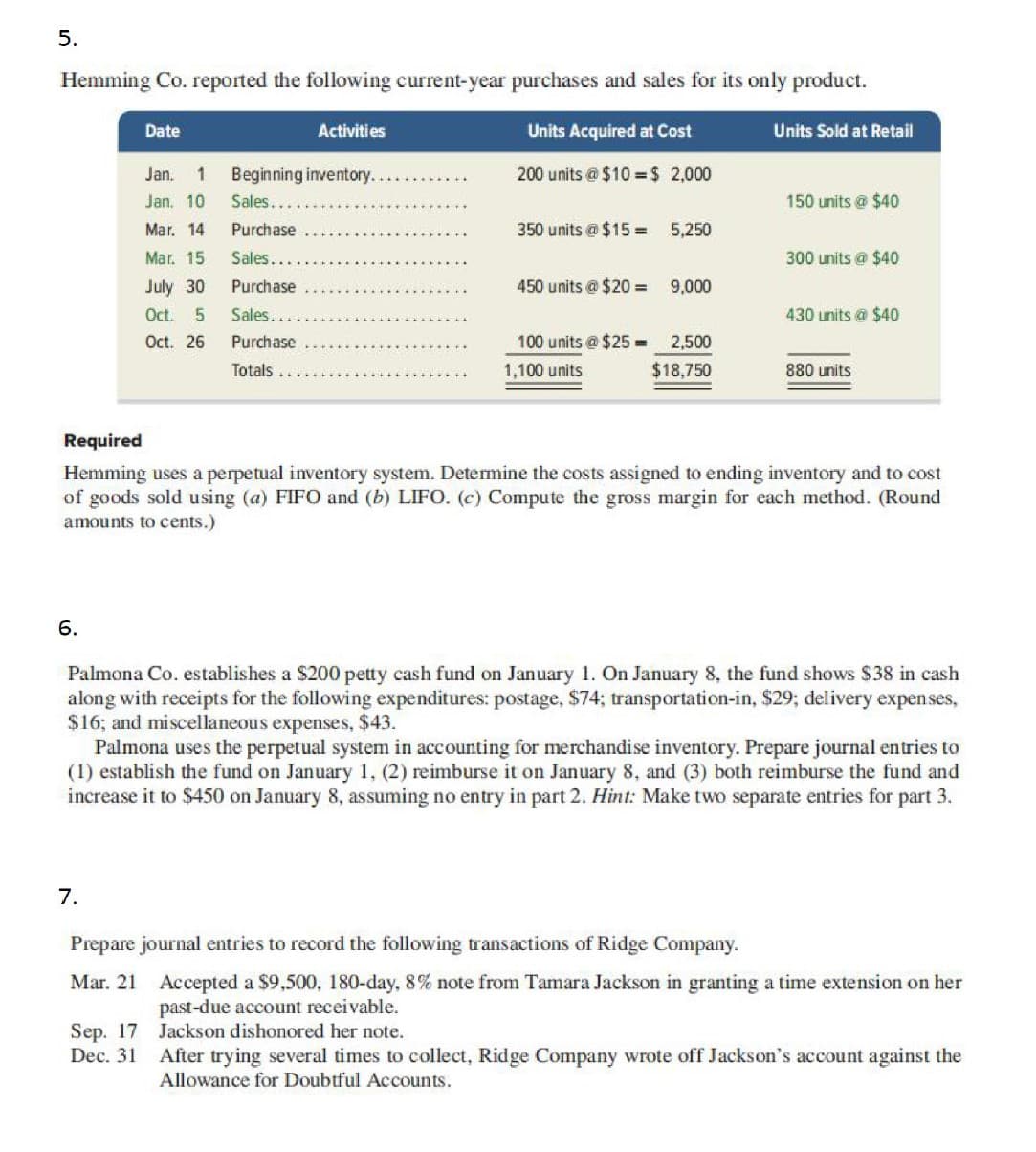

5. Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Units Acquired at Cost Units Sold at Retail Jan. 1 Beginning inventory... 200 units e $10 =$ 2,000 Jan. 10 Sales.. 150 units@ $40 Mar. 14 Purchase 350 units @ $15 = 5,250 Mar. 15 Sales. 300 units @ $40 July 30 Purchase 450 units @ $20 = 9,000 Ot. Sales. 430 units @ $40 Oct. 26 Purchase 100 units @ $25 = 2,500 Totals 1,100 units $18,750 880 units Required Hemming uses a perpetual inventory system. Detemine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross margin for each method. (Round amounts to cents.) 6. Palmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $38 in cash along with receipts for the following expenditures: postage, $74; transportation-in, $29; delivery expenses, $16; and miscellaneous expenses, $43. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to (1) establish the fund on January 1, (2) reimburse it on January 8, and (3) both reimburse the fund and increase it to $450 on January 8, assuming no entry in part 2. Hint: Make two separate entries for part 3. 7. Prepare journal entries to record the following transactions of Ridge Company. Mar. 21 Accepted a $9,500, 180-day, 8% note from Tamara Jackson in granting a time extension on her past-due account receivable. Sep. 17 Jackson dishonored her note. Dec. 31 After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts.

5. Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Units Acquired at Cost Units Sold at Retail Jan. 1 Beginning inventory... 200 units e $10 =$ 2,000 Jan. 10 Sales.. 150 units@ $40 Mar. 14 Purchase 350 units @ $15 = 5,250 Mar. 15 Sales. 300 units @ $40 July 30 Purchase 450 units @ $20 = 9,000 Ot. Sales. 430 units @ $40 Oct. 26 Purchase 100 units @ $25 = 2,500 Totals 1,100 units $18,750 880 units Required Hemming uses a perpetual inventory system. Detemine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross margin for each method. (Round amounts to cents.) 6. Palmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $38 in cash along with receipts for the following expenditures: postage, $74; transportation-in, $29; delivery expenses, $16; and miscellaneous expenses, $43. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to (1) establish the fund on January 1, (2) reimburse it on January 8, and (3) both reimburse the fund and increase it to $450 on January 8, assuming no entry in part 2. Hint: Make two separate entries for part 3. 7. Prepare journal entries to record the following transactions of Ridge Company. Mar. 21 Accepted a $9,500, 180-day, 8% note from Tamara Jackson in granting a time extension on her past-due account receivable. Sep. 17 Jackson dishonored her note. Dec. 31 After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful Accounts.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 51E: Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases...

Related questions

Question

Transcribed Image Text:Hemming Co. reported the following current-year purchases and sales for its only product.

Date

Activities

Units Acquired at Cost

Units Sold at Retail

Jan.

Beginning inventory..

200 units @ $10 = $ 2,000

Jan. 10

Sales..

150 units @ $40

Mar. 14

Purchase

350 units @ $15 = 5,250

Mar. 15

Sales...

300 units @ $40

July 30

Purchase

450 units @ $20 =

9,000

Oct. 5

Sales..

430 units @ $40

Oct. 26

Purchase

100 units @ $25 = 2,500

Totals

1,100 units

$18,750

880 units

Required

Hemming uses a perpetual inventory system. Determine the costs assigned to ending inventory and to cost

of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross margin for each method. (Round

amounts to cents.)

6.

Palmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $38 in cash

along with receipts for the following expenditures: postage, $74; transportation-in, $29; delivery expenses,

$16; and miscellaneous expenses, $43.

Palmona uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to

(1) establish the fund on January 1, (2) reimburse it on January 8, and (3) both reimburse the fund and

increase it to $450 on January 8, assuming no entry in part 2. Hint: Make two separate entries for part 3.

7.

Prepare journal entries to record the following transactions of Ridge Company.

Mar. 21

Accepted a $9,500, 180-day, 8% note from Tamara Jackson in granting a time extension on her

past-due account receivable.

Sep. 17 Jackson dishonored her note.

Dec. 31

After trying several times to collect, Ridge Company wrote off Jackson's account against the

Allowance for Doubtful Accounts.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT