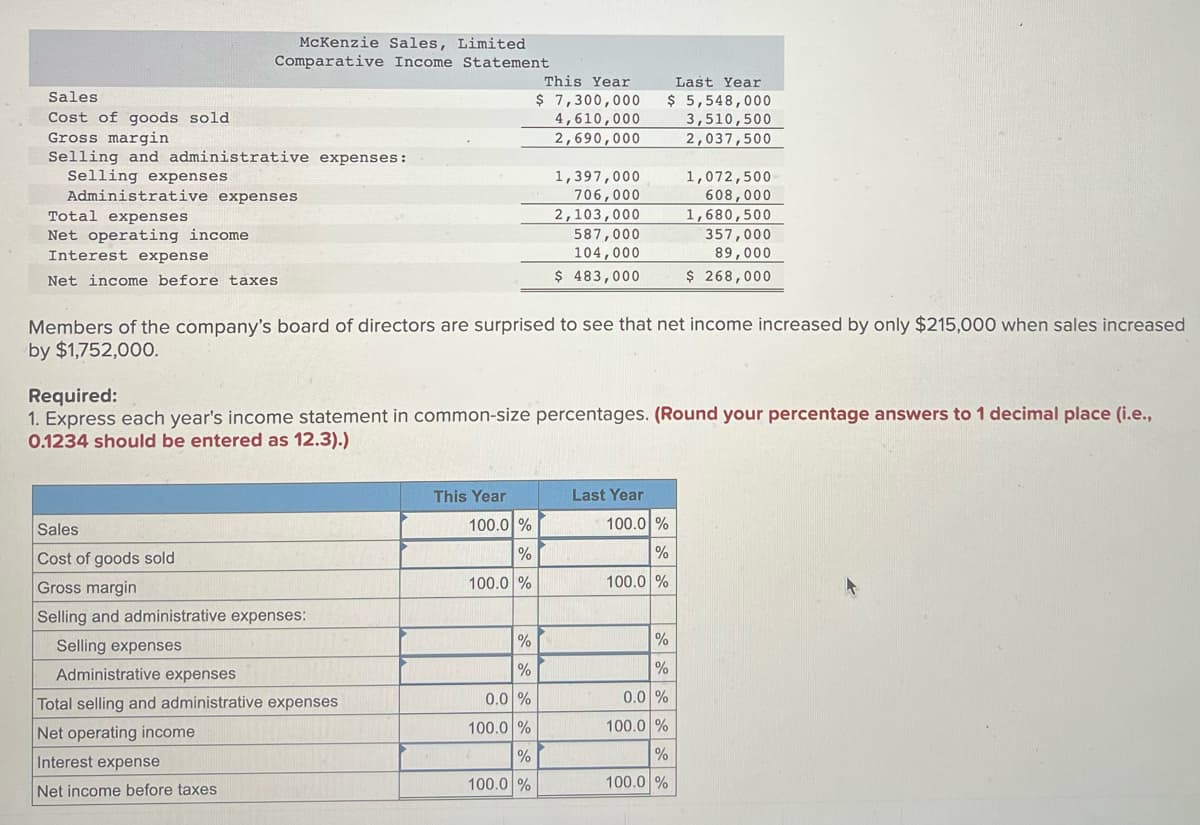

McKenzie Sales, Limited Comparative Income Statement Last Year $ 5,548,000 Sales This Year $ 7,300,000 4,610,000 2,690,000 Cost of goods sold 3,510,500 Gross margin 2,037,500 Selling and administrative expenses: Selling expenses 1,397,000 1,072,500 Administrative expenses 706,000 608,000 Total expenses 2,103,000 1,680,500 Net operating income. 587,000 104,000 357,000 89,000 Interest expense Net income before taxes $ 483,000 $ 268,000 Members of the company's board of directors are surprised to see that net income increased by only $215,000 when sales increased by $1,752,000. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) This Year Last Year Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Total selling and administrative expenses Net operating income Interest expense Net income before taxes 100.0% % 100.0 % % d % 0.0 % 100.0 % % 100.0 % 100.0 % % 100.0 % % % 0.0 % 100.0 % % 100.0 %

McKenzie Sales, Limited Comparative Income Statement Last Year $ 5,548,000 Sales This Year $ 7,300,000 4,610,000 2,690,000 Cost of goods sold 3,510,500 Gross margin 2,037,500 Selling and administrative expenses: Selling expenses 1,397,000 1,072,500 Administrative expenses 706,000 608,000 Total expenses 2,103,000 1,680,500 Net operating income. 587,000 104,000 357,000 89,000 Interest expense Net income before taxes $ 483,000 $ 268,000 Members of the company's board of directors are surprised to see that net income increased by only $215,000 when sales increased by $1,752,000. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) This Year Last Year Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Total selling and administrative expenses Net operating income Interest expense Net income before taxes 100.0% % 100.0 % % d % 0.0 % 100.0 % % 100.0 % 100.0 % % 100.0 % % % 0.0 % 100.0 % % 100.0 %

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.13MCE

Related questions

Question

Transcribed Image Text:McKenzie Sales, Limited

Comparative Income Statement

Sales

This Year

$ 7,300,000

4,610,000

2,690,000

Last Year

$ 5,548,000

3,510,500

2,037,500

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expenses

1,397,000

1,072,500

Administrative expenses

706,000

608,000

Total expenses

2,103,000

1,680,500

Net operating income

587,000

357,000

89,000

Interest expense

104,000

$ 483,000

$ 268,000

Net income before taxes.

Members of the company's board of directors are surprised to see that net income increased by only $215,000 when sales increased

by $1,752,000.

Required:

1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e.,

0.1234 should be entered as 12.3).)

This Year

Last Year

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expenses

Administrative expenses

Total selling and administrative expenses

Net operating income.

Interest expense

Net income before taxes

100.0 %

%

100.0 %

%

%

0.0 %

100.0 %

%

100.0 %

100.0 %

%

100.0 %

%

%

0.0 %

100.0 %

%

100.0 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,