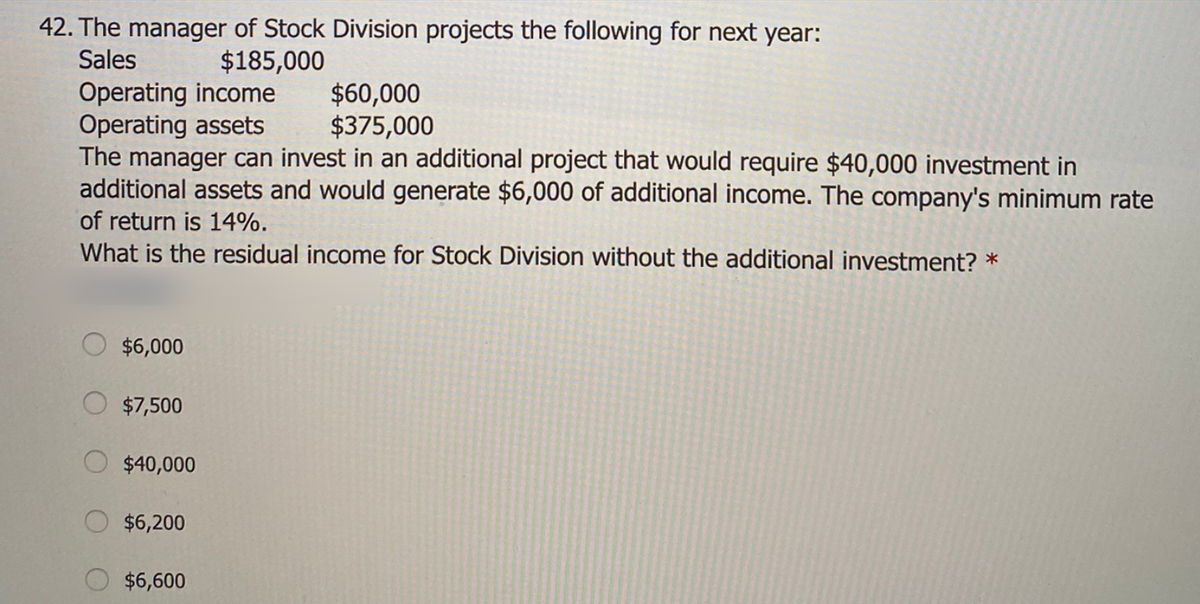

42. The manager of Stock Division projects the following for next year: Sales $185,000 Operating income Operating assets The manager can invest in an additional project that would require $40,000 investment in additional assets and would generate $6,000 of additional income. The company's minimum rate $60,000 $375,000 of return is 14%. What is the residual income for Stock Division without the additional investment? * $6,000 $7,500 $40,000 $6,200 $6,600

42. The manager of Stock Division projects the following for next year: Sales $185,000 Operating income Operating assets The manager can invest in an additional project that would require $40,000 investment in additional assets and would generate $6,000 of additional income. The company's minimum rate $60,000 $375,000 of return is 14%. What is the residual income for Stock Division without the additional investment? * $6,000 $7,500 $40,000 $6,200 $6,600

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:42. The manager of Stock Division projects the following for next year:

Sales

$185,000

Operating income

Operating assets

The manager can invest in an additional project that would require $40,000 investment in

additional assets and would generate $6,000 of additional income. The company's minimum rate

$60,000

$375,000

of return is 14%.

What is the residual income for Stock Division without the additional investment? *

$6,000

$7,500

$40,000

$6,200

$6,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning