me third question: In 2020, Al-Naw company sold 1,200,000 units of i- oduct at a selling price of 32 dol er unit, and the variable costs per mounted to 22 dollars, and the fix osts for the company's fiscal yea mounted to 10,000,000 dollars. \

me third question: In 2020, Al-Naw company sold 1,200,000 units of i- oduct at a selling price of 32 dol er unit, and the variable costs per mounted to 22 dollars, and the fix osts for the company's fiscal yea mounted to 10,000,000 dollars. \

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EB: Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90....

Related questions

Question

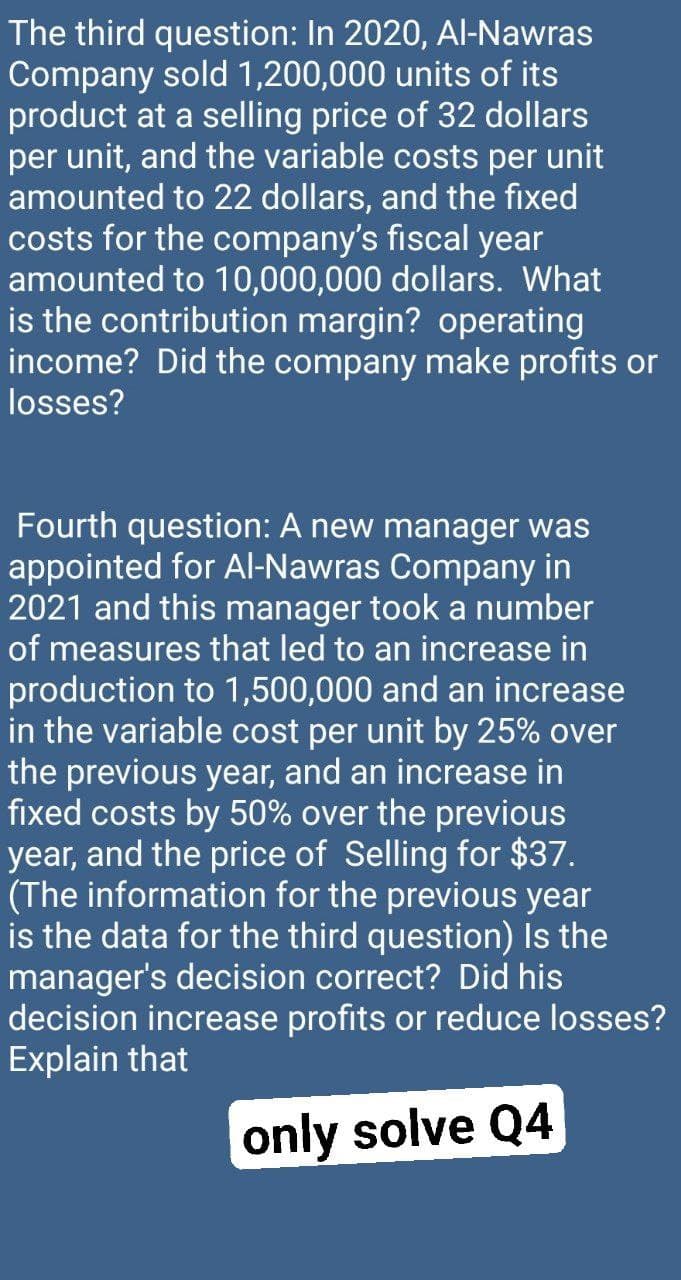

Transcribed Image Text:The third question: In 2020, Al-Nawras

Company sold 1,200,000 units of its

product at a selling price of 32 dollars

per unit, and the variable costs per unit

amounted to 22 dollars, and the fixed

costs for the company's fiscal year

amounted to 10,000,000 dollars. What

is the contribution margin? operating

income? Did the company make profits or

losses?

Fourth question: A new manager was

appointed for Al-Nawras Company in

2021 and this manager took a number

of measures that led to an increase in

production to 1,500,000 and an increase

in the variable cost per unit by 25% over

the previous year, and an increase in

fixed costs by 50% over the previous

year, and the price of Selling for $37.

(The information for the previous year

is the data for the third question) Is the

manager's decision correct? Did his

decision increase profits or reduce losses?

Explain that

only solve Q4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning