4. What was the balance of work-in-process inventory on December 31, 2017? 5. What was the cost of goods sold before proration of under- or overallocated overhead? 6. What was the under- or overallocated manufacturing overhead in 2017?

4. What was the balance of work-in-process inventory on December 31, 2017? 5. What was the cost of goods sold before proration of under- or overallocated overhead? 6. What was the under- or overallocated manufacturing overhead in 2017?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 3SEA: JOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD Hilburn Manufacturing Corporation had the...

Related questions

Question

100%

For Q4 Q5 and Q6

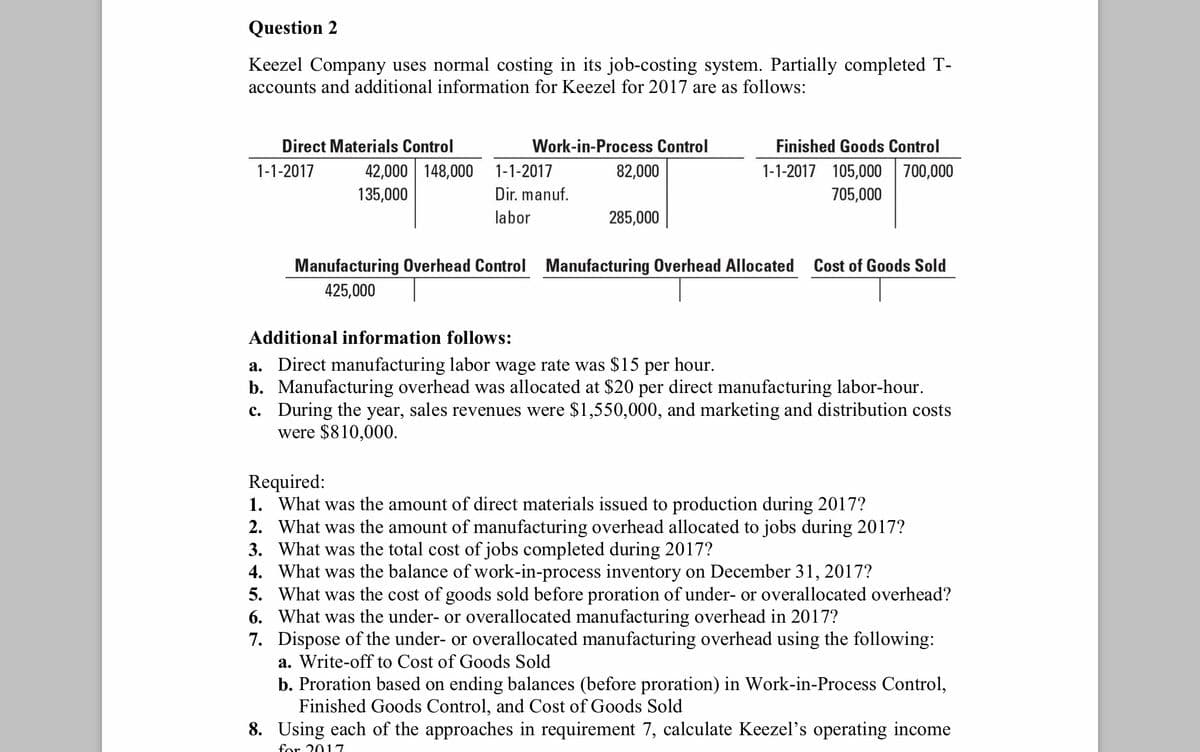

Transcribed Image Text:Question 2

Keezel Company uses normal costing in its job-costing system. Partially completed T-

accounts and additional information for Keezel for 2017 are as follows:

Direct Materials Control

Work-in-Process Control

Finished Goods Control

42,000 148,000 1-1-2017

Dir. manuf.

1-1-2017

82,000

1-1-2017 105,000 700,000

135,000

705,000

labor

285,000

Manufacturing Overhead Control Manufacturing Overhead Allocated Cost of Goods Sold

425,000

Additional information follows:

a. Direct manufacturing labor wage rate was $15 per hour.

b. Manufacturing overhead was allocated at $20 per direct manufacturing labor-hour.

c. During the year, sales revenues were $1,550,000, and marketing and distribution costs

were $810,000.

Required:

1. What was the amount of direct materials issued to production during 2017?

2. What was the amount of manufacturing overhead allocated to jobs during 2017?

3. What was the total cost of jobs completed during 2017?

4. What was the balance of work-in-process inventory on December 31, 2017?

5. What was the cost of goods sold before proration of under- or overallocated overhead?

6. What was the under- or overallocated manufacturing overhead in 2017?

7. Dispose of the under- or overallocated manufacturing overhead using the following:

a. Write-off to Cost of Goods Sold

b. Proration based on ending balances (before proration) in Work-in-Process Control,

Finished Goods Control, and Cost of Goods Sold

8. Using each of the approaches in requirement 7, calculate Keezel's operating income

for 2017

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning