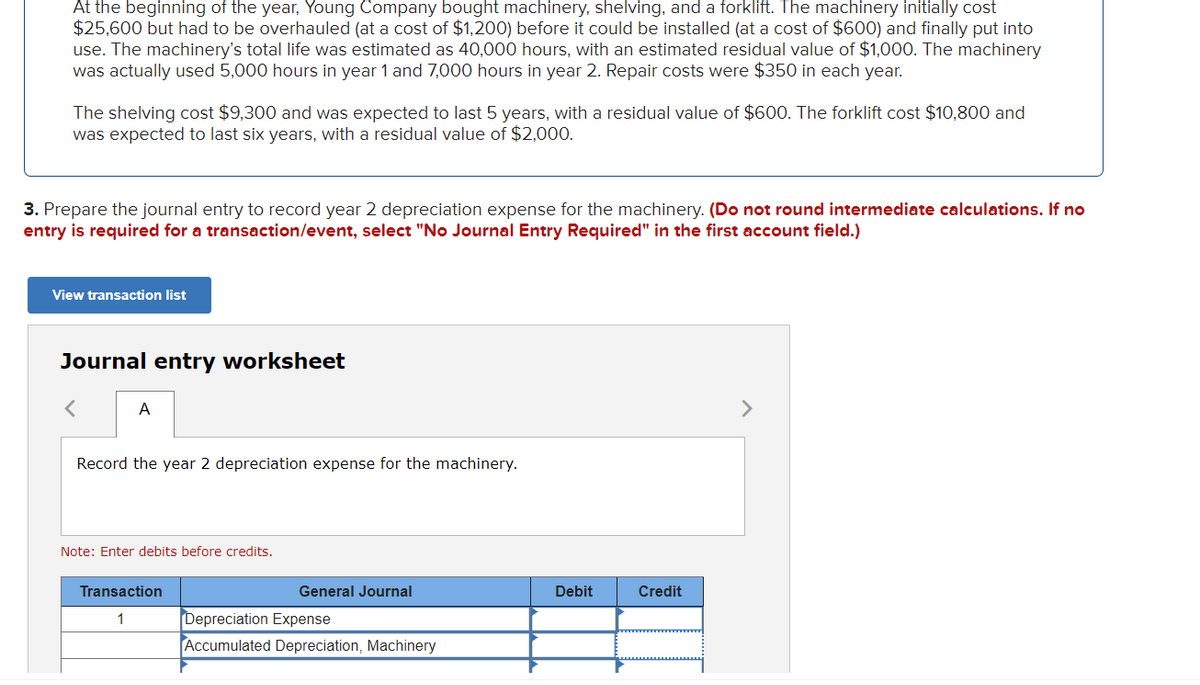

At the beginning of the year, Young Company bought machinery, shelving, and a forklift. The machinery initially cost $25,600 but had to be overhauled (at a cost of $1,200) before it could be installed (at a cost of $600) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $350 in each year. The shelving cost $9,300 and was expected to last 5 years, with a residual value of $600. The forklift cost $10,800 and was expected to last six years, with a residual value of $2,000. 3. Prepare the journal entry to record year 2 depreciation expense for the machinery. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet A > Record the year 2 depreciation expense for the machinery. Note: Enter debits before credits. Transaction General Journal Debit Credit Depreciation Expense Accumulated Depreciation, Machinery 1

At the beginning of the year, Young Company bought machinery, shelving, and a forklift. The machinery initially cost $25,600 but had to be overhauled (at a cost of $1,200) before it could be installed (at a cost of $600) and finally put into use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $350 in each year. The shelving cost $9,300 and was expected to last 5 years, with a residual value of $600. The forklift cost $10,800 and was expected to last six years, with a residual value of $2,000. 3. Prepare the journal entry to record year 2 depreciation expense for the machinery. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet A > Record the year 2 depreciation expense for the machinery. Note: Enter debits before credits. Transaction General Journal Debit Credit Depreciation Expense Accumulated Depreciation, Machinery 1

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

How do you get the debit and credit

Transcribed Image Text:At the beginning of the year, Young Company bought machinery, shelving, and a forklift. The machinery initially cost

$25,600 but had to be overhauled (at a cost of $1,200) before it could be installed (at a cost of $600) and finally put into

use. The machinery's total life was estimated as 40,000 hours, with an estimated residual value of $1,000. The machinery

was actually used 5,000 hours in year 1 and 7,000 hours in year 2. Repair costs were $350 in each year.

The shelving cost $9,300 and was expected to last 5 years, with a residual value of $600. The forklift cost $10,800 and

was expected to last six years, with a residual value of $2,000.

3. Prepare the journal entry to record year 2 depreciation expense for the machinery. (Do not round intermediate calculations. If no

entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

A

>

Record the year 2 depreciation expense for the machinery.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Depreciation Expense

Accumulated Depreciation, Machinery

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College