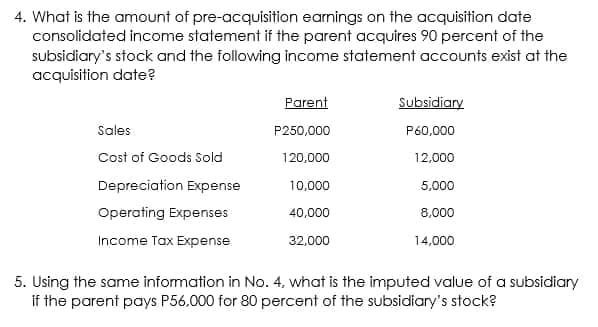

4. What is the amount of pre-acquisition earnings on the acquisition date consolidated income statement if the parent acquires 90 percent of the subsidiary's stock and the following income statement accounts exist at the acquisition date? Parent Subsidiary Sales P250,000 P60,000 Cost of Goods Sold 120,000 12,000 Depreciation Expense 10,000 5,000 Operating Expenses 40,000 8,000 Income Tax Expense 32,000 14,000 5. Using the same information in No. 4, what is the imputed value of a subsidiary if the parent pays P56.000 for 80 percent of the subsidiary's stock?

4. What is the amount of pre-acquisition earnings on the acquisition date consolidated income statement if the parent acquires 90 percent of the subsidiary's stock and the following income statement accounts exist at the acquisition date? Parent Subsidiary Sales P250,000 P60,000 Cost of Goods Sold 120,000 12,000 Depreciation Expense 10,000 5,000 Operating Expenses 40,000 8,000 Income Tax Expense 32,000 14,000 5. Using the same information in No. 4, what is the imputed value of a subsidiary if the parent pays P56.000 for 80 percent of the subsidiary's stock?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:4. What is the amount of pre-acquisition earnings on the acquisition date

consolidated income statement if the parent acquires 90 percent of the

subsidiary's stock and the following income statement accounts exist at the

acquisition date?

Parent

Subsidiary

Sales

P250,000

P60,000

Cost of Goods Sold

120,000

12,000

Depreciation Expense

10,000

5,000

Operating Expenses

40,000

8,000

Income Tax Expense

32,000

14,000

5. Using the same information in No. 4, what is the imputed value of a subsidiary

if the parent pays P56.000 for 80 percent of the subsidiary's stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning