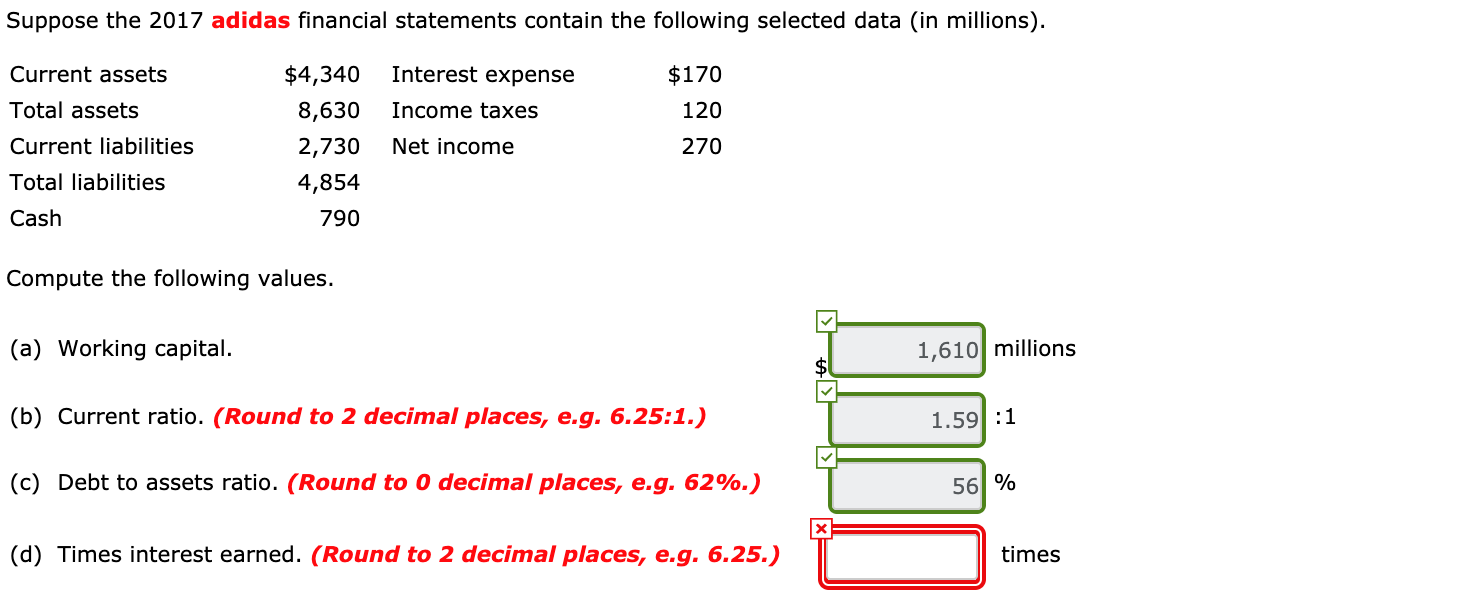

Suppose the 2017 adidas financial statements contain the following selected data (in millions). Current assets $4,340 Interest expense $170 Total assets 8,630 Income taxes 120 Current liabilities 2,730 Net income 270 Total liabilities 4,854 Cash 790 Compute the following values. (a) Working capital. 1,610 millions $4 (b) Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) 1.59 :1 (c) Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) 56 % (d) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) times

Suppose the 2017 adidas financial statements contain the following selected data (in millions). Current assets $4,340 Interest expense $170 Total assets 8,630 Income taxes 120 Current liabilities 2,730 Net income 270 Total liabilities 4,854 Cash 790 Compute the following values. (a) Working capital. 1,610 millions $4 (b) Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) 1.59 :1 (c) Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) 56 % (d) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) times

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 54CE

Related questions

Question

Practice Pack

Transcribed Image Text:Suppose the 2017 adidas financial statements contain the following selected data (in millions).

Current assets

$4,340

Interest expense

$170

Total assets

8,630

Income taxes

120

Current liabilities

2,730

Net income

270

Total liabilities

4,854

Cash

790

Compute the following values.

(a) Working capital.

1,610 millions

$4

(b) Current ratio. (Round to 2 decimal places, e.g. 6.25:1.)

1.59 :1

(c) Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.)

56 %

(d) Times interest earned. (Round to 2 decimal places, e.g. 6.25.)

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub