6, Cou The no

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 24E: Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January...

Related questions

Question

Do all parts otherwise I will give you downvote

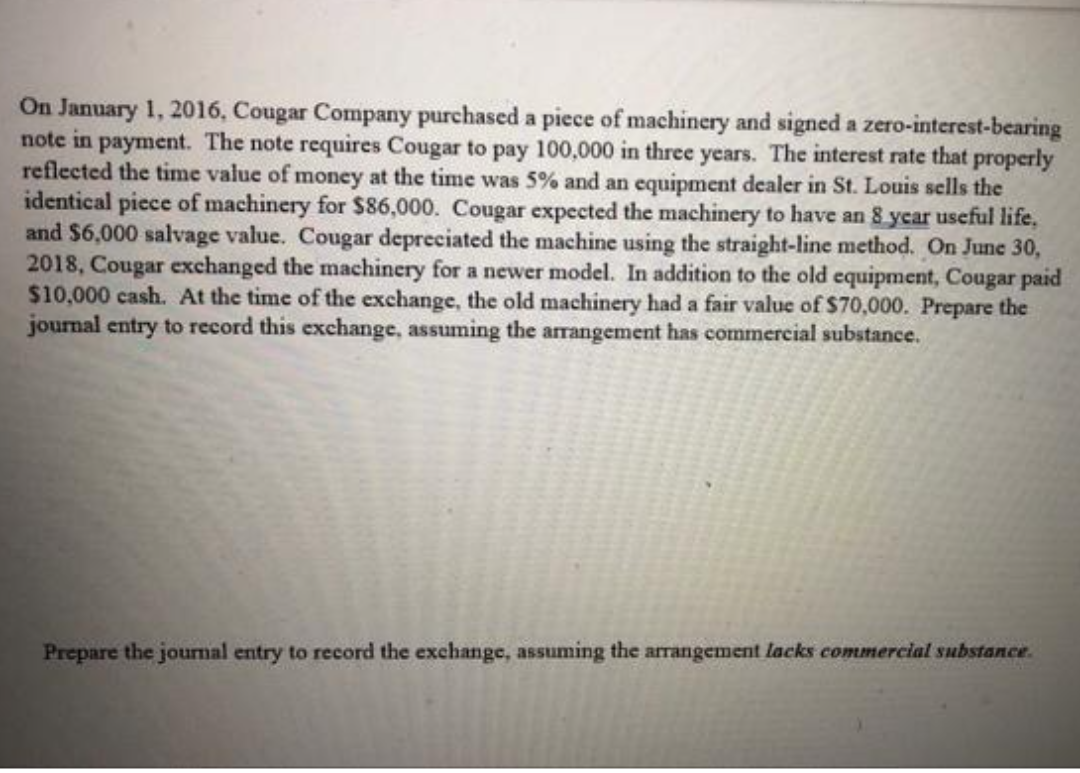

Transcribed Image Text:On January 1, 2016, Cougar Company purchased a piece of machinery and signed a zero-interest-bearing

note in payment. The note requires Cougar to pay 100,000 in three years. The interest rate that properly

reflected the time value of money at the time was 5% and an equipment dealer in St. Louis sells the

identical piece of machinery for $86,000. Cougar expected the machinery to have an 8 year useful life,

and $6,000 salvage value. Cougar depreciated the machine using the straight-line method. On June 30,

2018, Cougar exchanged the machinery for a newer model. In addition to the old equipment, Cougar paid

$10,000 cash. At the time of the exchange, the old machinery had a fair value of $70,000. Prepare the

journal entry to record this exchange, assuming the arrangement has commercial substance.

Prepare the journal entry to record the exchange, assuming the arrangement lacks commercial substance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College