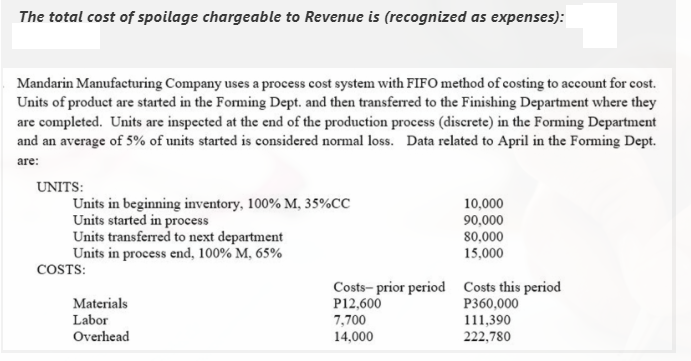

Mandarin Manufacturing Company uses a process cost system with FIFO method of costing to account for cost. Units of product are started in the Forming Dept. and then transferred to the Finishing Department where they are completed. Units are inspected at the end of the production process (discrete) in the Forming Department and an average of 5% of units started is considered normal loss. Data related to April in the Forming Dept. are: UNITS: Units in beginning inventory, 100% M, 35%CC Units started in process Units transferred to next department Units in process end, 100% M, 65% 10,000 90,000 80,000 15,000 COSTS: Costs- prior period Costs this period P12,600 Materials P360,000 Labor 7,700 14,000 111,390 222,780 Overhead

Mandarin Manufacturing Company uses a process cost system with FIFO method of costing to account for cost. Units of product are started in the Forming Dept. and then transferred to the Finishing Department where they are completed. Units are inspected at the end of the production process (discrete) in the Forming Department and an average of 5% of units started is considered normal loss. Data related to April in the Forming Dept. are: UNITS: Units in beginning inventory, 100% M, 35%CC Units started in process Units transferred to next department Units in process end, 100% M, 65% 10,000 90,000 80,000 15,000 COSTS: Costs- prior period Costs this period P12,600 Materials P360,000 Labor 7,700 14,000 111,390 222,780 Overhead

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 10P: Mt. Palomar Manufacturing Co. uses a process cost system. Its manufacturing operation is carried on...

Related questions

Question

100%

The total cost of spoilage chargeable to Revenue is (recognized as expenses):

Transcribed Image Text:The total cost of spoilage chargeable to Revenue is (recognized as expenses):

Mandarin Manufacturing Company uses a process cost system with FIFO method of costing to account for cost.

Units of product are started in the Forming Dept. and then transferred to the Finishing Department where they

are completed. Units are inspected at the end of the production process (discrete) in the Forming Department

and an average of 5% of units started is considered normal loss. Data related to April in the Forming Dept.

are:

UNITS:

Units in beginning inventory, 100% M, 35%CC

Units started in process

Units transferred to next department

Units in process end, 100% M, 65%

10,000

90,000

80,000

15,000

COSTS:

Costs- prior period Costs this period

P12,600

Materials

Labor

P360,000

111,390

222,780

7,700

Overhead

14,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT