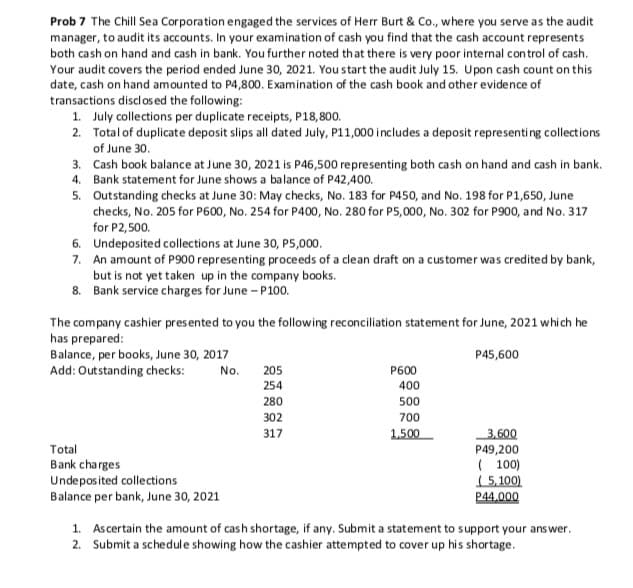

Prob 7 The Chill Sea Corporation engaged the services of Herr Burt & Co., where you serve as the audit manager, to audit its accounts. In your examination of cash you find that the cash account represents both cash on hand and cash in bank. You further noted that there is very poor internal control of cash. Your audit covers the period ended June 30, 2021. You start the audit July 15. Upon cash count on this date, cash on hand amounted to P4,800. Examination of the cash book and other evidence of transactions disclos ed the following: 1. July collections per duplicate receipts, P18,800. 2. Total of duplicate deposit slips all dated July, P11,000 includes a deposit representing collections of June 30. 3. Cash book balance at June 30, 2021 is P46,500 representing both cash on hand and cash in bank. 4. Bank statement for June shows a balance of P42,400. 5. Outstanding checks at June 30: May checks, No. 183 for P450, and No. 198 for P1,650, June checks, No. 205 for P600, No. 254 for P400, No. 280 for P5,000, No. 302 for P900, and No. 317 for P2,500. 6. Undeposited collections at June 30, P5,000. 7. An amount of P900 representing proceeds of a clean draft on a customer was credited by bank, but is not yet taken up in the company books. 8. Bank service charges for June - P100. The company cashier presented to you the following reconciliation statement for June, 2021 which he has prepared: Balance, per books, June 30, 2017 Add: Outstanding checks: P45,600 No. 205 P600 254 400 500 280 302 700 317 1.500 Total Bank charges Undeposited collections Balance per bank, June 30, 2021 3,600 P49,200 ( 100) 1 5,100) P44,000 1. Ascertain the amount of cash shortage, if any. Submit a statement to support your answer. 2. Submit a schedule showing how the cashier attempted to cover up his shortage.

Prob 7 The Chill Sea Corporation engaged the services of Herr Burt & Co., where you serve as the audit manager, to audit its accounts. In your examination of cash you find that the cash account represents both cash on hand and cash in bank. You further noted that there is very poor internal control of cash. Your audit covers the period ended June 30, 2021. You start the audit July 15. Upon cash count on this date, cash on hand amounted to P4,800. Examination of the cash book and other evidence of transactions disclos ed the following: 1. July collections per duplicate receipts, P18,800. 2. Total of duplicate deposit slips all dated July, P11,000 includes a deposit representing collections of June 30. 3. Cash book balance at June 30, 2021 is P46,500 representing both cash on hand and cash in bank. 4. Bank statement for June shows a balance of P42,400. 5. Outstanding checks at June 30: May checks, No. 183 for P450, and No. 198 for P1,650, June checks, No. 205 for P600, No. 254 for P400, No. 280 for P5,000, No. 302 for P900, and No. 317 for P2,500. 6. Undeposited collections at June 30, P5,000. 7. An amount of P900 representing proceeds of a clean draft on a customer was credited by bank, but is not yet taken up in the company books. 8. Bank service charges for June - P100. The company cashier presented to you the following reconciliation statement for June, 2021 which he has prepared: Balance, per books, June 30, 2017 Add: Outstanding checks: P45,600 No. 205 P600 254 400 500 280 302 700 317 1.500 Total Bank charges Undeposited collections Balance per bank, June 30, 2021 3,600 P49,200 ( 100) 1 5,100) P44,000 1. Ascertain the amount of cash shortage, if any. Submit a statement to support your answer. 2. Submit a schedule showing how the cashier attempted to cover up his shortage.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.18EX

Related questions

Question

100%

BADLY NEED HELP!

Transcribed Image Text:Prob 7 The Chill Sea Corporation engaged the services of Herr Burt & Co., where you serve as the audit

manager, to audit its accounts. In your examination of cash you find that the cash account represents

both cash on hand and cash in bank. You further noted that there is very poor internal control of cash.

Your audit covers the period ended June 30, 2021. You start the audit July 15. Upon cash count on this

date, cash on hand amounted to P4,800. Examination of the cash book and other evidence of

transactions disclos ed the following:

1. July collections per duplicate receipts, P18,800.

2. Total of duplicate deposit slips all dated July, P11,000 includes a deposit representing collections

of June 30.

3. Cash book balance at June 30, 2021 is P46,500 representing both cash on hand and cash in bank.

4. Bank statement for June shows a balance of P42,400.

5. Outstanding checks at June 30: May checks, No. 183 for P450, and No. 198 for P1,650, June

checks, No. 205 for P600, No. 254 for P400, No. 280 for P5,000, No. 302 for P900, and No. 317

for P2,500.

6. Undeposited collections at June 30, P5,000.

7. An amount of P900 representing proceeds of a clean draft on a customer was credited by bank,

but is not yet taken up in the company books.

8. Bank service charges for June - P100.

The company cashier presented to you the following reconciliation statement for June, 2021 which he

has prepared:

Balance, per books, June 30, 2017

Add: Outstanding checks:

P45,600

No.

205

P600

254

400

280

500

302

700

317

1.500

3,600

Total

Bank charges

Undeposited collections

Balance per bank, June 30, 2021

P49,200

( 100)

1 5,100)

P44,000

1. Ascertain the amount of cash shortage, if any. Submit a statement to support your answer.

2. Submit a schedule showing how the cashier attempted to cover up his shortage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning