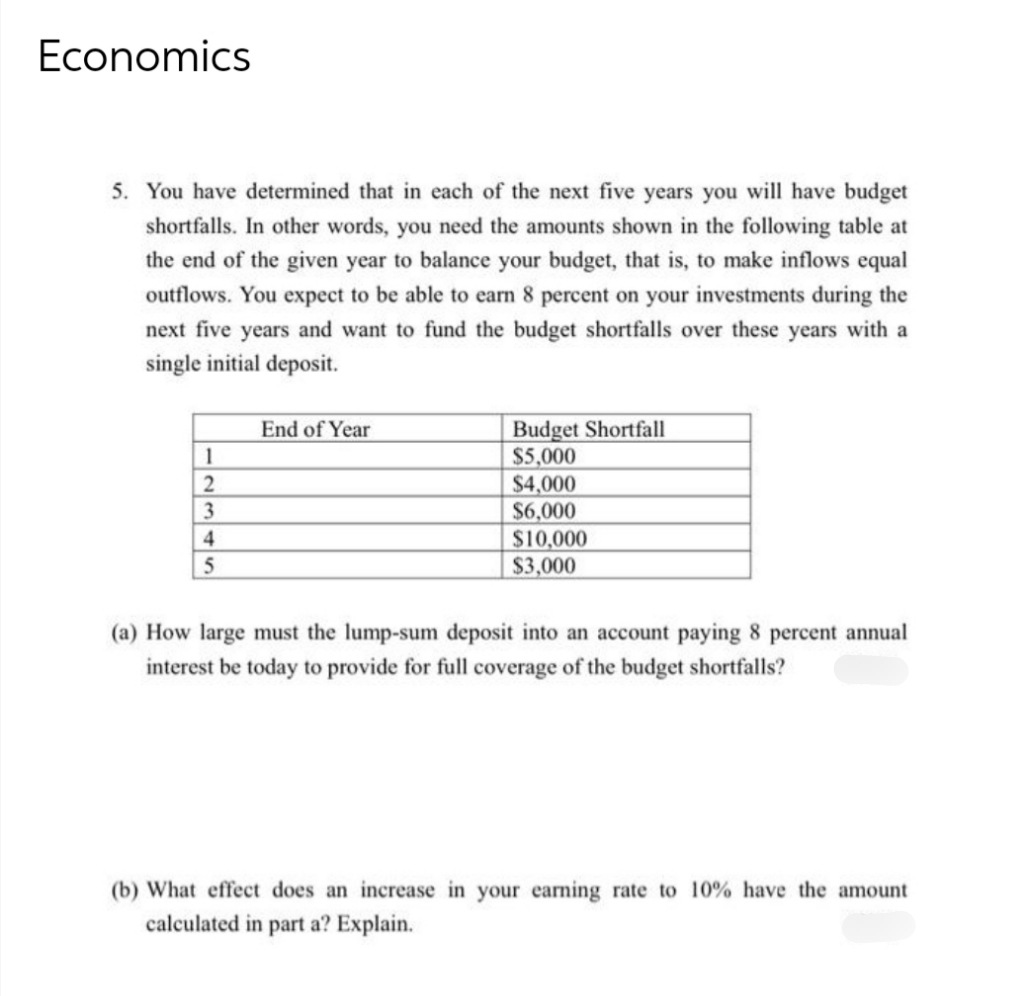

5. You have determined that in each of the next five years you will have budget shortfalls. In other words, you need the amounts shown in the following table at the end of the given year to balance your budget, that is, to make inflows equal outflows. You expect to be able to earn 8 percent on your investments during the next five years and want to fund the budget shortfalls over these years with a single initial deposit. 1 23 4 45 5 End of Year Budget Shortfall $5,000 $4,000 $6,000 $10,000 $3,000 (a) How large must the lump-sum deposit into an account paying 8 percent annual interest be today to provide for full coverage of the budget shortfalls? (b) What effect does an increase in your earning rate to 10% have the amount calculated in part a? Explain.

5. You have determined that in each of the next five years you will have budget shortfalls. In other words, you need the amounts shown in the following table at the end of the given year to balance your budget, that is, to make inflows equal outflows. You expect to be able to earn 8 percent on your investments during the next five years and want to fund the budget shortfalls over these years with a single initial deposit. 1 23 4 45 5 End of Year Budget Shortfall $5,000 $4,000 $6,000 $10,000 $3,000 (a) How large must the lump-sum deposit into an account paying 8 percent annual interest be today to provide for full coverage of the budget shortfalls? (b) What effect does an increase in your earning rate to 10% have the amount calculated in part a? Explain.

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 13PAE

Related questions

Question

2

Transcribed Image Text:Economics

5. You have determined that in each of the next five years you will have budget

shortfalls. In other words, you need the amounts shown in the following table at

the end of the given year to balance your budget, that is, to make inflows equal

outflows. You expect to be able to earn 8 percent on your investments during the

next five years and want to fund the budget shortfalls over these years with a

single initial deposit.

1

2

3

4

5

End of Year

Budget Shortfall

$5,000

$4,000

$6,000

$10,000

$3,000

(a) How large must the lump-sum deposit into an account paying 8 percent annual

interest be today to provide for full coverage of the budget shortfalls?

(b) What effect does an increase in your earning rate to 10% have the amount

calculated in part a? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax