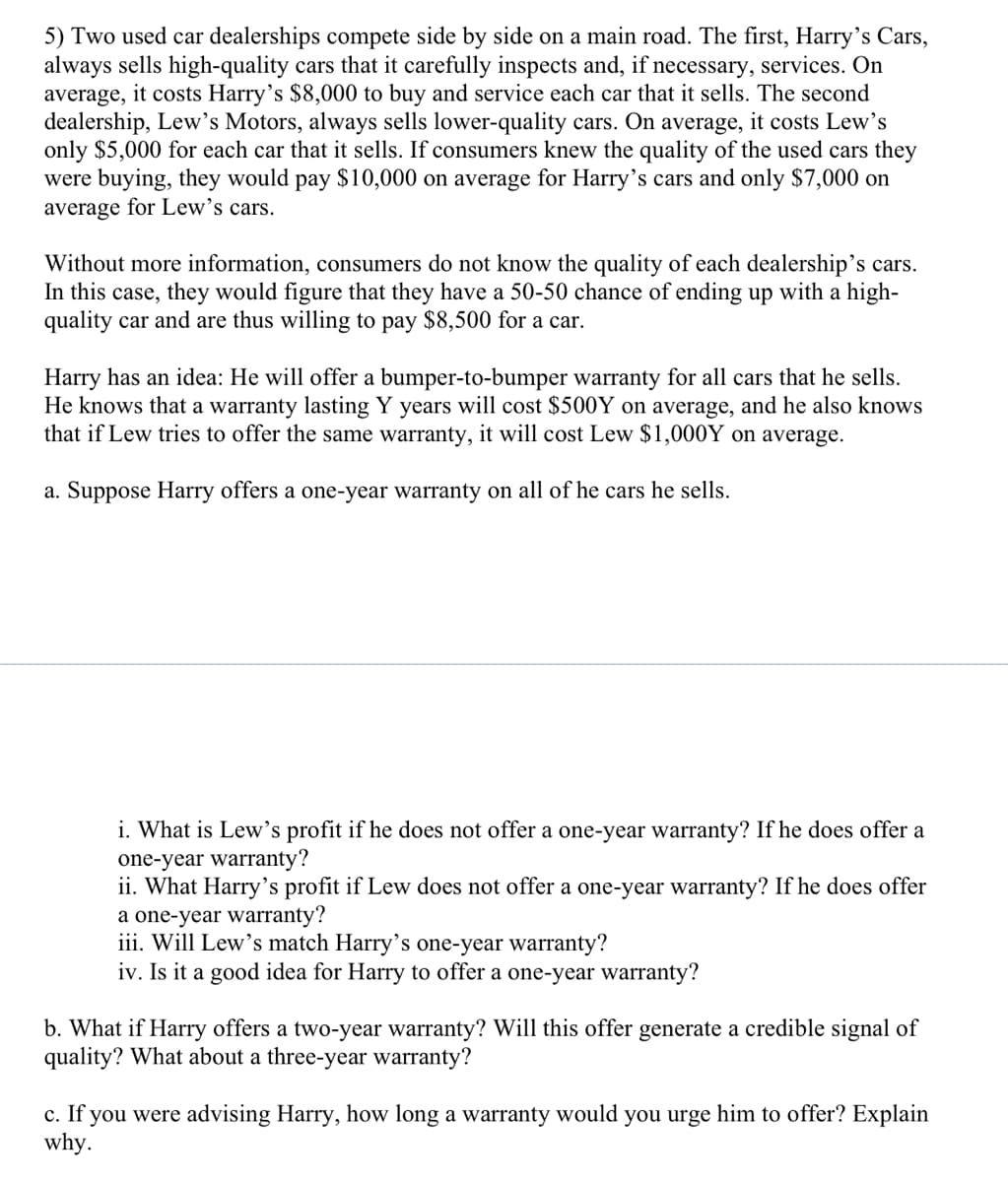

5) Two used car dealerships compete side by side on a main road. The first, Harry's Cars, always sells high-quality cars that it carefully inspects and, if necessary, services. On average, it costs Harry's $8,000 to buy and service each car that it sells. The second dealership, Lew's Motors, always sells lower-quality cars. On average, it costs Lew's only $5,000 for each car that it sells. If consumers knew the quality of the used cars they were buying, they would pay $10,000 on average for Harry's cars and only $7,000 on average for Lew's cars. Without more information, consumers do not know the quality of each dealership's cars. In this case, they would figure that they have a 50-50 chance of ending up with a high- quality car and are thus willing to pay $8,500 for a car. Harry has an idea: He will offer a bumper-to-bumper warranty for all cars that he sells. He knows that a warranty lasting Y years will cost $500Y on average, and he also knows that if Lew tries to offer the same warranty, it will cost Lew $1,000Y on average. a. Suppose Harry offers a one-year warranty on all of he cars he sells. i. What is Lew's profit if he does not offer a one-year warranty? If he does offer a one-year warranty? ii. What Harry's profit if Lew does not offer a one-year warranty? If he does offer a one-year warranty? iii. Will Lew's match Harry's one-year warranty? iv. Is it a good idea for Harry to offer a one-year warranty?

5) Two used car dealerships compete side by side on a main road. The first, Harry's Cars, always sells high-quality cars that it carefully inspects and, if necessary, services. On average, it costs Harry's $8,000 to buy and service each car that it sells. The second dealership, Lew's Motors, always sells lower-quality cars. On average, it costs Lew's only $5,000 for each car that it sells. If consumers knew the quality of the used cars they were buying, they would pay $10,000 on average for Harry's cars and only $7,000 on average for Lew's cars. Without more information, consumers do not know the quality of each dealership's cars. In this case, they would figure that they have a 50-50 chance of ending up with a high- quality car and are thus willing to pay $8,500 for a car. Harry has an idea: He will offer a bumper-to-bumper warranty for all cars that he sells. He knows that a warranty lasting Y years will cost $500Y on average, and he also knows that if Lew tries to offer the same warranty, it will cost Lew $1,000Y on average. a. Suppose Harry offers a one-year warranty on all of he cars he sells. i. What is Lew's profit if he does not offer a one-year warranty? If he does offer a one-year warranty? ii. What Harry's profit if Lew does not offer a one-year warranty? If he does offer a one-year warranty? iii. Will Lew's match Harry's one-year warranty? iv. Is it a good idea for Harry to offer a one-year warranty?

Chapter8: Market Failure

Section: Chapter Questions

Problem 10P

Related questions

Question

I need help with a

Transcribed Image Text:5) Two used car dealerships compete side by side on a main road. The first, Harry's Cars,

always sells high-quality cars that it carefully inspects and, if necessary, services. On

average, it costs Harry’s $8,000 to buy and service each car that it sells. The second

dealership, Lew's Motors, always sells lower-quality cars. On average, it costs Lew's

only $5,000 for each car that it sells. If consumers knew the quality of the used cars they

were buying, they would pay $10,000 on average for Harry's cars and only $7,000 on

average for Lew’s cars.

Without more information, consumers do not know the quality of each dealership's cars.

In this case, they would figure that they have a 50-50 chance of ending up with a high-

quality car and are thus willing to pay $8,500 for a car.

Harry has an idea: He will offer a bumper-to-bumper warranty for all cars that he sells.

He knows that a warranty lasting Y years will cost $500Y on average, and he also knows

that if Lew tries to offer the same warranty, it will cost Lew $1,000Y on average.

a. Suppose Harry offers a one-year warranty on all of he cars he sells.

i. What is Lew's profit if he does not offer a one-year warranty? If he does offer a

one-year warranty?

ii. What Harry's profit if Lew does not offer a one-year warranty? If he does offer

a one-year warranty?

iii. Will Lew's match Harry's one-year warranty?

iv. Is it a good idea for Harry to offer a one-year warranty?

b. What if Harry offers a two-year warranty? Will this offer generate a credible signal of

quality? What about a three-year warranty?

c. If you were advising Harry, how long a warranty would you urge him to offer? Explain

why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning