5. Impact of budget deficits The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that the financial industry is close to bankruptcy and the U.S. government decides to implement a bailout plan of several billion dollars without increasing taxes, causing a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both. INTEREST RATE LOANABLE FUNDS Based on this model, the budget deficit leads to 4 - 4 - in the level of investment and in the interest rate.

5. Impact of budget deficits The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that the financial industry is close to bankruptcy and the U.S. government decides to implement a bailout plan of several billion dollars without increasing taxes, causing a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both. INTEREST RATE LOANABLE FUNDS Based on this model, the budget deficit leads to 4 - 4 - in the level of investment and in the interest rate.

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Homework (Ch 23)

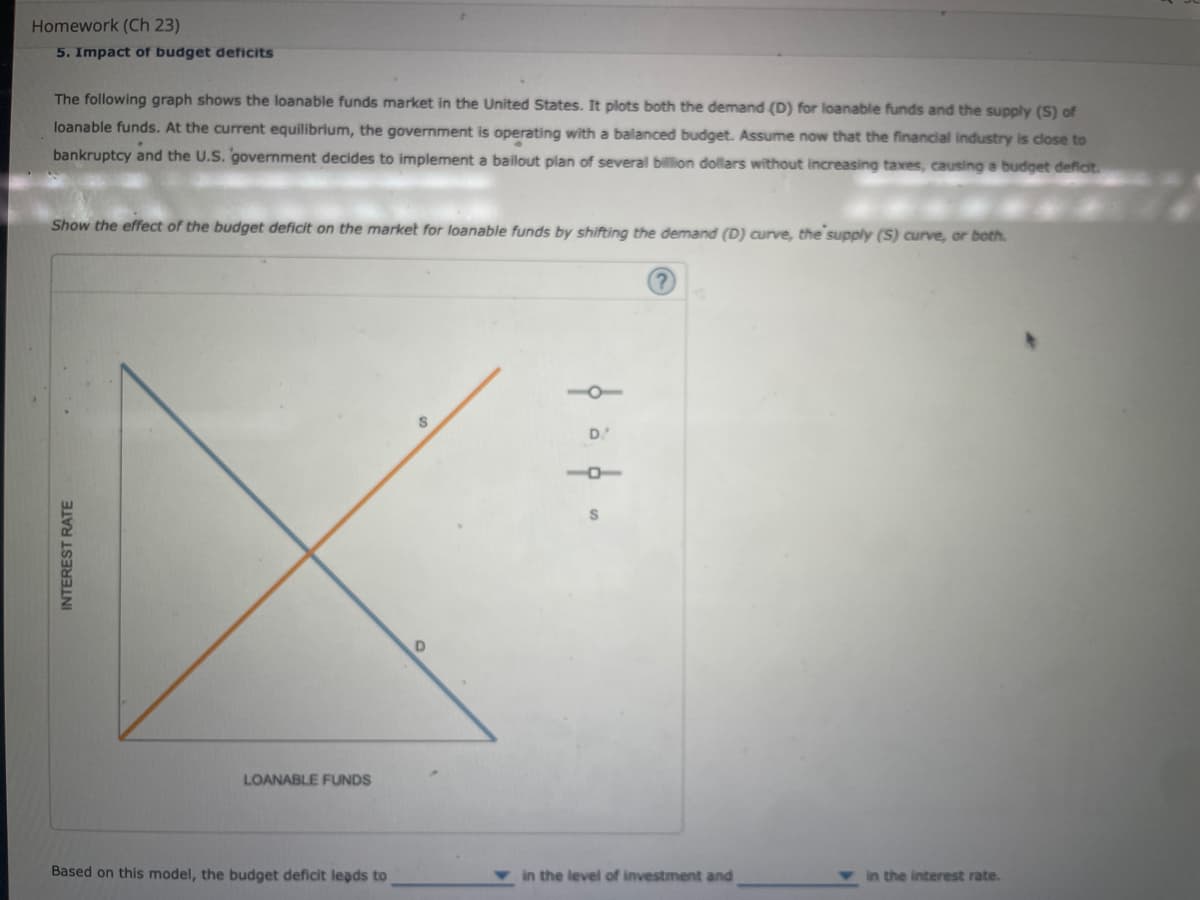

5. Impact of budget deficits

The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of

loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that the financial industry is close to

bankruptcy and the U.S. government decides to implement a bailout plan of several billion dollars without increasing taxes, causing a budget deficit.

Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both.

INTEREST RATE

LOANABLE FUNDS

Based on this model, the budget deficit leads to

D

$ 6 m

D/

in the level of investment and

in the interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax