5. The following balances were extracted from N's financial statements: Extracts from the statement of financial position as at 31 December 2022 40,000 110,000 Deferred taxation Current tax payable 2021 31,000 98,000 Extract from statement of profit or loss for the year ended 31 December 2022 Income tax expense £135,000 A. £156,000 B. £114,000 C. £135,000 D. £21,000 The amount of tax paid that should be included in N's statement of cash flows for the year ended 31 December 2022 is:

5. The following balances were extracted from N's financial statements: Extracts from the statement of financial position as at 31 December 2022 40,000 110,000 Deferred taxation Current tax payable 2021 31,000 98,000 Extract from statement of profit or loss for the year ended 31 December 2022 Income tax expense £135,000 A. £156,000 B. £114,000 C. £135,000 D. £21,000 The amount of tax paid that should be included in N's statement of cash flows for the year ended 31 December 2022 is:

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 34P

Related questions

Question

Please do not give image format

Transcribed Image Text:5.

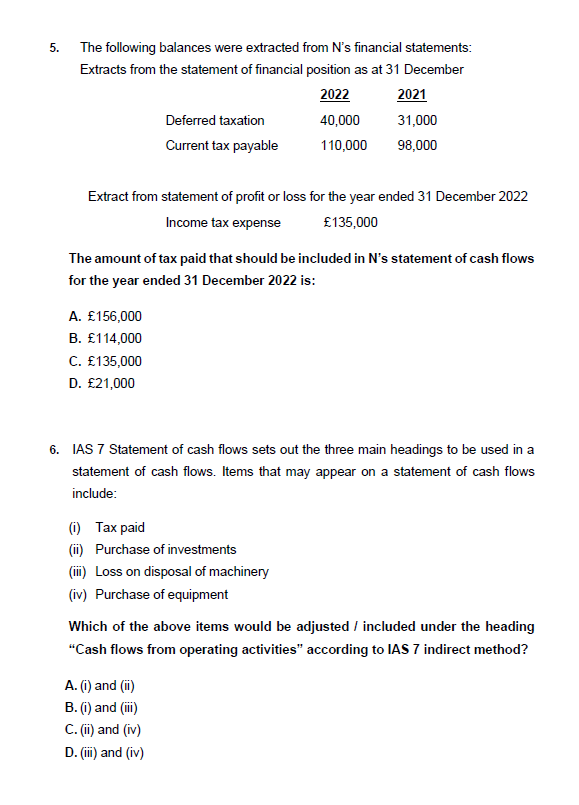

The following balances were extracted from N's financial statements:

Extracts from the statement of financial position as at 31 December

2022

Deferred taxation

Current tax payable

A. £156,000

B. £114,000

C. £135,000

D. £21,000

Extract from statement of profit or loss for the year ended 31 December 2022

Income tax expense

£135,000

40,000

110,000

The amount of tax paid that should be included in N's statement of cash flows

for the year ended 31 December 2022 is:

2021

31,000

98,000

(i) Tax paid

(ii) Purchase of investments

(iii) Loss on disposal of machinery

(iv) Purchase of equipment

6. IAS 7 Statement of cash flows sets out the three main headings to be used in a

statement of cash flows. Items that may appear on a statement of cash flows

include:

A. (i) and (ii)

B. (i) and (iii)

C. (ii) and (iv)

D. (iii) and (iv)

Which of the above items would be adjusted / included under the heading

"Cash flows from operating activities" according to IAS 7 indirect method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT