Do b)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 55APSA: Problem 2-55A Events and Transactions The accountant for Boatsman Products Inc. received the...

Related questions

Question

Do b)

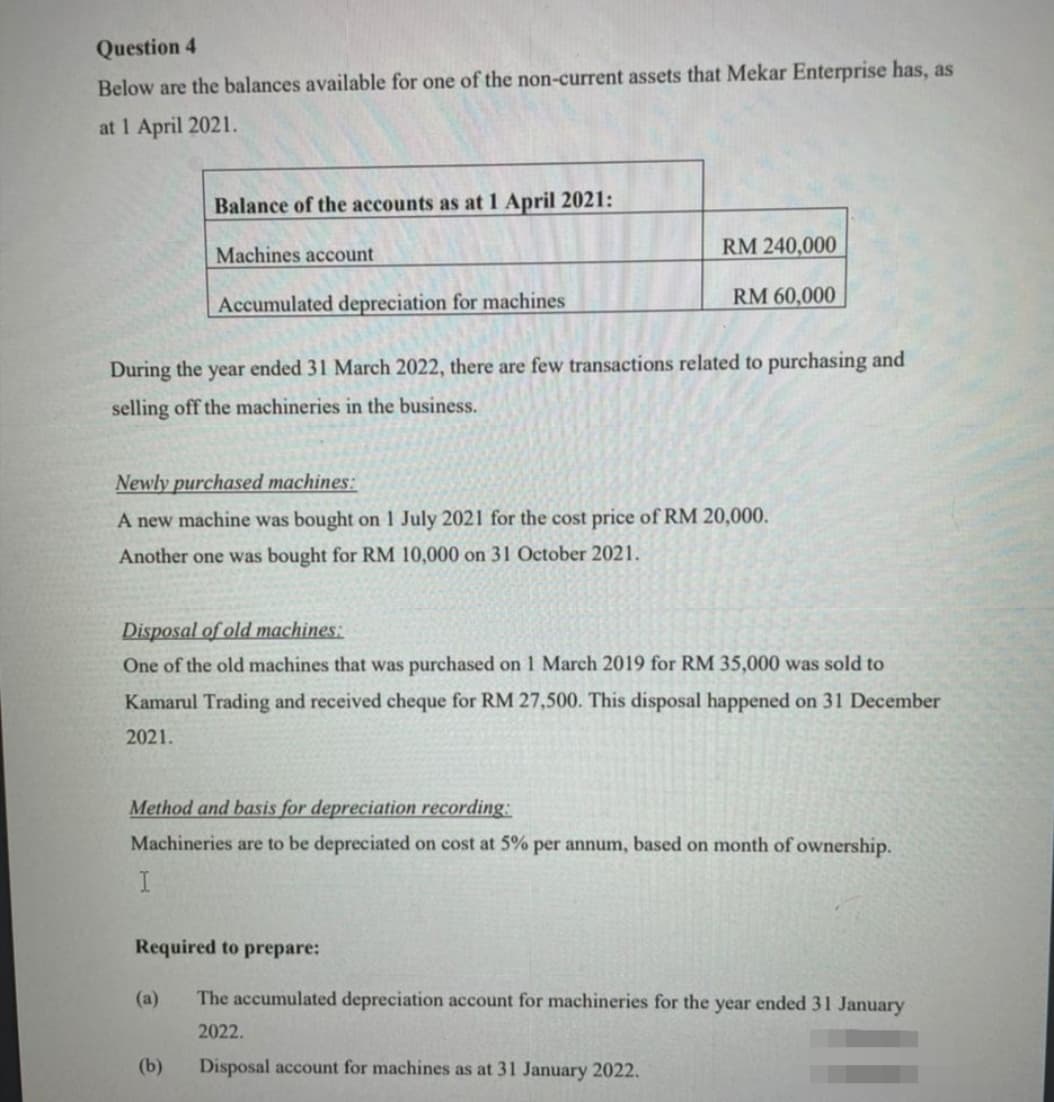

Transcribed Image Text:Question 4

Below are the balances available for one of the non-current assets that Mekar Enterprise has, as

at 1 April 2021.

Balance of the accounts as at 1 April 2021:

Machines account

RM 240,000

Accumulated depreciation for machines

RM 60,000

During the

year

ended 31 March 2022, there are few transactions related to purchasing and

selling off the machineries in the business.

Newly purchased machines:

A new machine was bought on 1 July 2021 for the cost price of RM 20,000.

Another one was bought for RM 10,000 on 31 October 2021.

Disposal of old machines:

One of the old machines that was purchased on 1 March 2019 for RM 35,000 was sold to

Kamarul Trading and received cheque for RM 27,500. This disposal happened on 31 December

2021.

Method and basis for depreciation recording:

Machineries are to be depreciated on cost at 5% per annum, based on month of ownership.

Required to prepare:

(a)

The accumulated depreciation account for machineries for the year ended 31 January

2022.

(b)

Disposal account for machines as at 31 January 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning