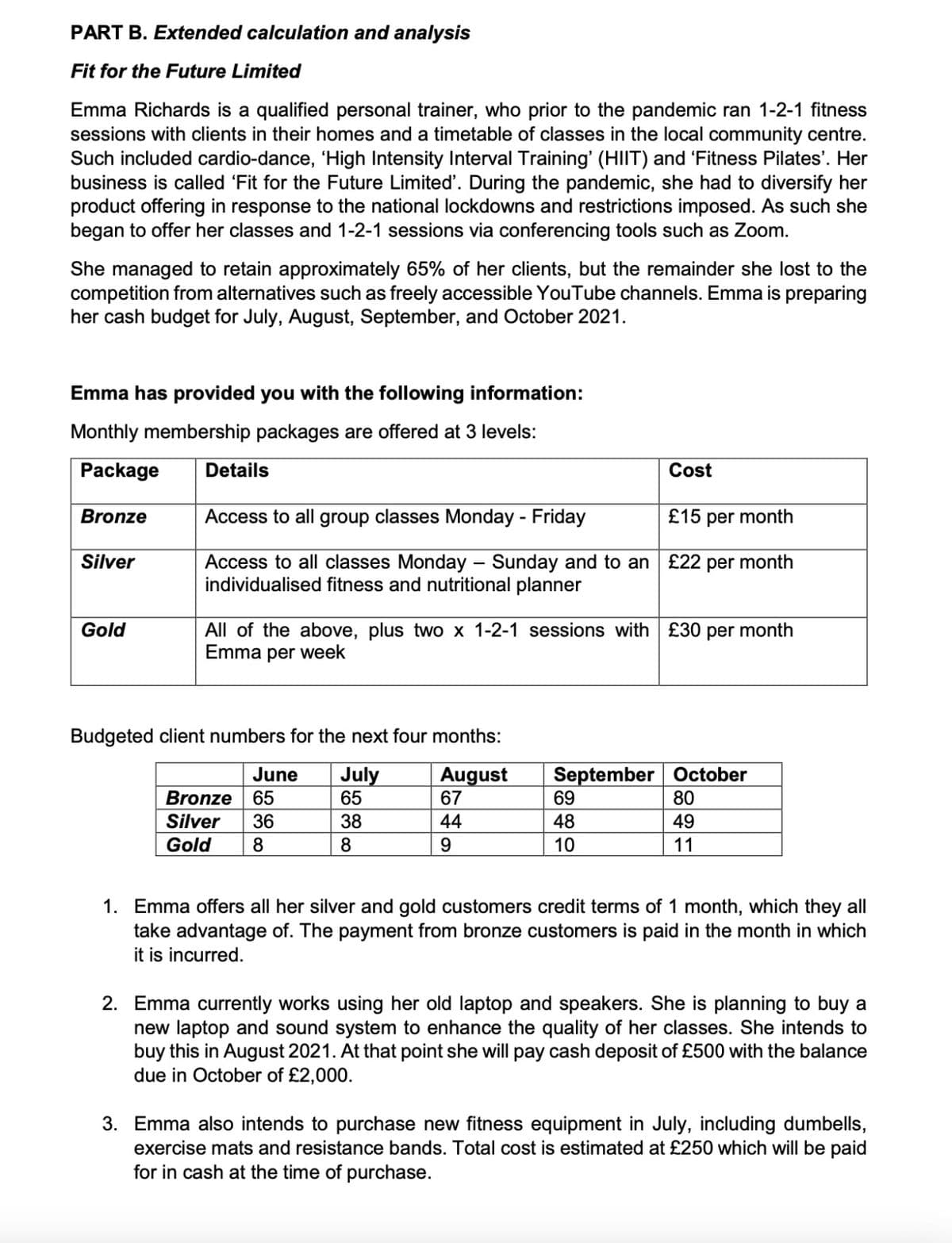

Transcribed Image Text:PART B. Extended calculation and analysis

Fit for the Future Limited

Emma Richards is a qualified personal trainer, who prior to the pandemic ran 1-2-1 fitness

sessions with clients in their homes and a timetable of classes in the local community centre.

Such included cardio-dance, 'High Intensity Interval Training' (HIIT) and 'Fitness Pilates'. Her

business is called 'Fit for the Future Limited'. During the pandemic, she had to diversify her

product offering in response to the national lockdowns and restrictions imposed. As such she

began to offer her classes and 1-2-1 sessions via conferencing tools such as Zoom.

She managed to retain approximately 65% of her clients, but the remainder she lost to the

competition from alternatives such as freely accessible YouTube channels. Emma is preparing

her cash budget for July, August, September, and October 2021.

Emma has provided you with the following information:

Monthly membership packages are offered at 3 levels:

Package

Details

Cost

Bronze

Access to all group classes Monday - Friday

£15 per month

Access to all classes Monday – Sunday and to an £22 per month

individualised fitness and nutritional planner

Silver

All of the above, plus two x 1-2-1 sessions with £30 per month

Emma per week

Gold

Budgeted client numbers for the next four months:

July

65

August

67

September October

69

June

Bronze

65

80

Silver

36

38

44

48

49

Gold

8

8

9.

10

11

1. Emma offers all her silver and gold customers credit terms of 1 month, which they all

take advantage of. The payment from bronze customers is paid in the month in which

it is incurred.

2. Emma currently works using her old laptop and speakers. She is planning to buy a

new laptop and sound system to enhance the quality of her classes. She intends to

buy this in August 2021. At that point she will pay cash deposit of £500 with the balance

due in October of £2,000.

3. Emma also intends to purchase new fitness equipment in July, including dumbells,

exercise mats and resistance bands. Total cost is estimated at £250 which will be paid

for in cash at the time of purchase.

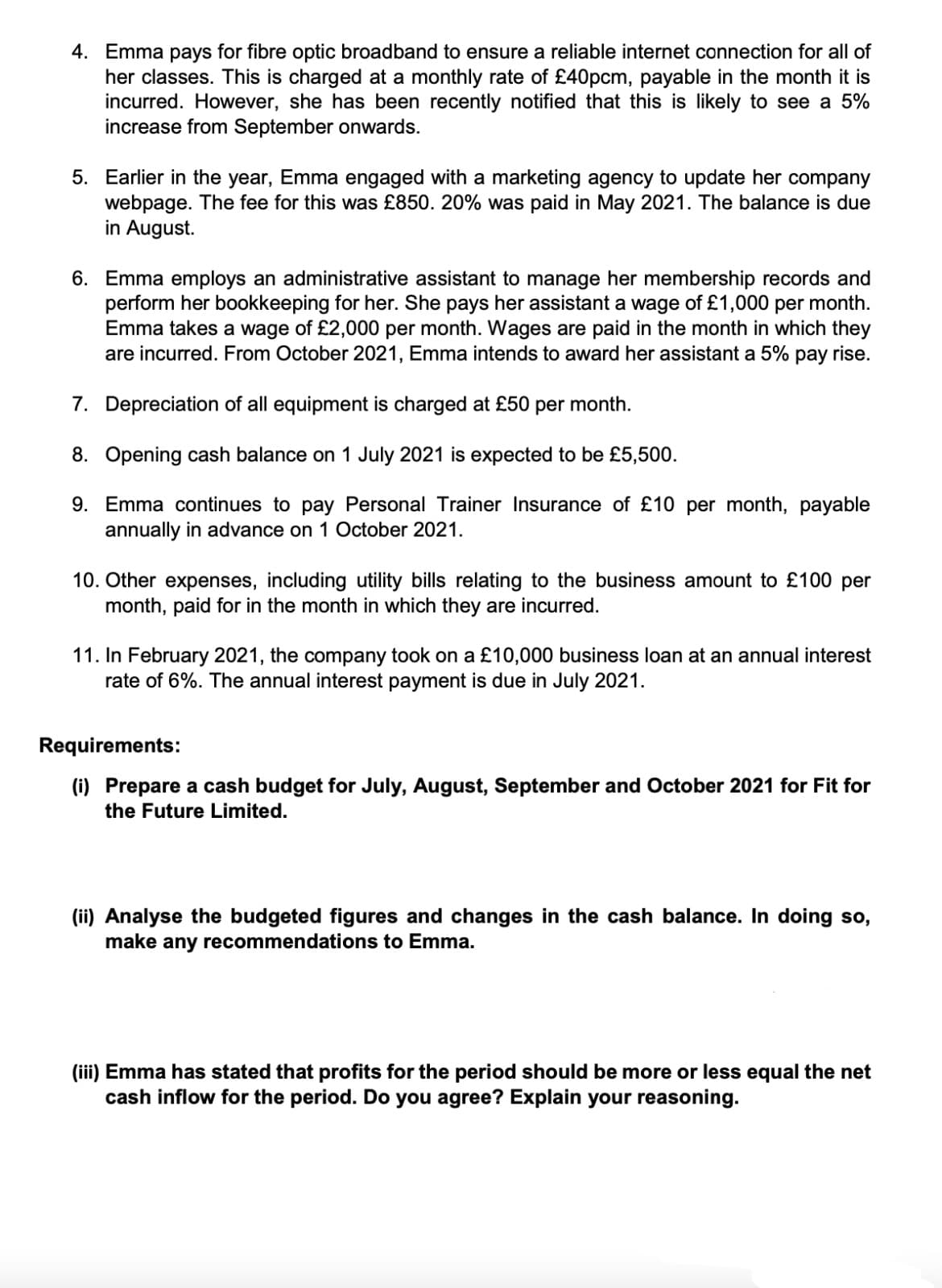

Transcribed Image Text:4. Emma pays for fibre optic broadband to ensure a reliable internet connection for all of

her classes. This is charged at a monthly rate of £40pcm, payable in the month it is

incurred. However, she has been recently notified that this is likely to see a 5%

increase from September onwards.

5. Earlier in the year, Emma engaged with a marketing agency to update her company

webpage. The fee for this was £850. 20% was paid in May 2021. The balance is due

in August.

6. Emma employs an administrative assistant to manage her membership records and

perform her bookkeeping for her. She pays her assistant a wage of £1,000 per month.

Emma takes a wage of £2,000 per month. Wages are paid in the month in which they

are incurred. From October 2021, Emma intends to award her assistant a 5% pay rise.

7. Depreciation of all equipment is charged at £50 per month.

8. Opening cash balance on 1 July 2021 is expected to be £5,500.

9. Emma continues to pay Personal Trainer Insurance of £10 per month, payable

annually in advance on 1 October 2021.

10. Other expenses, including utility bills relating to the business amount to £100 per

month, paid for in the month in which they are incurred.

11. In February 2021, the company took on a £10,000 business loan at an annual interest

rate of 6%. The annual interest payment is due in July 2021.

Requirements:

(i) Prepare a cash budget for July, August, September and October 2021 for Fit for

the Future Limited.

(ii) Analyse the budgeted figures and changes in the cash balance. In doing so,

make any recommendations to Emma.

(iii) Emma has stated that profits for the period should be more or less equal the net

cash inflow for the period. Do you agree? Explain your reasoning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning