The balances on December 31 before any adjustments : Que ful a Sales - 5,000,000 Que Accounts Receivable- 600,000 cou Allowance for doubtful accounts- 25,000 Required: Assuming on December 31,2019, the company determined that 2% of sales is uncollectible. question 1. What is the adjusting entry to recognize this? Question 2. What is the balance of the allowance for doubtful accounts after effecting the adjustment? Question 3. What is the net realizable balance of the ac- counts receivable ?

The balances on December 31 before any adjustments : Que ful a Sales - 5,000,000 Que Accounts Receivable- 600,000 cou Allowance for doubtful accounts- 25,000 Required: Assuming on December 31,2019, the company determined that 2% of sales is uncollectible. question 1. What is the adjusting entry to recognize this? Question 2. What is the balance of the allowance for doubtful accounts after effecting the adjustment? Question 3. What is the net realizable balance of the ac- counts receivable ?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Please answer it completely. Thanks tutor.

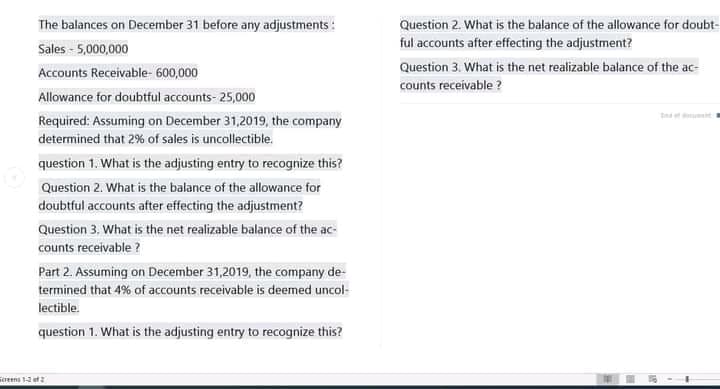

Transcribed Image Text:The balances on December 31 before any adjustments :

Question 2. What is the balance of the allowance for doubt-

Sales - 5,000,000

ful accounts after effecting the adjustment?

Question 3. What is the net realizable balance of the ac-

Accounts Receivable- 600,000

counts receivable ?

Allowance for doubtful accounts- 25,000

tn nt

Required: Assuming on December 31,2019, the company

determined that 2% of sales is uncollectible.

question 1. What is the adjusting entry to recognize this?

Question 2. What is the balance of the allowance for

doubtful accounts after effecting the adjustment?

Question 3. What is the net realizable balance of the ac-

counts receivable ?

Part 2. Assuming on December 31,2019, the company de-

termined that 4% of accounts receivable is deemed uncol-

lectible.

question 1. What is the adjusting entry to recognize this?

oeens 1ef

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT