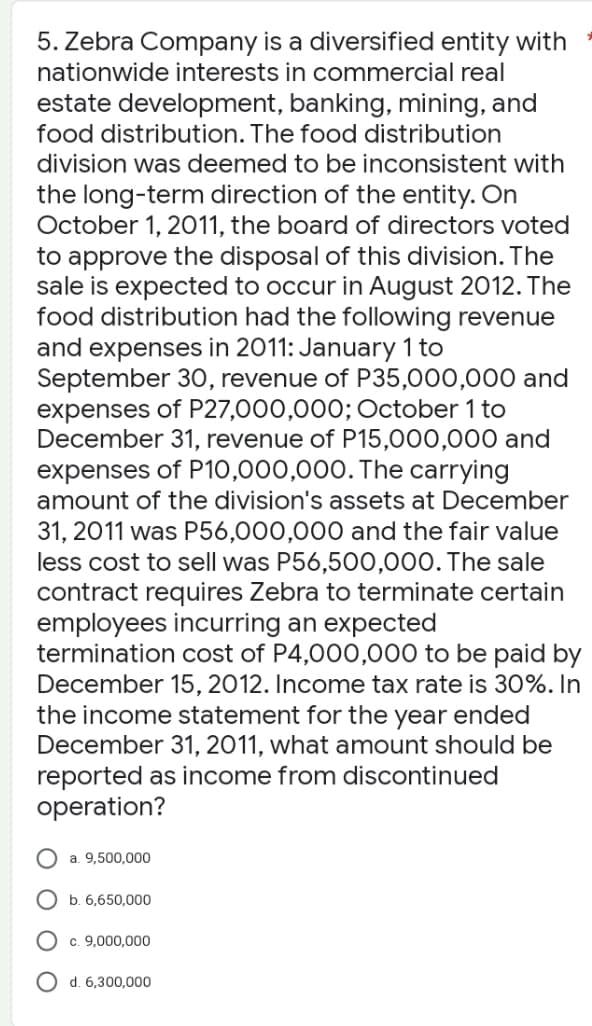

5. Zebra Company is a diversified entity with nationwide interests in commercial real estate development, banking, mining, and food distribution. The food distribution division was deemed to be inconsistent with the long-term direction of the entity. On October 1, 2011, the board of directors voted to approve the disposal of this division. The sale is expected to occur in August 2012. The food distribution had the following revenue and expenses in 2011: January 1 to September 30, revenue of P35,000,000 and expenses of P27,000,000; October 1 to December 31, revenue of P15,000,000 and expenses of P10,000,000. The carrying amount of the division's assets at December 31, 2011 was P56,000,000 and the fair value less cost to sell was P56,500,000. The sale contract requires Zebra to terminate certain employees incurring an expected termination cost of P4,000,000 to be paid b December 15, 2012. Income tax rate is 30%. 11 the income statement for the year ended December 31, 2011, what amount should be reported as income from discontinued operation?

5. Zebra Company is a diversified entity with nationwide interests in commercial real estate development, banking, mining, and food distribution. The food distribution division was deemed to be inconsistent with the long-term direction of the entity. On October 1, 2011, the board of directors voted to approve the disposal of this division. The sale is expected to occur in August 2012. The food distribution had the following revenue and expenses in 2011: January 1 to September 30, revenue of P35,000,000 and expenses of P27,000,000; October 1 to December 31, revenue of P15,000,000 and expenses of P10,000,000. The carrying amount of the division's assets at December 31, 2011 was P56,000,000 and the fair value less cost to sell was P56,500,000. The sale contract requires Zebra to terminate certain employees incurring an expected termination cost of P4,000,000 to be paid b December 15, 2012. Income tax rate is 30%. 11 the income statement for the year ended December 31, 2011, what amount should be reported as income from discontinued operation?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter6: Accounting Quality

Section: Chapter Questions

Problem 24PC

Related questions

Question

Transcribed Image Text:5. Zebra Company is a diversified entity with

nationwide interests in commercial real

estate development, banking, mining, and

food distribution. The food distribution

division was deemed to be inconsistent with

the long-term direction of the entity. On

October 1, 2011, the board of directors voted

to approve the disposal of this division. The

sale is expected to occur in August 2012. The

food distribution had the following revenue

and expenses in 2011: January 1 to

September 30, revenue of P35,000,000 and

expenses of P27,000,000; October 1 to

December 31, revenue of P15,000,000 and

expenses of P10,000,000. The carrying

amount of the division's assets at December

31, 2011 was P56,000,000 and the fair value

less cost to sell was P56,500,000. The sale

contract requires Zebra to terminate certain

employees incurring an expected

termination cost of P4,000,000 to be paid by

December 15, 2012. Income tax rate is 30%. In

the income statement for the year ended

December 31, 2011, what amount should be

reported as income from discontinued

operation?

a. 9,500,000

b. 6,650,000

c. 9,000,000

d. 6,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning