4. What is the entity's projected net income?a. 564,000 b. 171,000 с. 105,000 d. 156,000 5. What is the entity's projected earnings before interest and taxes (EBIT) a. 660,000 b. 550,000 с. 300,000

4. What is the entity's projected net income?a. 564,000 b. 171,000 с. 105,000 d. 156,000 5. What is the entity's projected earnings before interest and taxes (EBIT) a. 660,000 b. 550,000 с. 300,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter6: Statement Of Cash Flows

Section: Chapter Questions

Problem 25E

Related questions

Question

Pls show ur solutions pls

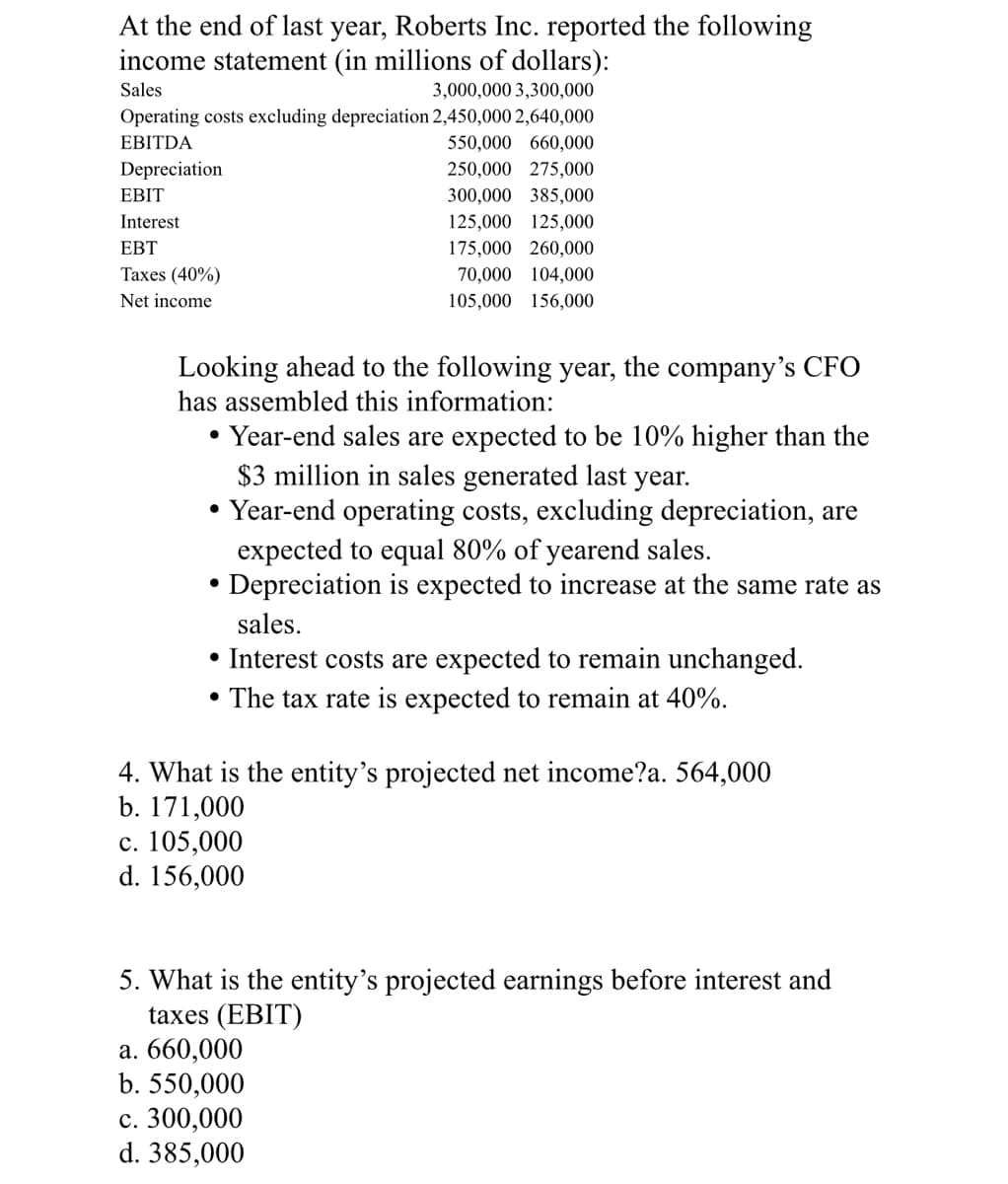

Transcribed Image Text:At the end of last year, Roberts Inc. reported the following

income statement (in millions of dollars):

Sales

3,000,000 3,300,000

Operating costs excluding depreciation 2,450,000 2,640,000

550,000 660,000

EBITDA

Depreciation

250,000 275,000

ЕBIT

300,000 385,000

Interest

125,000 125,000

EBT

175,000 260,000

Taxes (40%)

70,000 104,000

Net income

105,000 156,000

Looking ahead to the following year, the company's CFO

has assembled this information:

• Year-end sales are expected to be 10% higher than the

$3 million in sales generated last

• Year-end operating costs, excluding depreciation, are

expected to equal 80% of yearend sales.

• Depreciation is expected to increase at the same rate as

year.

sales.

• Interest costs are expected to remain unchanged.

• The tax rate is expected to remain at 40%.

4. What is the entity's projected net income?a. 564,000

b. 171,000

с. 105,000

d. 156,000

5. What is the entity's projected earnings before interest and

taxes (EBIT)

а. 660,000

b. 550,000

с. 300,000

d. 385,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning