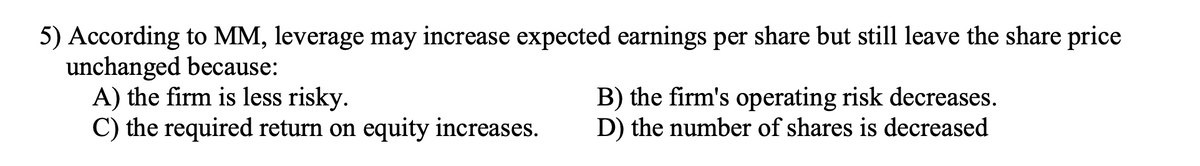

5) According to MM, leverage may increase expected earnings per share but still leave the share price unchanged because: A) the firm is less risky. C) the required return on equity increases. B) the firm's operating risk decreases. D) the number of shares is decreased

Q: The dividend growth model: a. is only as reliable as the estimated rate of growth. b. can only be…

A: Dividend Growth Model is a stock valuation method that calculates a stock’s intrinsic value and…

Q: If the debt component in the capital structure is predominant –

A: Debt: It is a part of the capital structure that involves bonds, loans, etc. Introducing debt to the…

Q: increase a firm’s cost of capital

A: The consideration of a below-average risk project is likely to increase a firm's cost of capital.

Q: Why is the cost of retained earnings cheaper than the cost of issuing new common stock? Group of…

A: Cost of retained earnings is the cost of financing through internal equity, where as cost of issuing…

Q: which one is correct please confirm? QUESTION 21 Finance researcher Myron Gordon argues that ____.…

A: According to Myron Gordon a company’s stock is worth sum of all its future dividend’s present value.…

Q: True or False: It is free for a company to raise money through retained earnings, because retained…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Which of the following events would cause a company's cost of retained earnings to increase? Group…

A: When profit increases and divided is reduced, it leads to increase in retained earnings.

Q: Which of the following are false? I) Managers are reluctant to make dividend changes that might have…

A: As per Lintner’s stylized facts, Managers are reluctant to make the dividend changes that might have…

Q: Explain what this statement means: "One type of leverage affects both EBIT and EPS. The other type…

A: Since you have asked multiple questions, we will solve the first question for you. IF you want any…

Q: Explain why the following statement is true: "All else the same, firms with relatively stable sales…

A: 1.Stable sales indicate stable cash flows which means that the firm will be able to service its…

Q: Which of the following statements are true and which are false? o). High breakeven points in capital…

A: o). High breakeven points in capital intensive industries are desirable. True

Q: Which of the following statements is most correct?(a) P/E ratios are higher for firms with high…

A: The question is based on the concept of market value and book value of shares. Price to earnings…

Q: In general, as a company increases the amount of short-term financing relative to long-term…

A: Explanation : An increase in the proportion of short-term financing will not affect a company’s…

Q: If a company’s market price rises above the IPO price, does that suggest that the company left money…

A: An initial public offering refers to the new or fresh issue of stock to a group of investors.…

Q: Which of the following statements is not correct? The higher the sales growth rate g is, the…

A: Additional fund needed is the amount of money a company needs to raise from its external sources to…

Q: Modig theory says percentage earnings that a firm pays in dividends has no effect on its cost of…

A: a) This statement is untrue. Modigliani and Miller suggested that a dividend policy is irrelevant…

Q: investors

A: Introduction: Dividend is defined as a share in the profits of the company that is paid by the…

Q: A firm using a Leveraged vs a Conservative Capital Structure would have the following…

A: Capital structure is the structure of financing the funds from the different source. Sources are the…

Q: Which of the following is one of the causes of over capitalization? a. Reduction in the market…

A: Over Capitalization means when a company have huge amount of debt in its book and its Net assists…

Q: According to Modigliani and Miller, what happens to the cost of equity when the firm increases its…

A: Equity financing is the process of raising money from the investors and give ownership to the equity…

Q: Through the effects of financial leverage, when EBIT decreases, earnings per share will

A: EBIT(Earnings before interest and taxes) is a measurement of a company's profitability directly…

Q: According to MM propositions, which of the following statements best describes the consequence of…

A: The M&M Theorem, or the Modigliani-Miller Theorem is a capital structure theory developed by…

Q: istributed even if the company recorded losses in the last period. c) The balance between curren

A: The right option is C The balance between current dividends and future growth is achieved,…

Q: The price-to-earnings ratio: ( al is of little value to investors these days due to the fact that…

A: The price-earning ratio, or P/E ratio, is another name for the comparison between the stock's market…

Q: Which of the following statements is correct? O The fundamental value of the shares in a firm is…

A: Fundamental value of a firm is its intrinsic value. It is the value which is determined after…

Q: The bird-in-hand theory would predict that the companies could decrease their cost of equity…

A: The minimum rate of return which is expected to be generated by an investment so that its financing…

Q: When the yield curve becomes inverted and slopes downard, it is an indicator of: a) A coming…

A: Yield curve is very important in telling that how would be future interest rate in the market and…

Q: Which one of the following statements concerning financial leverage is correct? A) Financial…

A: Financial leverage which is also known as leverage or trading on equity

Q: company whose stock is selling at a P/E ratio greater than the P/E ratio of a market index most…

A: A price multiple is a ratio of a stock’s market prices to some measure of base value per share.…

Q: The tendency of the return on stockholders' equity to vary disproportionately from the return on…

A: The return on stockholders' equity refers to the amount given to the shareholders from the total…

Q: If a firm went from zero debt to successively higher levels of debt, why would you expect its stock…

A: Debt- It refers to the amount of money that is to be repaid by the borrower to the lender which is…

Q: Which is NOT a potential explanation for IPO short-term underpricing? Underwriters can unload more…

A: Underpricing is the practice of listing an initial public offering (IPO) at a price below its real…

Q: Assume that Modigliani-Miller Propositions 1 and 2 hold. Ex- plain carefully why the conclusion of…

A: The Modigliani-Miller theorem (MM) states that the market value of a company is calculated by its…

Q: Which of the following statements is INCORRECT? Cutting the firm's dividend to increase…

A: Statement 3"A firm will increase its share price by reducing the total payout to shareholders." is…

Q: Which one of the followings is incorrect regarding to cost of equity: On average, it is higher…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: Is this statement true or false? Give a reason for your answer. "The bird-in-hand theory suggests…

A: It indicates that the investors will generally prefer the stock dividends to expected capital gains…

Q: Assume all firms have the same expected dividends. If they have different expected returns, how will…

A: All the firms have same expected dividends but different expected returns.

Q: Which of the following will increase the price of a stock? Group of answer choices: A. Decrease in…

A: The required rate of return refers to the minimum return a speculator will acknowledge for claiming…

Q: Is the following sentence true or false? Please explain.…

A: Cost of equity is the return paid to the shareholders by the company for taking the risk by…

Q: Indicate whether the following statements are true or false. If the statementis false, explain…

A: A residual dividend is a dividend policy that companies use when calculating the dividends to be…

Q: Schalheim Sisters Inc. has always paid out all of its earnings as dividends; hence, the firm has no…

A: The right answer is option (d). Under the CAPM method, the cost of capital is calculated by, first…

Q: Which of the following statements is correct? A. If a firm’s assets are growing at a positive…

A: AFN stands for “additional funds needed,” and it refers to the additional resources that will be…

Q: For each of the companies described here, would you expect it to have a low, medium, or high…

A: A dividend is a distribution of a portion of a company's earnings to a group of shareholders…

Q: As companies evolve, certain factors can drive sudden growth. This may lead to a period of…

A: Dividend per share = $3.12 Growth rate of next year = 16% Constant Growth rate = 3.20% Risk free…

Q: If a firm goes from zero debt to successively higher levels of debt, why would you expectits stock…

A: price of stock =FCFFWACC wacc=wd×rd×1-tax+we×rewhere,wd=weight of debtwe=equityrd=cost of…

Q: Although the exact relationship between a firm's degree of financial leverage and its beta is…

A: Beta is a measure of volatility or systematic risk higher the beta higher will be the risk. The beta…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Which one of the followings is incorrect regarding to cost of equity: On average, it is higher than cost of debt. It moves in the same direction with tax rates. It is affected by return on market portfolio. For a dividend paying company, it is sensitive to growth expectations for future dividends. It is highly dependent on risk level of the firm and growth rate. For calculating cost of equity, we can rely on dividend growth model or SML approach. Both models might suffer from the assumption that past is a good predictor of future. True False Percy's Wholesale Supply has earnings before interest and taxes of €106,000. Both the book and the market value of debt is €170,000. The unlevered cost of equity is 15.5 per cent while the pre-tax cost of debt is 8.6 per cent. The tax rate is 28 per cent. What is the firm's weighted average cost of capital? Show your steps.A firm is planning to borrow money to make an equity repurchase to increase its stock price. It is basing its analysis on the fact that there will be fewer shares outstanding after the repurchases, and higher earnings per share. There are no taxes. a. Will earnings per share always increase after such an action? Explain.b. Will the higher earnings per share always translate into a higher stock price? Explain.c. Under what conditions will such a transaction lead to a higher price?Which of the following is/are true regarding payout policy to shareholders? A. Most of the time that firms announce an increase in dividends, the market reacts negatively, as this is an admission that the firm has few good investment opportunities going forward. B. Large, mature firms should return a lot of cash to shareholders because there aren’t enough good investment opportunities out there for them. C. Flexibility is one key reason why we have seen much more use of share repurchases to return cash to shareholders in the last 3 decades. D. The primary value driver for the firm is how cash is paid out, not cash generation. E. (A) and (B) F. (B) and (C) G. (C) and (D)

- Wyden Brothers uses the CAPM to calculate the cost of equity capital. The company’s capital structure consists of common stock, preferred stock, and debt. Which of the following events will reduce the company’s WACC? a) A reduction in the market risk premium. b) An increase in the risk-free interest rate. c) An increase in the beta of the company’s stock. d) An increase in expected inflation. e) An increase in the flotation costs associated with issuing preferred stock.Which of the following typically is true for profitability ratios? a. Growth stocks have lower price to earnings ratios.b. Companies in more competitive industries have higher profit margins.c. The gross profit ratio declines as competition increases.d. When a company has debt, its return on equity will be lower than its return on assets.A company whose stock is selling at a P/E ratio greater than the P/E ratio of a market index most likely has A. an anticipated earnings growth rate which is less than that of the average firm. B. a dividend yield which is less than that of the average firm. C. less predictable earnings growth than that of the average firm. D. greater cyclicality of earnings growth than that of the average firm.

- Which is true in relation to stock market efficiency? A.Market Price and Intrinsic value are inputs in determining whether a share is overvalued or undervalued B. If markets are truly efficient, each share prices should have a high deviation from its intrinsic value C. Intrinsic Value is readily observed from the stock market daily reports D. Large companies which is followed by many analyst are generally considered as highly inefficientWhich statement is false regarding the Capital Asset Pricing Model? A. The beta coefficient of a stock is constant. B. The risk free rate is usually based on the treasury bill yield. C. Market risk premium is the difference between market return and the risk free rate. D. The cost of retained earnings is equal to the cost of new shares issued.Reverse engineering share prices is an exercise in deductive reasoning. If we assume market price reflects share value, then through reverse engineering we can infer what the market assumes about a. the expected rate of return on equity capital, holding expected profitability and long-run growth constant. b. the expected profitability, holding the expected rate of return on equity capital and long-run growth constant. c. the expected long-run growth, holding the expected rate of return on equity capital and expected profitability constant.

- Does decreasing net margin percentages and slightly increasing financial leverage have an effect on Return on Equity (ROE)?. If Yes, What should a company do to solve such problem.Which statement below is incorrect? Select one: A. Compared to interview, survey is more suitable to ask standardised questions. B. If a firm has more intangible assets, according to the trade-off theory, it is more likely to have a higher leverage. C. If a firm is more profitable, according to the pecking order theory, it should use less debt for financing. D. The CAPM model implies that a stock with a higher beta has a higher return on average.Which of the following statements is correct? A. The optimal dividend policy is the one that satisfies management, not shareholders. B. The use of debt financing has no effect on earnings per share (EPS) or stock price. C. Stock price is dependent on the projected EPS and the use of debt, but not on the timing of the earnings stream. D. The riskiness of projected EPS can impact the firm's value. E. Dlvidend policy is one aspect of the firm's financial policy that is determined solely by the shareholders. Reset Selection