4. Five transactions for Jodry & Associates follow. A. Journalize the five transactions under a GST/PST system. The rate of GST is 5%; PST is 8%. Both taxes are charged on all sales, and both percentages are calculated on the original amount of the invoice. Use the following accounts: A/R - Booker Industries A/R - Genco Corporation A/R - Hall Industries A/P - Bell Cellphones A/P- Great Stationers HST Payable HST Recoverable PST Payable Sales Office Supplies Expense Telephone Expense GST Payable GST Recoverable

4. Five transactions for Jodry & Associates follow. A. Journalize the five transactions under a GST/PST system. The rate of GST is 5%; PST is 8%. Both taxes are charged on all sales, and both percentages are calculated on the original amount of the invoice. Use the following accounts: A/R - Booker Industries A/R - Genco Corporation A/R - Hall Industries A/P - Bell Cellphones A/P- Great Stationers HST Payable HST Recoverable PST Payable Sales Office Supplies Expense Telephone Expense GST Payable GST Recoverable

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

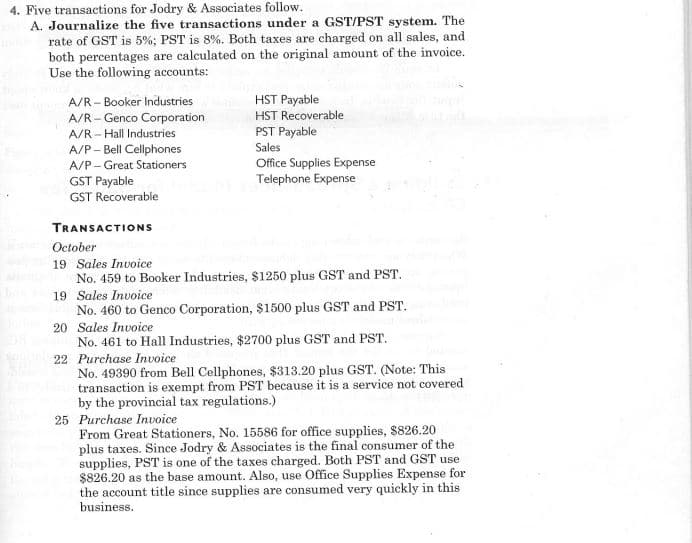

Transcribed Image Text:4. Five transactions for Jodry & Associates follow.

A. Journalize the five transactions under a GST/PST system. The

rate of GST is 5%; PST is 8%. Both taxes are charged on all sales, and

both percentages are calculated on the original amount of the invoice.

Use the following accounts:

A/R - Booker Industries

A/R - Genco Corporation

A/R - Hall Industries

A/P- Bell Cellphones

HST Payable

HST Recoverable

PST Payable

Sales

Office Supplies Expense

Telephone Expense

A/P- Great Stationers

GST Payable

GST Recoverable

TRANSACTIONS

October

19 Sales Invoice

No. 459 to Booker Industries, $1250 plus GST and PST.

19 Sales Invoice

No. 460 to Genco Corporation, $1500 plus GST and PST.

20 Sales Invoice

No. 461 to Hall Industries, $2700 plus GST and PST.

22 Purchase Invoice

No. 49390 from Bell Cellphones, $313.20 plus GST. (Note: This

transaction is exempt from PST because it is a service not covered

by the provincial tax regulations.)

25 Purchase Invoice

From Great Stationers, No. 15586 for office supplies, $826.20

plus taxes. Since Jodry & Associates is the final consumer of the

supplies, PST is one of the taxes charged. Both PST and GST use

$826.20 as the base amount. Also, use Office Supplies Expense for

the account title since supplies are consumed very quickly in this

business.

Transcribed Image Text:B. Journalize the five transactions again under an HST system. The

rate of HST is 13%. Ignore all references to GST and PST.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning