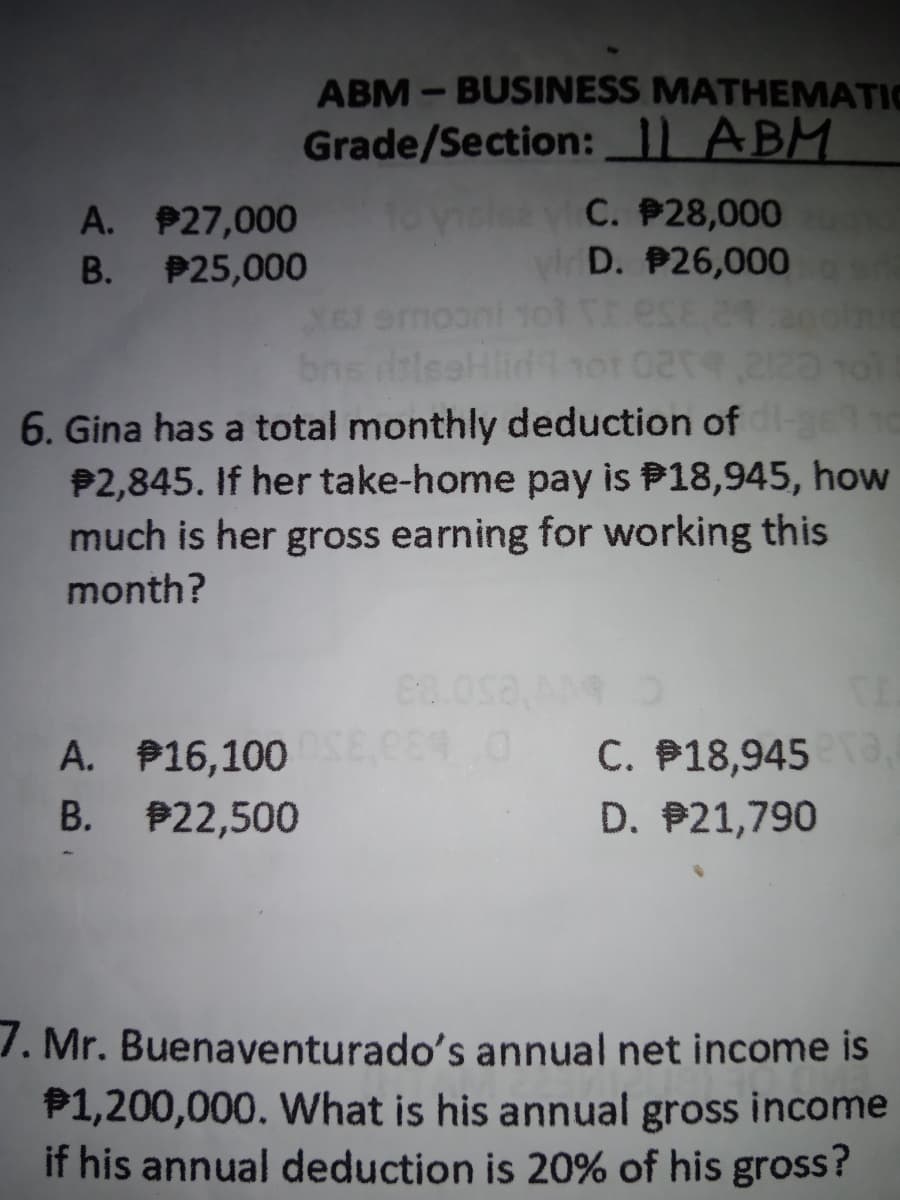

5. Gina has a total monthly deduction of e P2,845. If her take-home pay is P18,945, ho- much is her gross earning for working this month?

Q: Hermione's employer pays $2,356 in health insurance and $156 in life insurance per year. She also…

A: Yearly health insurance = 2356 Life insurance yearly = 156 Paid time for off per year = 3626 Monthly…

Q: Dan Smith receives an hourly wage rate of $30. If Dan worked 48 hours for the current week and the…

A: The answer for the multiple choice question and the relevant working is given hereunder :

Q: An employee has year-to- date earnings of $41,050. The employee's gross pay for the next pay period…

A: Federal Insurance Contributions Act tax: It is a federal payroll contribution that is directed for…

Q: Mary Gonzalez had total cumulative gross earnings of $5,800 as of 1/31/20X1. Her gross earnings for…

A: State unemployment and Federal unemployment taxes are employer payroll taxes. These taxes are not…

Q: Isabelle's hourly rate is $21.25. She worked 40 hours. Her deduction for federal income tax is based…

A: Gross pay= 40 hours * $ 21.25 = $ 850

Q: Suppose the basic monthly pay an employee is P18,000.00 and his overtime pay isP1,200.00. If he has…

A: Gross pay includes all sum paid to employees in form of basic salary, overtime, allowances,…

Q: Hobby Hut has three employees. Find the amount subject FUTA and the amount of the FUTA for this pay…

A: >FUTA stands for Federal Unemployment Tax Act. It is an act that imposes a payroll tax on…

Q: A call center agent receiving a monthly salary of P21,000 with mandatory annual deductions of…

A: Gross income refers to the aggregate amount earned through person before the taxes as well as any…

Q: 1.Michael is paid on a daily basis. He is paid P 535.00 a day plus commission 1.5% on all his sales.…

A: Gross Income: If a person is given a salary or wage by a company, their gross income is what they…

Q: An employee earns $20 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Hours worked = 55 Normal hourly rate = $ 20 Overtime rate = $ 20*1.5 = $ 30 Normal weekly hours =…

Q: A man earns a salary of $114,764 annually and is paid biweekly. How much is his gross biweekly…

A: Formula: Gross biweekly income = Annual salary / Number of bi week Division of annual salary with…

Q: 3. A. Luna is a sales agent. His official working hours is 8 hours a day, with a monthly salary of…

A: Gross Pay will be Particulars Amount Salary for the month P33,000 Add: Allowances…

Q: Kathleen Garza's regular hourly wage rate is $29, and she receives a wage of 1% times the regular…

A: Journal Entry Journal entry is used to record the business transactions of an enterprise.

Q: Michael makes an annual salary of $42,525 he is paid semi-monthly. What is his gross pay? And…

A: Gross pay is pay before deductions. After deductions of taxes give net pay.

Q: An employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: a. Gross pay = Normal pay + Overtime pay = $16*40 + 1.5* $16* (55-40)Gross pay = $640 + $560 Gross…

Q: Brianna's semimonthly salary is $3,875. What would be her equivalent biweekly salary (in $)? (Round…

A: Total months in year=12 semi months=12*2=24

Q: 7. You are the marketing manager for Pointer Plumbing. You are earning an annual salary of $41,600.…

A: With holding allowances: It is an exemption and reduces income tax liability of an employee

Q: Marsha Mellow's weekly gross earning for the week ended May 23 were $1,250 and her federal income…

A: Gross Pay: It is referred as the sum total of income, wages, commissions, extra time, and bonus…

Q: An employee is paidba salary of $11,050 per month. If the current FICA rate is 6.2% on the first…

A: Medicare tax: Medicare tax can be defined as the amount of tax that is withheld by the employer form…

Q: Paula Ryan pays her two employees $410 and $650 per week. Assume a state unemployment rate of 5.4%…

A: Introduction:- A tax is a governmental organization's mandatory financial charge or other type of…

Q: Lindsey Vater’s weekly gross earnings for the week ended March 9 were $800, and her federal income…

A: An employee's net pay seems to be the whole amount obtained or received. It is calculated by…

Q: An employee earns $36 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Solution:- a) Calculation of the gross pay for the week as follows:-

Q: is $20, and she receives an hourly rate of $30 for work in excess of 40 hours. During a January pay…

A: Normal Pay $20×40 =$800 Over time pay $30×10…

Q: Giana Balley works for JMK all year and eams a monthly salary of $11,800 There is no overtima,pay…

A: Social tax security is a compulsory contribution of employer and employee. It funds the retirement,…

Q: 4.Mr. Alvin's daily rate is P740.25, and is given a sick leave of 25 working days. Suppose the sick…

A: Note: Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: Bryan is a salaried worker whose salary is $48,000 per year. The $2,000 he receives twice a month…

A: As Bryan receives $ 2000 per month and the salary per year is $ 48000 So he received = 48000/12= $…

Q: 3. Twenty-two percent of Charmaine's monthly salary is deducted for withholding. If those deductions…

A: Formula: Monthly Salary= Total DeductionRate of Deduction×100% Given: Total Deduction is ₱2090 Rate…

Q: Baker Green's weekly gross earnings for the week ending December 7 were $1,200, and her federal…

A: Social Security amount = Gross earnings ×social Security rate = $1200× 6% = $72

Q: 2. A. Luna is a sales agent. His official working hours is 8 hours a day, with a monthly salary of…

A: Overtime pay is the pay which an employee earns by way of doing the overtime work in the company.…

Q: An employee earns $24 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Social security tax will be charged on gross pay Medicare tax will be charged on gross pay

Q: Hank earns $18.50 per hour with timeandahalf for hours in excess of 40 per week. He worked 44 hours…

A: Hank's net pay for the week is calculated as below:

Q: mala works full time and receives Health and Dental from her employer. tof the health and dental is…

A: The employers provide the employees the health and other related benefits but some portion is to be…

Q: 5. A. Luna is a sales agent. His official working hours is 8 hours a day, with a monthly salary of…

A: Total compensation is the total amount which an employee receives from his or her employer during…

Q: John Doe is married and claims 3 withholding allowances. He collects overtime pay, when he work over…

A: Introduction FICA (Federal Insurance Contributions Act): The Federal Insurance Contributions Act is…

Q: a person earns P37 nd the gross amount the perso eceives if he is paid monthly.

A: Monthly payment can be derived from annual payment by dividing number of months.

Q: An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Social security tax = Gross pay for the week x Social security tax rate = 2200*6% = $132 Medicare…

Q: An employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: a. Gross pay for the week 1120.00 b. Net pay for the week 778.00 Working Notes:…

Q: Martin Peters earns $6.10 per hour for the first 40 hours each week. He is paid 1 1/2 times regular…

A: FICA( Federation Insurance Contribution Act ): It is a US payroll tax that is mandatory for…

Q: the current FUTA rate is 0.6% and the SUTA taxt rate is 5.4%. both taxes are applied to the first…

A: SUTA and FUTA are calculated on wages untill wages exceed $ 7000, Which means that if wages are less…

Q: Q- if Russell's annual earnings are $47500, what is his semi-monthly pay, rounded to the nearest…

A: Cash Flows: Cash flows are the cash generated from the operation of the business organization. In…

Q: Compute Austin's total social security and Medicare taxes for the fourth quarter. if she is…

A: Social security & medicare tax are payroll tax expenses which is imposed by internal revenue…

Q: Calculation of Take-Home Wages (Accounting for Liabilities). Lina Lu is an hourly worker who earns…

A: Taxable Income:-It is income on which an individual has to pay taxes to the government as per the…

Q: The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both taxes are applied to the…

A: Formula to calculate total unemployment taxes (the empoyer must pay on this employee's wages):Total…

Q: 8. Z, minimum wage eamer, received the following for 2018: basic salary of P 140,000, overtime pay…

A: A minimum wage earner refers to that individual whose remuneration for the services provided by him…

Q: 9. Rita's monthly deduction is 10% of her monthly gross income. If she receives a monthly gross…

A: Net take-home pay is the amount of salary that the employee receives in hand. Employes' salary in…

Q: Mr. Sadot Basa earns a monthly income of 45,690. He receives his income twice a month (15th and 30th…

A: Some companies offer monthly payments on 15th and 30th of the respective months because biweekly…

Q: Suppose that an entry level policeman has a basic salary of P33,575 per month. He has to pay monthly…

A: Net Income is the money of pay remaining for issuance to the employees after deducting the…

Q: The converted daily compensation rate of Anna is P2,000. On top of her salary, she receives a daily…

A: Compensation is a systematic approach to providing monetary value to employees in exchange of work…

Q: An employee earns $36 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Gross pay for the week = (Normal rate × Normal hours) + (Bonus rate × Additional hours) Net pay for…

Step by step

Solved in 2 steps

- Required information Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.) a) Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA—Social Security FICA—Medicare FUTA SUTA b) Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA—Social Security…Required information Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Assuming situation (a), prepare the employer’s September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay General Journal The employee’s federal income taxes withheld by the employer are $80 for…Q- Abbys bi- weekly gross income is 1450 but only 1,200 is deductions add up to? Q- Steve's bi-week gross income is 880. His major deductions amount to 30.43% of his gross income. His bi-weekly net income will be?

- 1. A VAT-registered business makes a sale of P33,600, inclusive of VAT. The amount of sale that is reported in the statement of comprehensive income can be computed as* a. P33,600 x 112%b. P33,600 / 112%c. P33,600 x 12% / 112%d. P33,600 / 12% / 112% 2. You are an employee in the private sector. For the year 20x1, you received a 13th month pay of P110,000 and a Christmas bonus (non-performance based) of P25,000. Of the benefits you have received, how much is taxable?* a. P135,000b. P90,000c. P45,000d. P0Gross Income Compute how much will be included and excluded in the gross income given the following scenarios. 1. A call center agent receiving a monthly salary of P21,000 with mandatory annual deductions of P15,166, which includes SSS, PhilHealth, and Pag-Ibig contributions. What will be the amount for his annual gross income?BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $132,900 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,500 $ 1,900 b. 2,800 2,900 c. 128,600 10,000 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities.

- Nabb & Fry Co. reports net income of $25,000. Interest allowances are Nabb $5,000 and Fry$4,000, salary allowances are Nabb $14,000 and Fry $10,000, and the remainder is sharedequally. Show the distribution of income. (If an amount reducesthe account balance then enter with anegative sign preceding the number e.g. -15,000 or parenthesis e.g. (15,000).)Division of NetIncomeNabb FrySalary allowance $ $ $InterestallowanceRemainingexcess/deficiencyTotal division ofnet income$BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 5,000 $ 2,100 b. 2,500 2,600 c. 131,900 8,500 Assuming situation (a), prepare the employer’s September 30 journal entry to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $90 for this pay period. Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay General Journal The employee’s federal income taxes withheld by the employer are $90 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee. (Round your answers to 2 decimal places.) Please donot provide solution in…Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Amount to BeWithheld Employee MaritalStatus No. of WithholdingAllowances Gross Wageor Salary PercentageMethod Wage-BracketMethod Corn, A. S 2 $675 weekly $fill in the blank 1 $fill in the blank 2 Fogge, P. S 1 1,960 weekly fill in the blank 3 Felps, S. M 6 1,775 biweekly fill in the blank 5 fill in the blank 6 Carson, W. M 4 2,480 semimonthly fill in the blank 7 fill in the blank 8 Helm, M. M 9 5,380 monthly fill in the blank 9

- Maryland company offers a bonus plan to its employees equal to 3% of net income. Maryland's net income is expected to be $960,000. The amount of the employee's bonus expense is estimated to be? A. $27,961B. $28,800C. $29,000D. $29,691E. $30,000BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay General Journal The employee’s federal income taxes withheld by the employer are $70 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee.Note: Round your answers to 2 decimal places. Taxes to be Withheld From Gross Pay (Employee-Paid Taxes) September Earnings Subject to Tax Tax Rate Tax Amount Federal income tax $70.00 Prepare the employer's September 30…Employee Net Pay Steven Washington's weekly gross earnings for the week ending March 9 were $2,520, and her federal income tax withholding was $453.60. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Washington's net pay? If required, round your answer to two decimal places.$fill in the blank 1