Giana Balley works for JMK all year and eams a monthly salary of $11,800 There is no overtima,pay Giana's income tax wilthholding rate is 10% of gross pay In addition to payroll taves, Giana elects to contribute 3% monthly to United Way, JMK also deducts s275 monthly for co-payment of the health insurance premium. As of September 30, Giana had $106,200 of cumulative eanings O (Ckck the icon to view payroll tax rate information) Requirements 1. Compute Giana's net pay for October. 2. Joumalize the accrual of salaries expense and the payments related to the employment of Giana Bailey. Requirement 1. Compute Giana's net pay for October. (Round all amounts to the nearest cent.) Withholding deductions

Giana Balley works for JMK all year and eams a monthly salary of $11,800 There is no overtima,pay Giana's income tax wilthholding rate is 10% of gross pay In addition to payroll taves, Giana elects to contribute 3% monthly to United Way, JMK also deducts s275 monthly for co-payment of the health insurance premium. As of September 30, Giana had $106,200 of cumulative eanings O (Ckck the icon to view payroll tax rate information) Requirements 1. Compute Giana's net pay for October. 2. Joumalize the accrual of salaries expense and the payments related to the employment of Giana Bailey. Requirement 1. Compute Giana's net pay for October. (Round all amounts to the nearest cent.) Withholding deductions

Chapter3: Social Security Taxes

Section: Chapter Questions

Problem 4SSQ: Lori Kinmark works as a jeweler for a local company. She earns 1,000 per week, plus a year-end bonus...

Related questions

Question

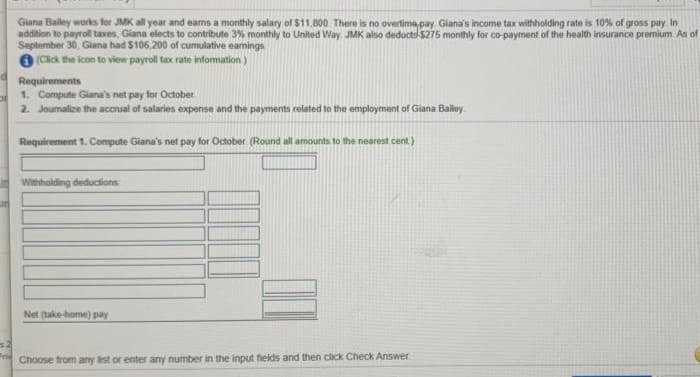

Transcribed Image Text:Giana Bailey works for JMK all year and eams a monthly salary of $11.800 There is no overtima,pay Giana's income tax withholding rate is 10% of gross pay In

addition to payroll taxes, Giana elects to contribute 3% monthly to United Way. JMK also deductss275 monthly for co-payment of the health insurance premium. As of

September 30, Giana had $106,200 of cumulative eamings

O (Cick the icon to view payroll tax rate information)

Requirements

1. Compute Giana's net pay for October.

2. Journalize the accrual of salaries expense and the payments related to the employment of Giana Bailey.

Requirement 1. Compute Giana's net pay for October. (Round all amounts to the nearest cent)

Withholding deductions

Net (take-home) pay

Frie

Choose trom any list or enter any number in the input fields and then click Check Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College