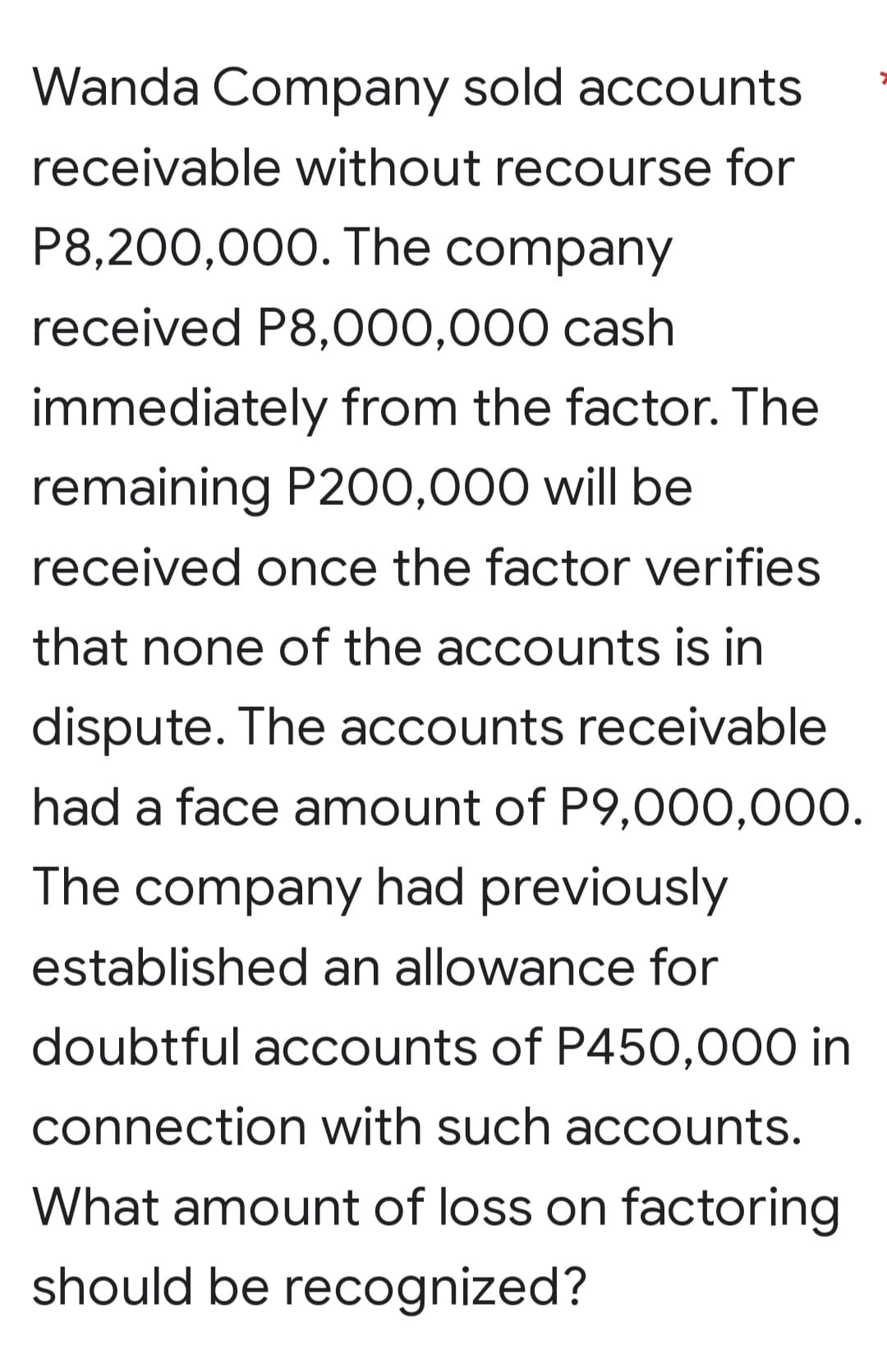

Wanda Company sold accounts receivable without recourse for P8,200,000. The company received P8,000,000 cash immediately from the factor. The remaining P200,000 will be received once the factor verifies that none of the accounts is in dispute. The accounts receivable had a face amount of P9,000,000. The company had previously established an allowance for doubtful accounts of P450,000 in connection with such accounts. What amount of loss on factoring should be recognized?

Wanda Company sold accounts receivable without recourse for P8,200,000. The company received P8,000,000 cash immediately from the factor. The remaining P200,000 will be received once the factor verifies that none of the accounts is in dispute. The accounts receivable had a face amount of P9,000,000. The company had previously established an allowance for doubtful accounts of P450,000 in connection with such accounts. What amount of loss on factoring should be recognized?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter24: Bankruptcy, Reorganization, And Liquidation

Section: Chapter Questions

Problem 1P: Southwestern Wear Inc. has the following balance sheet: The trustees costs total 281,250, and the...

Related questions

Topic Video

Question

Transcribed Image Text:Wanda Company sold accounts

receivable without recourse for

P8,200,000. The company

received P8,000,000 cash

immediately from the factor. The

remaining P200,000 will be

received once the factor verifies

that none of the accounts is in

dispute. The accounts receivable

had a face amount of P9,000,000.

The company had previously

established an allowance for

doubtful accounts of P450,000 in

connection with such accounts.

What amount of loss on factoring

should be recognized?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you