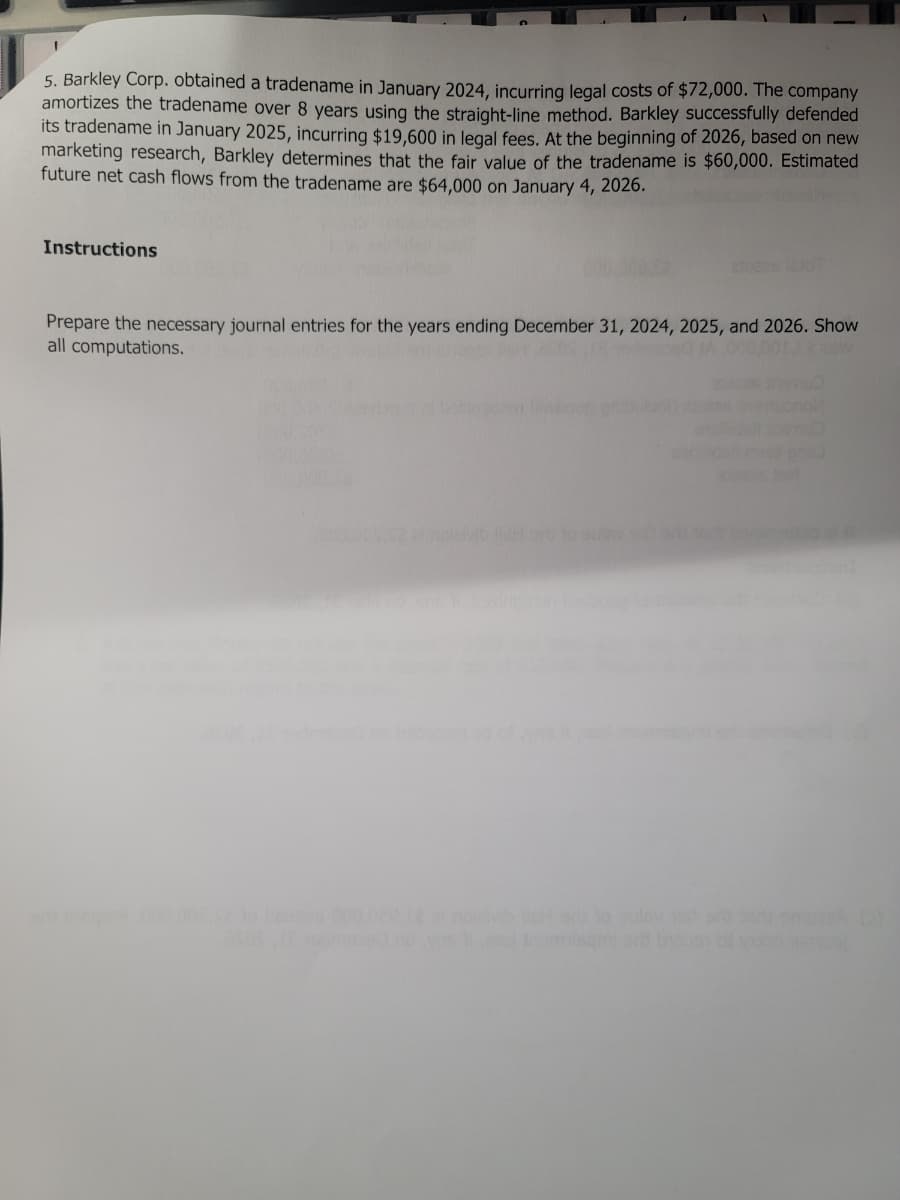

5. Barkley Corp. obtained a tradename in January 2024, incurring legal costs of $72,000. The company amortizes the tradename over 8 years using the straight-line method. Barkley successfully defended its tradename in January 2025, incurring $19,600 in legal fees. At the beginning of 2026, based on new marketing research, Barkley determines that the fair value of the tradename is $60,000. Estimated future net cash flows from the tradename are $64,000 on January 4, 2026.

5. Barkley Corp. obtained a tradename in January 2024, incurring legal costs of $72,000. The company amortizes the tradename over 8 years using the straight-line method. Barkley successfully defended its tradename in January 2025, incurring $19,600 in legal fees. At the beginning of 2026, based on new marketing research, Barkley determines that the fair value of the tradename is $60,000. Estimated future net cash flows from the tradename are $64,000 on January 4, 2026.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7MC

Related questions

Question

100%

Transcribed Image Text:5. Barkley Corp. obtained a tradename in January 2024, incurring legal costs of $72,000. The company

amortizes the tradename over 8 years using the straight-line method. Barkley successfully defended

its tradename in January 2025, incurring $19,600 in legal fees. At the beginning of 2026, based on new

marketing research, Barkley determines that the fair value of the tradename is $60,000. Estimated

future net cash flows from the tradename are $64,000 on January 4, 2026.

Instructions

Prepare the necessary journal entries for the years ending December 31, 2024, 2025, and 2026. Show

all computations.

misami arb broup

qual

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT