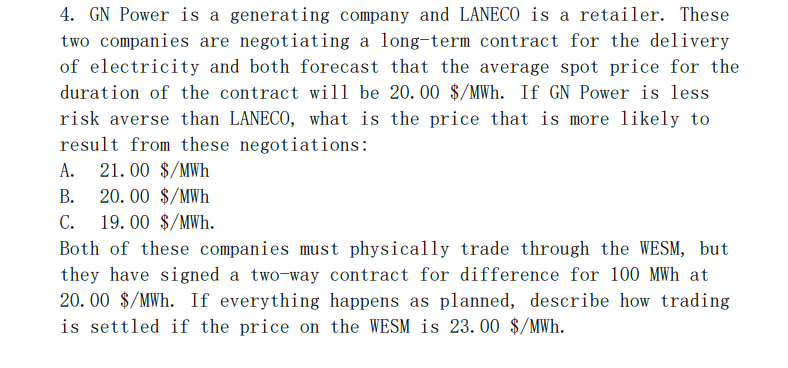

4. GN Power is a generating company and LANECO is a retailer. These two companies are negotiating a long-term contract for the delivery of electricity and both forecast that the average spot price for the duration of the contract will be 20.00 $/MWh. If GN Power is less risk averse than LANECO, what is the price that is more likely to result from these negotiations: A. 21. 00 $/MWh В. 20.00 $/MWh С. 19. 00 $/MWh. Both of these companies must physically trade through the WESM, but they have signed a two-way contract for difference for 100 MWh at 20. 00 $/MWh. If everything happens as planned, describe how trading is settled if the price on the WESM is 23. 00 $/MWh.

4. GN Power is a generating company and LANECO is a retailer. These two companies are negotiating a long-term contract for the delivery of electricity and both forecast that the average spot price for the duration of the contract will be 20.00 $/MWh. If GN Power is less risk averse than LANECO, what is the price that is more likely to result from these negotiations: A. 21. 00 $/MWh В. 20.00 $/MWh С. 19. 00 $/MWh. Both of these companies must physically trade through the WESM, but they have signed a two-way contract for difference for 100 MWh at 20. 00 $/MWh. If everything happens as planned, describe how trading is settled if the price on the WESM is 23. 00 $/MWh.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 20E: Assume the same facts as in E17-19, except that Rix cannot directly observe the stand-alone selling...

Related questions

Question

Transcribed Image Text:4. GN Power is a generating company and LANECO is a retailer. These

two companies are negotiating a long-term contract for the delivery

of electricity and both forecast that the average spot price for the

duration of the contract wil1 be 20. 00 $/MWh. If GN Power is less

risk averse than LANECO, what is the price that is more likely to

result from these negotiations:

21. 00 $/MWh

А.

В.

20. 00 $/MWh

С.

19. 00 $/MWh.

Both of these companies must physically trade through the WESM, but

they have signed a two-way contract for difference for 100 MWh at

20. 00 $/MWh. If everything happens as planned, describe how trading

is settled if the price on the WESM is 23. 00 $/MWh.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning