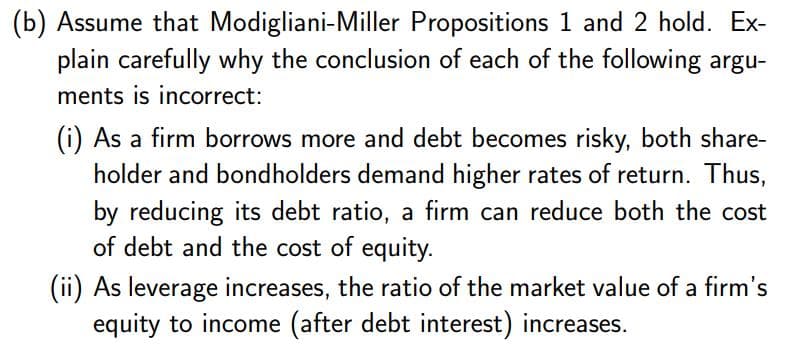

Assume that Modigliani-Miller Propositions 1 and 2 hold. Ex- plain carefully why the conclusion of each of the following argu- ments is incorrect: (i) As a firm borrows more and debt becomes risky, both share- holder and bondholders demand higher rates of return. Thus, reducing its debt ratio, a firm can reduce both the cost of debt and the cost of equity. ii) As leverage increases, the ratio of the market value of a firm's equity to income (after debt interest) increases.

Assume that Modigliani-Miller Propositions 1 and 2 hold. Ex- plain carefully why the conclusion of each of the following argu- ments is incorrect: (i) As a firm borrows more and debt becomes risky, both share- holder and bondholders demand higher rates of return. Thus, reducing its debt ratio, a firm can reduce both the cost of debt and the cost of equity. ii) As leverage increases, the ratio of the market value of a firm's equity to income (after debt interest) increases.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 2QE

Related questions

Question

100%

Transcribed Image Text:(b) Assume that Modigliani-Miller Propositions 1 and 2 hold. Ex-

plain carefully why the conclusion of each of the following argu-

ments is incorrect:

(i) As a firm borrows more and debt becomes risky, both share-

holder and bondholders demand higher rates of return. Thus,

by reducing its debt ratio, a firm can reduce both the cost

of debt and the cost of equity.

(ii) As leverage increases, the ratio of the market value of a firm's

equity to income (after debt interest) increases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning