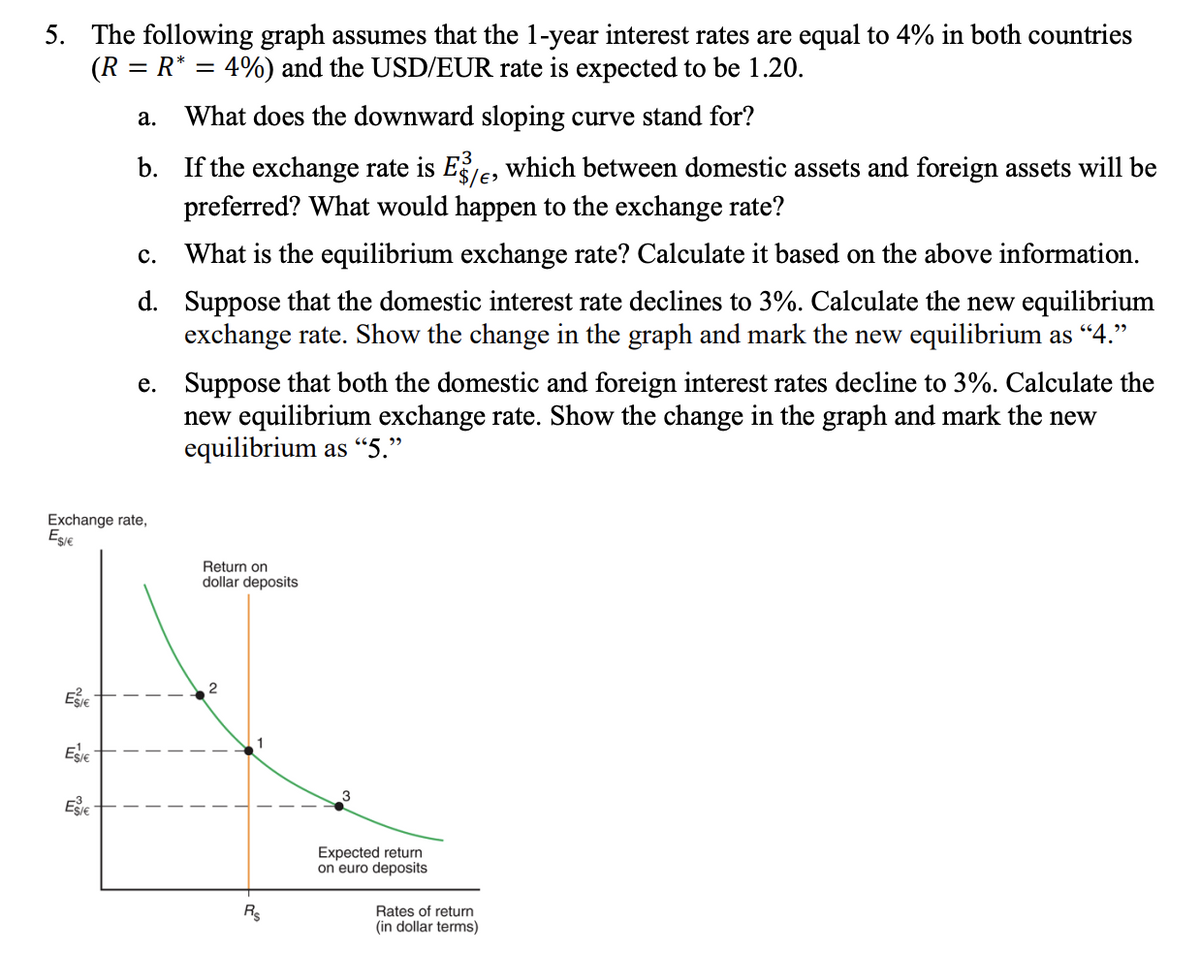

5. The following graph assumes that the 1-year interest rates are equal to 4% in both countries (R = R* = 4%) and the USD/EUR rate is expected to be 1.20. а. What does the downward sloping curve stand for? b. If the exchange rate is Ee, which between domestic assets and foreign assets will be preferred? What would happen to the exchange rate? с. What is the equilibrium exchange rate? Calculate it based on the above information.

5. The following graph assumes that the 1-year interest rates are equal to 4% in both countries (R = R* = 4%) and the USD/EUR rate is expected to be 1.20. а. What does the downward sloping curve stand for? b. If the exchange rate is Ee, which between domestic assets and foreign assets will be preferred? What would happen to the exchange rate? с. What is the equilibrium exchange rate? Calculate it based on the above information.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 6PA

Related questions

Question

Transcribed Image Text:5. The following graph assumes that the 1-year interest rates are equal to 4% in both countries

(R = R* = 4%) and the USD/EUR rate is expected to be 1.20.

а.

What does the downward sloping curve stand for?

b. If the exchange rate is Ee, which between domestic assets and foreign assets will be

preferred? What would happen to the exchange rate?

с.

What is the equilibrium exchange rate? Calculate it based on the above information.

d. Suppose that the domestic interest rate declines to 3%. Calculate the new equilibrium

exchange rate. Show the change in the graph and mark the new equilibrium as “4."

e. Suppose that both the domestic and foreign interest rates decline to 3%. Calculate the

new equilibrium exchange rate. Show the change in the graph and mark the new

equilibrium as “5."

Exchange rate,

Egie

Return on

dollar deposits

Expected return

on euro deposits

Rs

Rates of return

(in dollar terms)

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning