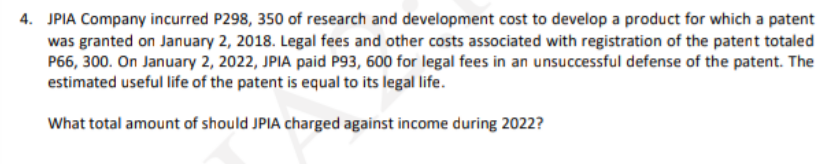

4. JPIA Company incurred P298, 350 of research and development cost to develop a product for which a patent was granted on January 2, 2018. Legal fees and other costs associated with registration of the patent totaled P66, 300. On January 2, 2022, JPIA paid P93, 600 for legal fees in an unsuccessful defense of the patent. The estimated useful life of the patent is equal to its legal life. What total amount of should JPIA charged against income during 2022?

4. JPIA Company incurred P298, 350 of research and development cost to develop a product for which a patent was granted on January 2, 2018. Legal fees and other costs associated with registration of the patent totaled P66, 300. On January 2, 2022, JPIA paid P93, 600 for legal fees in an unsuccessful defense of the patent. The estimated useful life of the patent is equal to its legal life. What total amount of should JPIA charged against income during 2022?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7MC

Related questions

Question

Transcribed Image Text:4. JPIA Company incurred P298, 350 of research and development cost to develop a product for which a patent

was granted on January 2, 2018. Legal fees and other costs associated with registration of the patent totaled

P66, 300. On January 2, 2022, JPIA paid P93, 600 for legal fees in an unsuccessful defense of the patent. The

estimated useful life of the patent is equal to its legal life.

What total amount of should JPIA charged against income during 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT