Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Units Acquired at Cost Jan. 1 Beginning inventory 295 units @ $13.80 Units Sold at Retail = $ 4,071 Jan. 10 Sales 240 units @ $43.80 Mar.14 Purchase 480 units @ $18.80 9,024 Mar.15 Sales 420 units @ $43.80 July30 Purchase 495 units @ $23.89 11.781 %3D

Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Units Acquired at Cost Jan. 1 Beginning inventory 295 units @ $13.80 Units Sold at Retail = $ 4,071 Jan. 10 Sales 240 units @ $43.80 Mar.14 Purchase 480 units @ $18.80 9,024 Mar.15 Sales 420 units @ $43.80 July30 Purchase 495 units @ $23.89 11.781 %3D

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

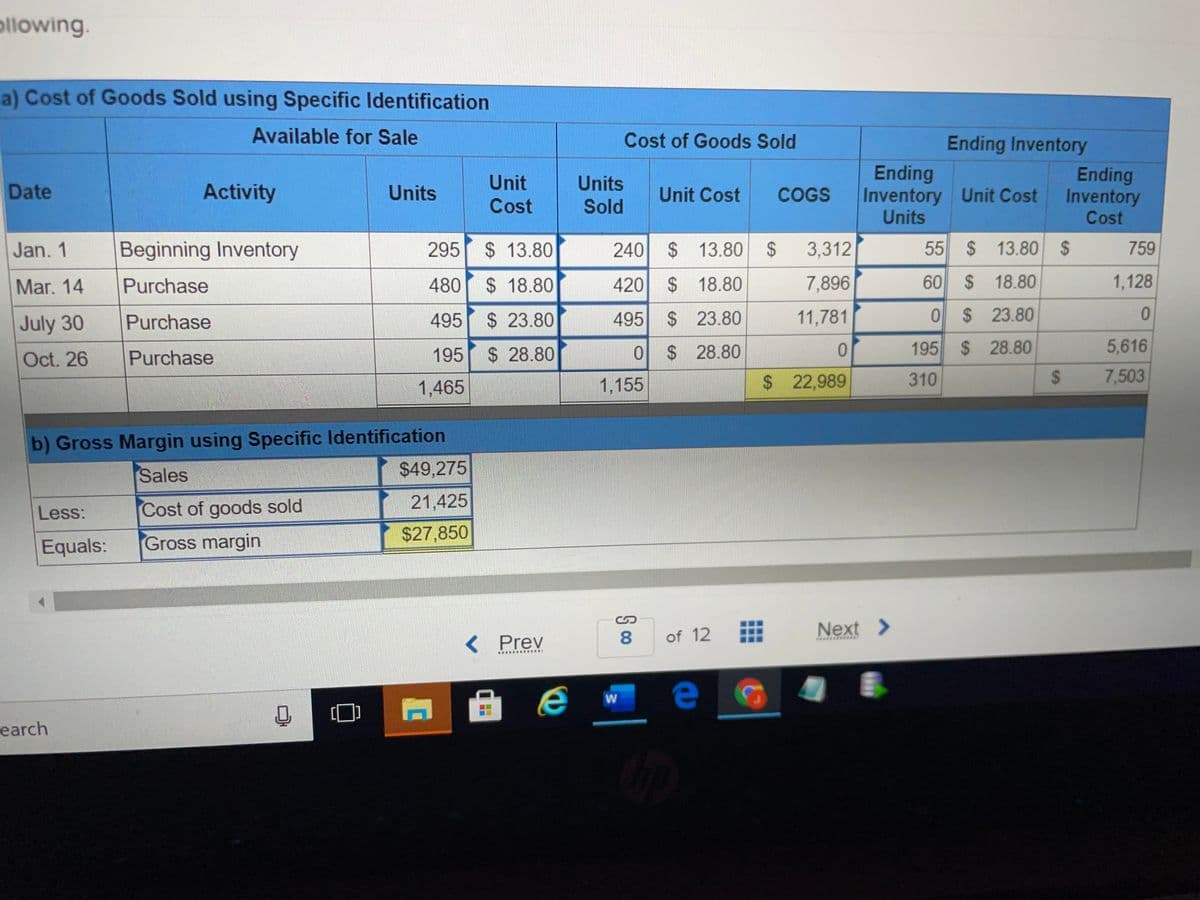

Transcribed Image Text:ollowing.

a) Cost of Goods Sold using Specific Identification

Available for Sale

Cost of Goods Sold

Ending Inventory

Unit

Cost

Units

Sold

Ending

Inventory Unit Cost

Units

Ending

Inventory

Cost

Date

Activity

Units

Unit Cost

COGS

Jan. 1

Beginning Inventory

295

$ 13.80

240

$13.80 $

3,312

55 $ 13.80 $

759

Mar. 14

Purchase

480 $ 18.80

420 $ 18.80

7,896

60 $ 18.80

1,128

July 30

Purchase

495

$ 23.80

495 $ 23.80

11,781

0 $ 23.80

0.

Oct. 26

195

$ 28.80

0 $ 28.80

195 $ 28.80

5,616

Purchase

1,465

1,155

$ 22,989

310

7,503

b) Gross Margin using Specific Identification

$49,275

Sales

Less:

Cost of goods sold

21,425

$27,850

Equals:

Gross margin

Next >

< Prev

8.

of 12

earch

%24

Transcribed Image Text:Check my worl

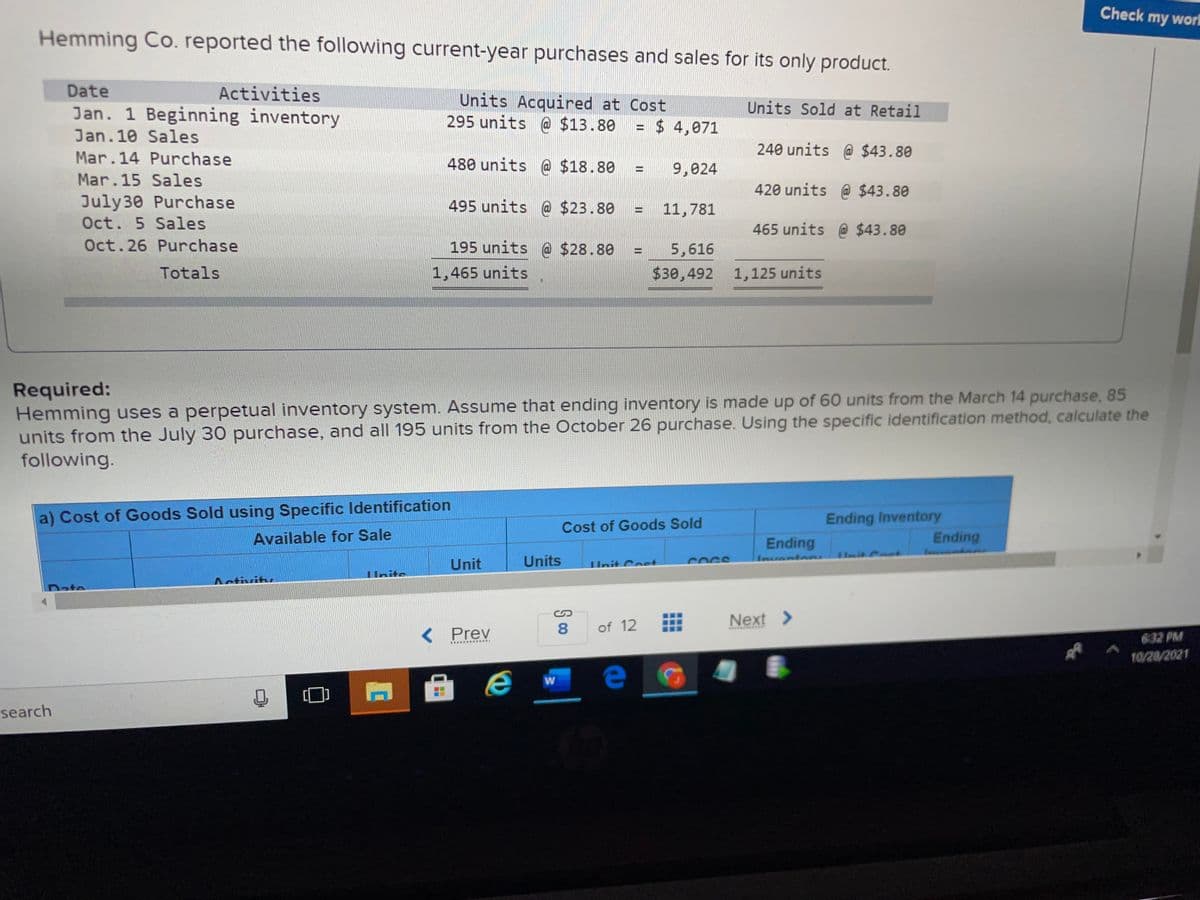

Hemming Co. reported the following current-year purchases and sales for its only product.

Date

Activities

Jan. 1 Beginning inventory

Units Acquired at Cost

295 units @ $13.80

Units Sold at Retail

$ 4,071

Jan. 10 Sales

240 units @ $43.80

Mar.14 Purchase

480 units @ $18.80

9,024

Mar.15 Sales

420 units @ $43.80

July30 Purchase

495 units @ $23.80

11,781

Oct. 5 Sales

465 units @ $43.80

Oct.26 Purchase

195 units @ $28.80

5,616

Totals

1,465 units

$30,492 1,125 units

Required:

Hemming uses a perpetual inventory system. Assume that ending inventory is made up of 60 units from the March 14 purchase, 85

units from the July 30 purchase, and all 195 units from the October 26 purchase. Using the specific identification method, calculate the

following.

Ending Inventory

Ending

a) Cost of Goods Sold using Specific ldentification

Cost of Goods Sold

Available for Sale

Ending

Unit

Units

Unit Cost

Insventen

COCS

Unite

ite

Date

Next >

< Prev

8.

of 12

632 PM

10/20/2021

search

II

S 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning