4. How much increase in the allowance for uncollectible accounts is required on December 31, 2022? 57,400 40,320 43,600 137,400 5. What is the balance of the allowance for uncollectible accounts after all the necessary adjusting entries on December 31, 2022? 127,480 60,000 113,800 117,400

4. How much increase in the allowance for uncollectible accounts is required on December 31, 2022? 57,400 40,320 43,600 137,400 5. What is the balance of the allowance for uncollectible accounts after all the necessary adjusting entries on December 31, 2022? 127,480 60,000 113,800 117,400

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

4.

How much increase in the allowance for uncollectible accounts is required on December 31, 2022?

57,400

40,320

43,600

137,400

5.

What is the balance of the allowance for uncollectible accounts after all the necessary adjusting entries on December

31, 2022?

31, 2022?

127,480

60,000

113,800

117,400

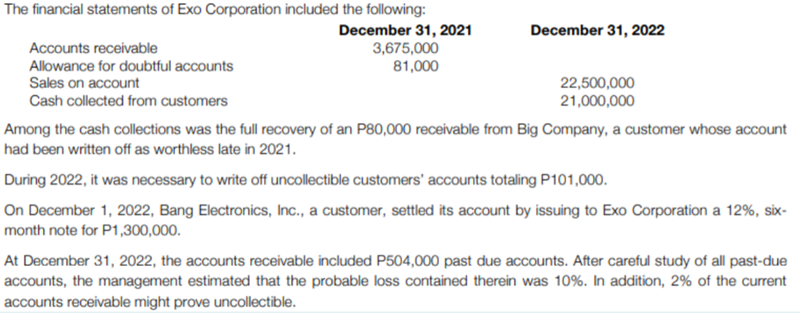

Transcribed Image Text:The financial statements of Exo Corporation included the following:

December 31, 2021

3,675,000

81,000

December 31, 2022

Accounts receivable

Allowance for doubtful accounts

Sales on account

22,500,000

21,000,000

Cash collected from customers

Among the cash collections was the full recovery of an P80,000 receivable from Big Company, a customer whose account

had been written off as worthless late in 2021.

During 2022, it was necessary to write off uncollectible customers' accounts totaling P101,000.

On December 1, 2022, Bang Electronics, Inc., a customer, settled its account by issuing to Exo Corporation a 12%, six-

month note for P1,300,000.

At December 31, 2022, the accounts receivable included P504,000 past due accounts. After careful study of all past-due

accounts, the management estimated that the probable loss contained therein was 10%. In addition, 2% of the current

accounts receivable might prove uncollectible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning