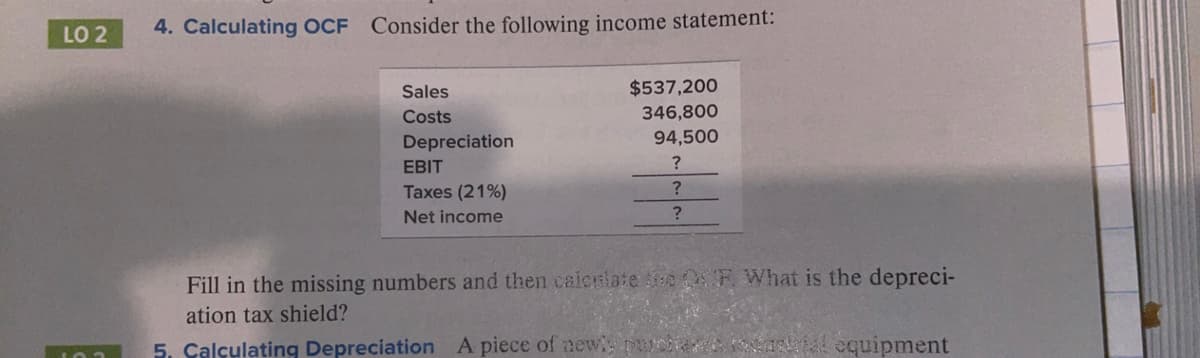

4. Calculating OCF Consider the following income statement! $537,200 346,800 Sales Costs Depreciation 94,500 EBIT Taxes (21%) ? Net income Fill in the missing numbers and then caicrlate o F What is the depreci- ation tax shield?

Q: D9 A stock has an initial value of $7, and can go up by 1.2 or down by 0.7, the risk free rate is…

A: Spot price (SP) =$7 Exercise price (EP) = $6 Expected future spot price (lower limit)on expiry date…

Q: 2. The current price on a stock is 240 lei and the expected dividend equals 11 lei per share. One…

A: Effective return implies for the actual profit that an investor receives after considering all…

Q: tfolio P has a beta of 1.0.

A: The beta of the portfolio refers to the weighted sum of the assets of the company according to the…

Q: 4. An investor has a budget of 100000 lei and intends to place it in Treasury bills and two stocks A…

A: The return that shows the expectation of profit of an investor from his portfolio is called expected…

Q: 10. If money is worth 8% compounded quarterly, what quarterly savings is required in order to have…

A: Quarterly compounding refers to the amount of interest earned on a quarterly basis on an account or…

Q: You have two options to invest $1000 in: i) A $1050 face value bond with coupon rate c = 6%. ii) A…

A: Bond is the debt security that investors uses to reduce the risk and increase stable return from…

Q: Consider two riskless perpetuities: (i) pays $120 every year; (ii) pays $10 every month. If the…

A: Perpetuity: Perpetuity is the series of fixed payments which is incurred or received for the…

Q: uppose that certain operati xpenditures were expected to be t the end of the first months, $1000 at…

A: In arithmetic increasing annuity there is increase of fixed amount of increase at each period of…

Q: do we need to check the credit worthiness of credit customers before granting their credit…

A: Giving credit to the business and customers is main earning sources for banks but they need to take…

Q: Taylor deposited $600 at the end of every three months into an investment for the past 5 years. The…

A: Future Value The future value is the amount that will be received at the end of a certain period.…

Q: Urgently need Given the following cash flow: $6,500, $4,500, and -$13,000. What is the barrowing…

A: Period Cash flow 1 6500 2 4500 3 -13000

Q: Mr. X lends $20,000 to Mr. Y on May 6, 2021. A promissory note is written by Mr. Y at a simple…

A: Promissory note is a negotiable instrument which creates the obligation to pay on one party and…

Q: You are considering two ways of financing a spring break vacation. You could put it on your credit…

A: The modified rate of return for compounding interest into actual terms of time is called the…

Q: In the accompanying diagram, what is the value of K on the left-hand cash-flow diagram that is…

A: Interest rate (i) = 10% Let's equate the future values of cashflows at year 7 in both the diagrams…

Q: Milhouse, 22, is about to begin his career as a rocket scientist for a NASA contractor. Being a…

A: Amount required to buy boat on retirement is $300,000 time till retirement is 43 years Annual amount…

Q: a. lane borrows $30,000 for 10 years. She wishes to pay it off with five payments. The first payment…

A: The concept of the time value of money states that the same amount of money is worth more today than…

Q: A raffle is taking place and tickets are being sold for $5. Everyone who enters will have an equal…

A: The expected profit of a project is the amount of return that can be expected if it is chosen for…

Q: Why digital payment has changed the fiance systems?

A: In the recent past and last few years’ digital payment systems have boomed. Different forms of new…

Q: Company "A" has a beta of 1.5 and a cost of capital of 25%. Company "B" has a beta of 0.8 and a…

A: The cost of capital is a firm's computation of the minimum return required to rationalize embarking…

Q: Solved Manually. Taylor Swift, a college student of USeP decides to get a student loan amounting to…

A: Loan amount = $4000 Interest rate = 5% Monthly interest rate = 5%/12 = 0.416666666666667% Monthly…

Q: Jill Angel holds a $200,000 portfolio consisting of the following stocks. The portfolio's beta is…

A: Portfolio beta (PB) = 0.88 Stock A beta (AB) = 0.50 New stock beta (NB) = 1.45 Weight of stock A or…

Q: After learning the course, you divide your portfolio into three equal parts, with one part in…

A: The beta of overall portfolio is calculated as weighted proportion of beta into each respective…

Q: 8. Assuming a discount rate of 7%, what is the net present value of buying the new machine? A:…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: Faisal has $14,000 in his savings account and can save an additional $4200 per year. If interest…

A: The time value of money concepts can be used to estimate the number of periods it will take to…

Q: You already have $54,700 in your savings account that earns 3.50% compounded annually. You will…

A: Current amount (PV) = $54700 Quarterly deposit (P) = $2,820 Interest rate = 3.50% Quarterly interest…

Q: Statement True False When returns on Stock A increase, returns on Stock B also increase. In general,…

A: Standard deviation is a measure of risk. The standard deviation or risk of a portfolio is least when…

Q: The profitability index of a certain project is 1.2 with an investment of P 56,600. Cost of capital…

A: Profitability Index (PI) is one of the types of capital budgeting technique. It is used to find the…

Q: Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed…

A: Operating cash flow: The amount of cash created by a business's regular operational activities…

Q: How did you calculate the depriciation expense?

A: This method also called diminishing balance method or declining balance method where the…

Q: Bianca decides to stop going to the coffee shops in the morning and figures she saves about $30 per…

A: The amount of money after 5 years can be calculated with the help of future value of annuity…

Q: In terms of Porfolio Variance calculation/formula of 0.02819 your computation is different than mine…

A: As per the given information in the question, we need to consider the standard deviation and weights…

Q: Rey borrowed F 40,000 at 12 % compounded semiannually. He agreed to pay the der semiannually a sum…

A: The loans are paid by the periodic payments that carry the payment for the principal amount and…

Q: H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed…

A: Initial investment is $2,400,000 Tax rate is 23% Required rate of return is 10% Estimated annual…

Q: Perpetuity LLC has preferred stocks that will pay annual dividend of $6.06 every year forever…

A: SOLUTION : GIVEN, Annual dividend = $6.06 Current price = $94.08 Now, Calculating the required…

Q: Von Bora Corporation (VBC) is expected to pay a $4.00 dividend at the end of this year. If you…

A: Value of a share of VBS stock = Dividend / (Required return - Growth rate) Dividend = $4.00 Required…

Q: On May 1, 2021, Bo Smith, proud father of newborn son Bobo, purchased $200,000 in zero-coupon bonds…

A: Bonds are defined as financial instruments used by companies to raise additional funds from the…

Q: The least risky capital market security is a. preferred stock. b. common stock. c. corporate bonds.…

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve…

Q: Carlos and Connie own a farm as tenancy by the entirety (TBE). The farm is currently valued at $2…

A: Answer:- A) If Connie dies, $1m is included in her gross estate for estate tax purposes. This…

Q: A stock has a required return of 11% and a dividend yield of 4%. The price of the stock is $90 and…

A: SOLUTION : GIVEN, Required return = 11% Dividend yield = 4% Stock price = $90 Now, Firsty we have…

Q: F asked money amounting to P 9,000 from his parents on the first month 2020 and 12,000 on 2022. He…

A: Present value includes the money without the interest and future value includes the payment with…

Q: 9.1 Calculating Operating Cash Flow Mater Pasta, Inc., has projected a sales volume of $1,432 for…

A: Operating cash flow is calculated as cash flow generated from business after taxes

Q: Discuss the main difficulties that are faced in calculating an appropriate cost of capital using…

A: According to the dividend growth model, the price of an equity share is the present value of…

Q: Net present value f

A: Net present value refers to the difference between the net cash inflows and cash outflows in a…

Q: St. Johns River Shipyards' welding machine is 15 years old, fully depreciated, and has no salvage…

A:

Q: The firm's bank charges $18 per wire and $0.50 per EDT. The EDT takes one day longer to clear. The…

A: Since The minimum transfer balance= TBAL TBAL=Incremental costDS×(K-ECR(1-RRR))365 Where: DS= Days…

Q: Suppose that you took out a mortgage loan and should repay $500 per month in the next 20 years. In…

A: Interest rate is the amount the lender charges the borrower and is the percentage of principal, or…

Q: a. How many shares must the venture capitalist receive to end up with 20% of the company? What is…

A: An investor that provides equity funding to the companies is known as a venture capitalist. These…

Q: A consulting company is buying a new computer system for their headquarters for $175,000. The asset…

A: New Computer Cost = $175,000 Asset Life = 5 Years

Q: Jean deposited P1,000, P1,500 and P2,000 at the end of the 2nd year, 3rd year and 4th year,…

A: Year Deposit 2 1000 3 1500 4 2000 Interest rate = 0.06

Q: um of Year's Digit is established in which funds will accumulate for replacemen

A: There are many methods of determining the depreciation and each and every method has own advantages…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?Consider the following income statement: Sales $ 383,208Costs 249,312Depreciation 56,700Taxes 25% Calculate the EBIT. Calculate the net income. Calculate the OCF. What is the depreciation tax shield? Pls fastSuppose a firm's tax rate is 25%. 1. What effect would a $10.92 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices that apply.) A. $10.92 million operating expense would be immediately expensed, increasing operating expenses by $10.92 million. This would lead to a reduction in taxes of 25%×$10.92 million=$2.73 million. B. A $10.92 million operating expense would be immediately expensed, increasing operating expenses by $10.92 million. This would lead to an increase in taxes of 25%×$10.92 million=$2.73 million C. Earnings would decline by $10.92 million−$2.73 million=$8.19 million. There would be no effect on next year's earnings. D. Earnings would decline by $10.92 million−$2.73 million=$8.19 million. The same effect would be seen on next year's earnings 2. What effect would a $10.25 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $2.05…

- 6. Fill in the missing numbers in the following income statement: (Do not round intermediate calculations.)Requirement 1: Sales $ 659,000 Costs 420,100 Depreciation 98,900 Requirement 1: find EBIT, Taxes (40%) and Net income. Requirement 2: What is the OCF? Requirement 3: What is the depreciation tax shield?Suppose a firm’s tax rate is 25%. 1. What effect would a $9.26 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices thatapply.) A. A $9.26 million operating expense would be immediately expensed, increasing operating expenses by $9.26 million. This would lead to a reduction in taxes of 25%×$9.26 million=$2.32 million. B. A $9.26 million operating expense would be immediately expensed, increasing operating expenses by $9.26 million. This would lead to an increase in taxes of 25%×$9.26 million =$2.32 million. C. Earnings would decline by $9.26 million−$2.32 million=$6.94 million. The same effect would be seen on next year's earnings. D. Earnings would decline by $9.26 million−$2.32 million=$6.94 million. There would be no effect on next year's earnings. 2. What effect would a $11.75 million capital expense have on this year's earnings if the capital expenditure is depreciated at a rate of $2.35 million…Patterson recently reported EBITA of $14.5 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?

- 4. Binford Tools has an expected perpetual EBITDA equal to $67k. Its tax rate is 35%. Binford has $139k in debt at a cost of 6.85%. The unlevered capital cost is 10.25%. What is Binford's total value assuming interest is tax deductible?Fill in the missing numbers for the following income statement. (Input all amounts as positive values. Do not round intermediate calculations.) Sales $ 678,900 Costs 433,800 Depreciation 106,400 EBIT $ Taxes (30%) Net income $ Calculate the OCF. OCF $ What is the depreciation tax shield? Depreciation tax shield $3. Assume a firm has earnings before depreciation and taxes of $500,000 and no depreciation. It is in a 40 percent tax bracket. a. Compute its cash flow. b. Assume it has $500,000 in depreciation. Recompute its cash flow. C. How large a cash flow benefit did the depreciation provide?

- Refer to the following financial information of Scholz Company: NOPAT 8.250.000.00 EBITDA 17,725.000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280.000.00 Tax rate 40% 1. Calculate the Company's depreciation and amortization expense 2. calculate its interest expense. Use 2 decimal places for your final answer. 3. calculate its EVA. Use 2 decimal places for your final answer.Suppose you sell a fixed asset for $112,000 when its book value is $112,000. If your company's marginal tax rate is 21 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? Multiple Choice $112,000 $0 $68,320 $34,720revenue $878,412.00 general & administrative expense $352,666.00 depreciation expense $131,455.00 leasing expense $108,195.00 interest expense $78,122.00 if average tax rate is 3.4%, what is its net income after taxes?