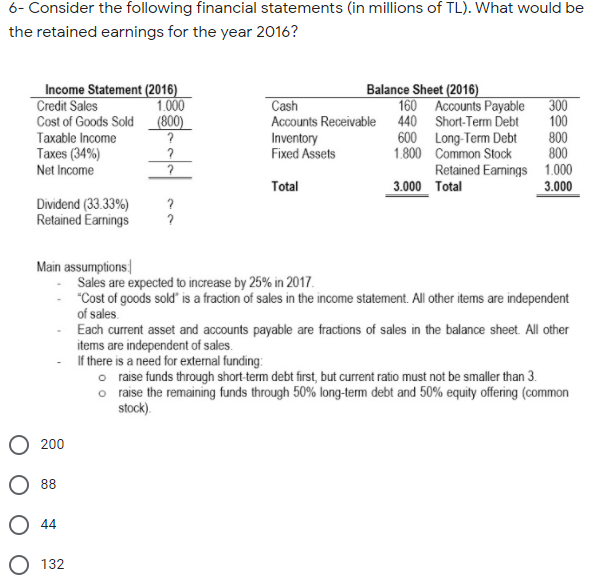

6- Consider the following financial statements (in millions of TL). What would be the retained earnings for the year 2016? Balance Sheet (2016) Income Statement (2016) Credit Sales Cost of Goods Sold (800) Taxable Income 1.000 Cash 160 Accounts Payable Accounts Receivable 440 Short-Term Debt 600 Long-Term Debt 1.800 Common Stock 300 100 800 800 Retained Eamings 1.000 3.000 ? Inventory Fixed Assets Taxes (34%) Net Income Total 3.000 Total Dividend (33.33%) Retained Earnings ? Main assumptions Sales are expected to increase by 25% in 2017. "Cost of goods sold" is a fraction of sales in the income statement. All other items are independent of sales. Each current asset and accounts payable are fractions of sales in the balance sheet All other items are independent of sales. If there is a need for external funding: o raise funds through short term debt first, but current ratio must not be smaller than 3. o raise the remaining funds through 50% long-term debt and 50% equity offering (common stock). I toin O 200 O 88 O 44 132

6- Consider the following financial statements (in millions of TL). What would be the retained earnings for the year 2016? Balance Sheet (2016) Income Statement (2016) Credit Sales Cost of Goods Sold (800) Taxable Income 1.000 Cash 160 Accounts Payable Accounts Receivable 440 Short-Term Debt 600 Long-Term Debt 1.800 Common Stock 300 100 800 800 Retained Eamings 1.000 3.000 ? Inventory Fixed Assets Taxes (34%) Net Income Total 3.000 Total Dividend (33.33%) Retained Earnings ? Main assumptions Sales are expected to increase by 25% in 2017. "Cost of goods sold" is a fraction of sales in the income statement. All other items are independent of sales. Each current asset and accounts payable are fractions of sales in the balance sheet All other items are independent of sales. If there is a need for external funding: o raise funds through short term debt first, but current ratio must not be smaller than 3. o raise the remaining funds through 50% long-term debt and 50% equity offering (common stock). I toin O 200 O 88 O 44 132

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:6- Consider the following financial statements (in millions of TL). What would be

the retained earnings for the year 2016?

Balance Sheet (2016)

Income Statement (2016)

Credit Sales

Cost of Goods Sold (800)

Taxable Income

1.000

Cash

160 Accounts Payable

Accounts Receivable 440 Short-Term Debt

600 Long-Term Debt

1.800 Common Stock

300

100

800

800

Retained Earnings 1.000

3.000

Inventory

Fixed Assets

Taxes (34%)

Net Income

Total

3.000 Total

Dividend (33.33%)

Retained Earnings

Main assumptions

Sales are expected to increase by 25% in 2017.

"Cost of goods sold" is a fraction of sales in the income statement. All other items are independent

of sales.

Each current asset and accounts payable are fractions of sales in the balance sheet. All other

items are independent of sales.

If there is a need for external funding:

o raise funds through short term debt first, but current ratio must not be smaller than 3.

o raise the remaining funds through 50% long-term debt and 50% equity offering (common

stock).

200

88

44

132

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT