Required: 1. Calculate the annual net operating Income from the expansion. 2. Calculate the annual net cash Inflow from the expansion. 3. Calculate the ARR. Note: Round your answer to 2 decimal places. 4. Calculate the payback period. Note: Round your answer to 1 decimal place. 5. Calculate the NPV. (Future Value of $1,Present Value of $1, Future Value Annulty of $1. Present Value Annulty of $1.) Note: Use appropriate factor(s) from the tables provided. Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.

Required: 1. Calculate the annual net operating Income from the expansion. 2. Calculate the annual net cash Inflow from the expansion. 3. Calculate the ARR. Note: Round your answer to 2 decimal places. 4. Calculate the payback period. Note: Round your answer to 1 decimal place. 5. Calculate the NPV. (Future Value of $1,Present Value of $1, Future Value Annulty of $1. Present Value Annulty of $1.) Note: Use appropriate factor(s) from the tables provided. Do not round Intermediate calculations. Round your final answer to nearest whole dollar amount.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

kk.

Subject :- Accounting

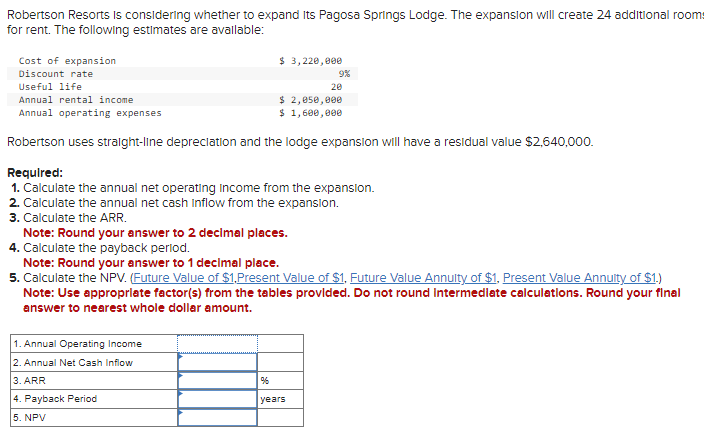

Transcribed Image Text:Robertson Resorts is considering whether to expand its Pagosa Springs Lodge. The expansion will create 24 additional room

for rent. The following estimates are available:

Cost of expansion

Discount rate

Useful life

Annual rental income

Annual operating expenses

Robertson uses straight-line depreciation and the lodge expansion will have a residual value $2,640,000.

Required:

1. Calculate the annual net operating income from the expansion.

2. Calculate the annual net cash Inflow from the expansion.

3. Calculate the ARR.

$ 3,220,000

Note: Round your answer to 2 decimal places.

4. Calculate the payback period.

1. Annual Operating Income

2. Annual Net Cash Inflow

3. ARR

4. Payback Period

5. NPV

%6

9%

$ 2,050,000

$ 1,600,000

Note: Round your answer to 1 decimal place.

5. Calculate the NPV. (Future Value of $1,Present Value of $1, Future Value Annulty of $1, Present Value Annuity of $1.)

Note: Use appropriate factor(s) from the tables provided. Do not round Intermediate calculations. Round your final

answer to nearest whole dollar amount.

20

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning