5. Answer questions A B and C

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 99.4C

Related questions

Question

100%

Practice Pack

5. Answer questions A B and C

Transcribed Image Text:Question

ConnecL

Content

fouTube Stu

Assignments

education.com/ext/map/indexhtml? con%3Dcon&external browser%3D0&launchUrl=https%253A%

%252Flms.

Saved

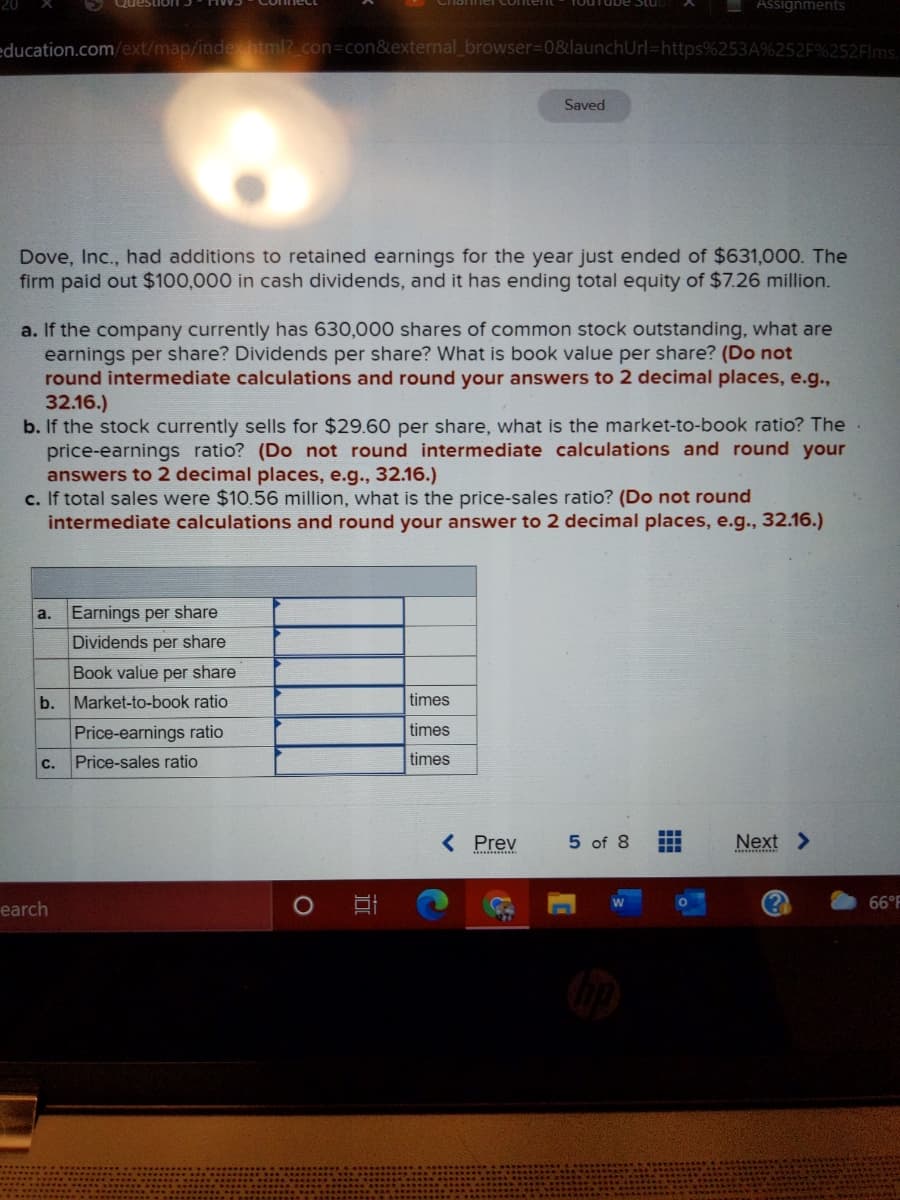

Dove, Inc., had additions to retained earnings for the year just ended of $631,000. The

firm paid out $100,000 in cash dividends, and it has ending total equity of $7.26 million.

a. If the company currently has 630,000 shares of common stock outstanding, what are

earnings per share? Dividends per share? What is book value per share? (Do not

round intermediate calculations and round your answers to 2 decimal places, e.g.,

32.16.)

b. If the stock currently sells for $29.60 per share, what is the market-to-book ratio? The .

price-earnings ratio? (Do not round intermediate calculations and round your

answers to 2 decimal places, e.g., 32.16.)

c. If total sales were $10.56 million, what is the price-sales ratio? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a.

Earnings per share

Dividends per share

Book value per share

b.

Market-to-book ratio

times

Price-earnings ratio

times

с.

Price-sales ratio

times

< Prev

5 of 8

Next >

earch

66°F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning