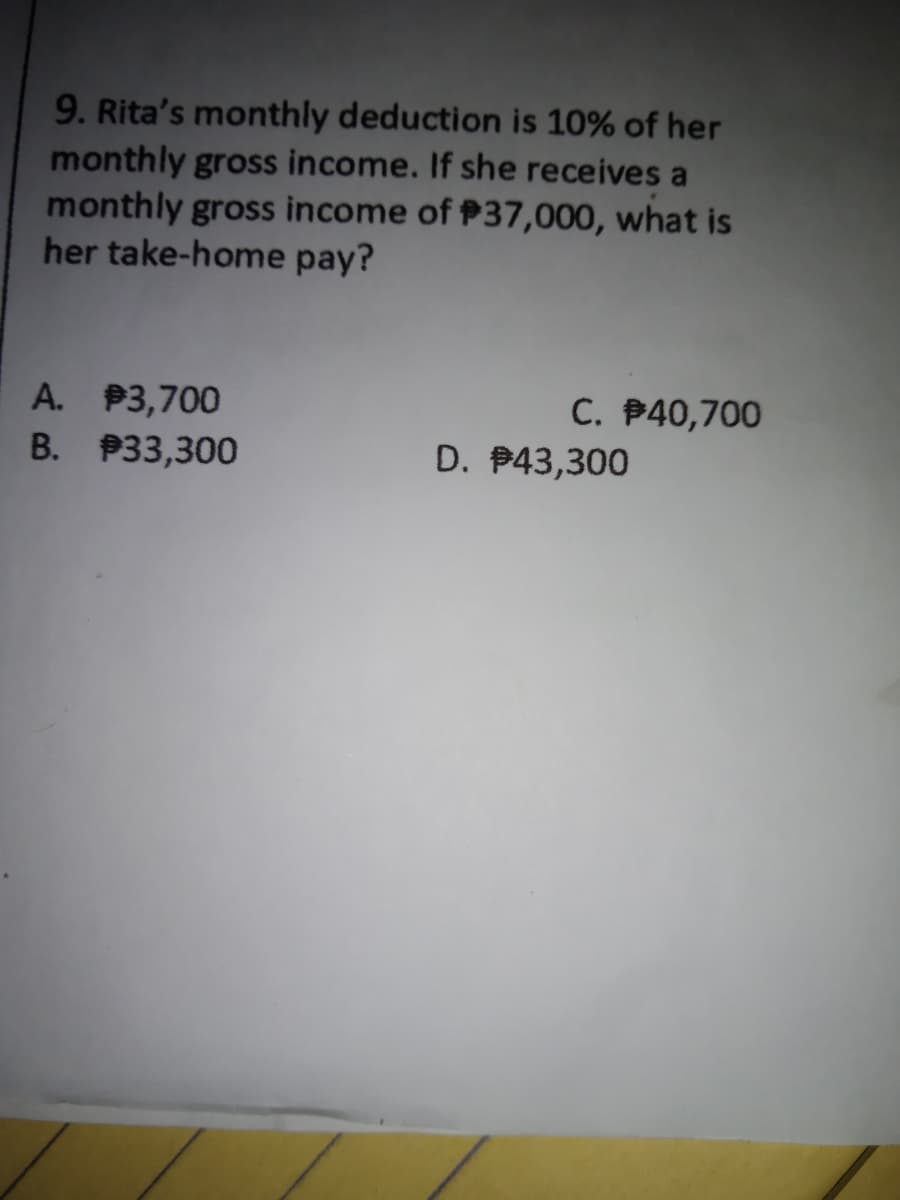

9. Rita's monthly deduction is 10% of her monthly gross income. If she receives a monthly gross income of P37,000, what is her take-home pay? C. B40,700 A. P3,700 B. P33,300 D. P43,300

Q: 3. Jane receives a basic pay of P9,880.00 a month and a 2% commission on her sales. She sold…

A: 3. Basic Pay = P9,880 Gross Earnings = P105,000 x 2% + P9880 = P11,980 Deductions: SSS = 4% X P9880…

Q: Delilah is paying $0.40 per $100 on her $210,000 home in homeowners' insurance annually. If her…

A: A mortgage is a type of loan that is taken for the purchase of a home or any other real estate…

Q: 7. Etta earns a yearly base salary in addition to a commission on the sales she makes. If Etta made…

A: Lets understand the basics. Sales commission is paid to employee for making sales. When we have…

Q: Average Social Security benefits and taxes Use Exhibit 14.3 to estimate the average Social Security…

A: Social benefits are the benefits which are given by the government to the persons of the country.…

Q: Page 4 of 4 12. Mr. Bean receives a monthly basic salary of P38,000. He also receives P2,0O00…

A: Total Compensation = 38000 +2000 +2000 +500 = php 42,500 A)…

Q: Marilyn earns $1,400.00 bi-weekly. She has a bi-weekly taxable car allowance of $70.00 and a…

A: Marilyn earns = $1400.00 per bi weekly Total earnings per year = Bi weekly income x total weeks/2…

Q: Isabelle's hourly rate is $21.25. She worked 40 hours. Her deduction for federal income tax is based…

A: Gross pay= 40 hours * $ 21.25 = $ 850

Q: Martin has $4,200 in doctor bills for the year. His deductible is $300. His policy pays 80% once he…

A: Martin pay including his deductible=$4,200-$300×80100+$300=$3,420

Q: 2. Rona works for a company that pays him a basic monthly salary of 120 000 plus 6.5% commission on…

A: Lets understand the basics. For calculating gross pay, we need to use below formula. Gross pay =…

Q: Assume the FUTA tax rate is 0.6% and the SUTA tax rateis 5.4%. Both taxes are applied to the first…

A: The FUTA is the Federal Unemployment Tax Act is the tax levied by the government upon the salaries…

Q: 13.What will be the total deduction for social security and Medicare taxes on Rony's next…

A: In this question, we will find the total deduction for social security and Medicare Social security…

Q: Marilyn earns $1,400.00 bi-weekly. She has a bi-weekly taxable car allowance of $70.00 and a…

A: Marilyn earns = $1400.00 per bi weekly Total earnings per year = Bi weekly income x total weeks/2…

Q: Anna has the following income for the quarter:

A: Assuming Anna is resident citizen of Phillipines :- As per…

Q: Michael makes an annual salary of $42,525 he is paid semi-monthly. What is his gross pay? And…

A: Gross pay is pay before deductions. After deductions of taxes give net pay.

Q: achel's health insurance policy has a monthly premium of $500. She has a $1,000 nnual deductible,…

A: Out of pocket cost means cost which are direct payment of money and subsequently no reimbursement…

Q: Your employer pays 70% of your total insurance premium of 8000 per year. How much do you pay as an…

A: Total insurance premium = $8000 Employer contribution = 0.70 (70%)

Q: Rachel's health insurance policy has a monthly premium of $500. She has a $1,000 annual deductible,…

A: Out-of-pocket costs are the costs incurred by the insured and include all deductibles, coinsurance,…

Q: Amount (GHC) Rate of tax (%) First 10,000.00 Free Next 30,000.00 Next 30,000.00 10 Next 60,000.00 20…

A: Annual Salary = GH¢ 250,000 Social Security Contribution= 5% =(250,000/100*5)= GH¢ 12,500

Q: Gabriela has the following income for the quarter

A: As per the provisions of Burau of Internal Revenue , Phillipines , quarterly…

Q: How much is the VAT on the gross receipts of Mr. Hernandez for the year?

A: Gross receipts are those receipts which have been earned by the person from the selling of products…

Q: Anna receives $1,000 on the first of each month. Josh receives $1,000 on the last day of each month.…

A: Present value of the annuity is the present value of streams of periodic cash flows that occur at…

Q: 16. Gus is the self-employed owner of Four Paws Pet Supply. His estimated annual earnings are…

A: Social security tax and Medicare taxes are to be paid each quarter by self employed person.

Q: What is the amount of dependent care credit for a couple with two children where they spend $5,000…

A: Dependent care credit can be claimed upto $3000 for one dependent and $6000 for two or more…

Q: 5. Gina has a total monthly deduction of e P2,845. If her take-home pay is P18,945, ho- much is her…

A: Net income is calculated by deducting the deductions from the gross earnings of the individual.

Q: The annual insurance premium on Julie’s home is $2,074 and the annual property tax is $1,403. If her…

A: Given: Annual insurance premium =$2074Annual property tax =$1403Monthly principal and interest…

Q: 5. A minimum wage earner in Metro Manila is paid P537.00 for an 8-hour workday. If he works for 22…

A: Wages means the amount paid to worker for producing the goods. Take home wages means the amount…

Q: 4.Mr. Alvin's daily rate is P740.25, and is given a sick leave of 25 working days. Suppose the sick…

A: Note: Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: 1. Gabriel works on a commission basis and receives 3.8% on his monthly sales for ST. Peter Life…

A: Dear student as you have asked multiple different questions ,and as per guidelines we will solve…

Q: Personal Earnings. Perry makes $26.35 per hour and he works 37.5 hours per week, what is his total…

A: Given data, Hourly wage=$26.35 No of hours worked per week=37.5 hours No of weeks in a year =52…

Q: rish receives $450 on the first of each month. Josh receives $450 on the last day of each month.…

A: Monthly receipt by Trish on the first of each month (P) = $ 450 Monthly receipt by Josh on the last…

Q: Crane Flight Services contributes $25 a week to Helen's retirement plan starting immediately.…

A: Periodic Payment = $25 Time Period = 22 Years Interest Rate = 434%

Q: The basic annual salary of Martha is R576 000. She is entitled to an annual bonus of 90% of her…

A: Hourly recovery tariff is calculated by dividing the pay for the period by the number of hours…

Q: 3. Twenty-two percent of Charmaine's monthly salary is deducted for withholding. If those deductions…

A: Formula: Monthly Salary= Total DeductionRate of Deduction×100% Given: Total Deduction is ₱2090 Rate…

Q: Federal 13% State 10% FICA 6.2% 1.45% Total deductions Medicare + %3D Net Pay

A: Determining gross pay for salaried employees is a bit different. To calculate gross pay, take total…

Q: 1. Cameron designates 10% of his monthly earnings as charitable contributions. After deducting this…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Jim has a house payment of $2,000 per month of which $1,700 is deductible interest and real estate…

A:

Q: Sarah had been contributing $300 pre-tax per month to a retirement account that pays 2.16% interest…

A: The penalty amount will be applicable on the future value amount after 10 years

Q: a person earns P37 nd the gross amount the perso eceives if he is paid monthly.

A: Monthly payment can be derived from annual payment by dividing number of months.

Q: nt's employee benefits include family health insur % to the cost of coverage. She is paid monthly a…

A: There is contribution of employee and also there is contribution from the employer also to the…

Q: Reggie makes $400 per week and has a cash taxable benefit of $5 00 per pay He is paid weekly How…

A: 1: Calculate the basic pay-period exemption Divide the basic yearly exemption ($3,500 for 2021) by…

Q: Padma's semi-annual premium is $975.00. She has the choice of paying the full amount or paying half.…

A: Insurance is one of the ways to reduce the risk. Insurance means get put the insurer in same…

Q: The annual insurance premium on Maria's home is $1,958 and the annual property tax is $1,432. If her…

A: Annual insurance premium =$1958Annual property tax =$1432Total insurance and property…

Q: 9. Penny wants to save $2500 in one year. What amount must she save from each paycheque if she is…

A: Biweekly indicating the payment made once in two weeks. Here, we can identify the required value of…

Q: 3. Manny's weekly wage as a welder are $520.75. He is single and claims 3 allowances. What amount is…

A: The federal income tax means the tax that is paid on the income earned by the taxpayer. The amount…

Q: One month from now, Kelly will make her first monthly contribution of $250250 to a Tax-Free…

A: Given information in question monthly contribution is = $250 Expected return = 8% (per annum) Future…

Q: What will be the amount for his annual gross income?

A: Income is a residual amount left after netting of net expenses incurred to earn that income. The net…

Q: Your employer contributes 50 a week to your retirement plan. Assume that you work for your employer…

A: Weekly contribution (C) = 50 Weekly discount rate (r) = 0.00125 (i.e. 0.065 / 52) Weekly period of…

Q: Sabrina Duncan had gross earnings for the pay period ending 10/15/20X1 of $5,785. Her total gross…

A: Gross earnings is an income of an individual/household or a company, in short it is the total…

Q: How much should a parent deposit every 3 months at 4% interest compounded quarterly to achieve a…

A: Compound interest is referred as the interest which is calculated on principal amount which involves…

Q: 7. The market value of Jennifer and Neil's home is $319,000. The assessed value is $280,000. The…

A: The calculation of property tax and monthly payments towards property tax is presented hereunder :

Step by step

Solved in 2 steps

- LO2 Joyce Lee earns 30,000 a year. Her employer pays a matching Social Security tax of 6.2% on the first 118,500 in earnings, a Medicare tax of 1.45% on gross earnings, and a FUTA tax of 0.6% and a SUTA tax of 5.4%, both on the first 7,000 in earnings. What is the total cost of Joyce Lee to her employer? (a) 32,295 (b) 30,000 (c) 30,420 (d) 32,715An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the FICA Medicare tax rate is 1.45%. What is the employees FICA taxes responsibility? A. $535.50 B. $612 C. None, only the employer pays FICA taxes D. $597.50 E. $550Use Figure 12.15 as a reference to answer the following questions. A. If an employee makes $1,400 per month and files as single with no withholding allowances, what would be his monthly income tax withholding? B. What would it be if an employee makes $2,500 per month and files as single with two withholding allowances?

- 13.What will be the total deduction for social security and Medicare taxes on Rony's next semimonthly paycheck of $3,760.00, if she has already earned $48,560.00 this year? (Social security tax is 6.2% of gross wages up to $128,400. Medicare tax is 1.45% of all gross wages.) $249.39 $257.04 $272.34 $287.64What will be the total deduction for social security and Medicare taxes on Rony's next semimonthly paycheck of $3,760.00, if she has already earned $46,560.00 this year? (Social security tax is 6.2% of gross wages up to $128,400. Medicare tax is 1.45% of all gross wages.) a. $249.39 b. $257.04 c. $272.34 d. $287.6416. Gus is the self-employed owner of Four Paws Pet Supply. His estimated annual earnings are $49,280.00 and he expects to pay 19% of this amount in income tax. What will be his quarterly estimated tax payment for the second quarter? (For self-employed persons, Social Security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.) A. $2,112.88 B. $2,340.80 C. $4,225.76 D. $9,363.20

- 12.Carolyne is paid $4,000.00 biweekly. This year, to date, she has earned $27,300.00. What will be the total deduction for Social Security and Medicare taxes on her next paycheck? (Social Security tax is 6.2% of gross wages up to $128,400. Medicare tax is 1.45% of all gross wages.) $306.00 $321.30 $336.60 $344.259. The annual insurance premium on Julie’s home is $2,074 and the annual property tax is $1,403. If her monthly principal and interest payment is $1,603, find the adjusted monthly payment including principal, interest taxes and insurance (PITI).1) Nancy has cumulative earnings of $104,500 and earns $7,800 during the current pay period.If the FICA rate is 4.2 percent for Social Security, with a limit of $106,800, and 1.45 percent forMedicare, applied to all earnings, calculate the total FICA tax to be withheld for this pay period.a. $440.70.b. $209.70.c. $113.10.d. $96.60.e. $231.00. 2) Ernie White has $6,800 cumulative earnings during the calendar year and earned $950 duringthe current pay period. If the state unemployment tax is 5.4 percent of the first $7,000, the federalunemployment tax is 0.6 percent of the first $7,000, the FICA Social Security tax is 6.2 percent ofthe first $106,800, and FICA Medicare tax is 1.45 percent on all earnings, the amounts placed inthe Taxable Earnings columns of the payroll register are: a. state unemployment, $0; federal unemployment, $0; Social Security, $850; Medicare,$850.b. state unemployment, $950; federal unemployment, $950; Social Security, $950; Medicare,$950.c. state unemployment,…

- Padma's semi-annual premium is $975.00. She has the choice of paying the full amount or paying half. If she pays half, she will be charged $489.50 each payment, which includes an administrative fee. What is the total amount of the administrative fee?Amy's gross pay for the week is $850. Her deduction for federal income tax is based on a rate of 25%. She has voluntary deductions of $255. Her year−to−date pay is under the limit for OASDI. What is her net pay? (Assume a FICA—OASDI Tax of 6.2% and FICA—Medicare Tax of 1.45%. Round all calculations to the nearest cent.)Compute Austin's total social security and Medicare taxes for the fourth quarter. if she is self-employed and earns $5,300.00 on a semimonthly basis. (For self-employed persons, Social Security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.) the options are: a. 437.25 b. 810.90 c. 2623.50 d. 4865.40