5. What type of tax goes to help pay for medical care of people over 65 years old? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax 6. What type of tax takes a percentage of the money you make on a job? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax 7. What type of tax goes to help pay for retirement? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax

5. What type of tax goes to help pay for medical care of people over 65 years old? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax 6. What type of tax takes a percentage of the money you make on a job? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax 7. What type of tax goes to help pay for retirement? a. Income tax b. Property tax c. Sales Tax d. Social Security tax e. Medicare tax

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 34P

Related questions

Question

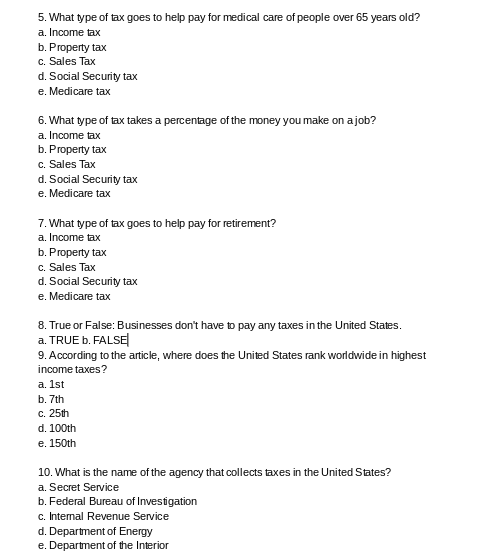

Transcribed Image Text:5. What type of tax goes to help pay for medical care of people over 65 years old?

a. Income tax

b. Property tax

c. Sales Tax

d. Social Security tax

e. Medicare tax

6. What type of tax takes a percentage of the money you make on a job?

a. Income tax

b. Property tax

c. Sales Tax

d. Social Security tax

e. Medicare tax

7. What type of tax goes to help pay for retirement?

a. Income tax

b. Property tax

c. Sales Tax

d. Social Security tax

e. Medicare tax

8. True or False: Businesses don't have to pay any taxes in the United States.

a. TRUE b. FALSE

9. According to the article, where does the United States rank worldwide in highest

income taxes?

a. 1st

b. 7th

c. 25th

d. 100th

e. 150th

10. What is the name of the agency that collects taxes in the United States?

a. Secret Service

b. Federal Bureau of Investigation

c. Internal Revenue Service

d. Department of Energy

e. Department of the Interior

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT