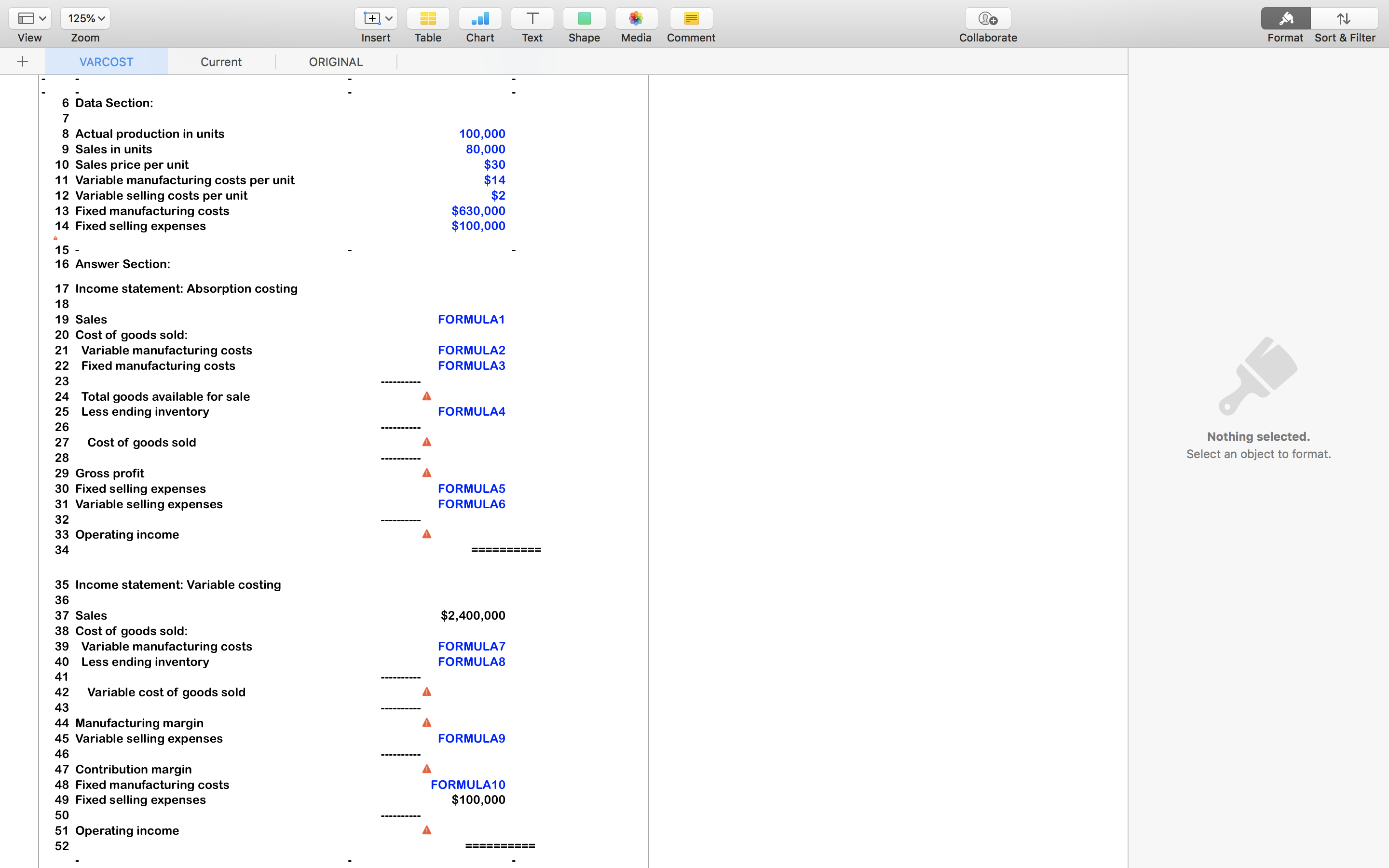

6 Data Section: 7 8 Actual production in units 9 Sales in units 10 Sales price per unit 11 Variable manufacturing costs per unit 12 Variable selling costs per unit 13 Fixed manufacturing costs 14 Fixed selling expenses 100,000 80,000 $30 $14 $2 $630,000 $100,000 A 15 - 16 Answer Section: 17 Income statement: Absorption costing 18 19 Sales FORMULA1 20 Cost of goods sold: 21 Variable manufacturing costs 22 Fixed manufacturing costs FORMULA2 FORMULA3 23 24 Total goods available for sale 25 Less ending inventory FORMULA4 26 27 Cost of goods sold 28 29 Gross profit 30 Fixed selling expenses 31 Variable selling expenses FORMULA5 FORMULA6 32 33 Operating income 34 === ==== === 35 Income statement: Variable costing 36 37 Sales $2,400,000 38 Cost of goods sold: 39 Variable manufacturing costs 40 Less ending inventory FORMULA7 FORMULA8 41 42 Variable cost of goods sold 43 44 Manufacturing margin 45 Variable selling expenses FORMULA9 46 47 Contribution margin 48 Fixed manufacturing costs 49 Fixed selling expenses FORMULA10 $100,000 50 51 Operating income 52

6 Data Section: 7 8 Actual production in units 9 Sales in units 10 Sales price per unit 11 Variable manufacturing costs per unit 12 Variable selling costs per unit 13 Fixed manufacturing costs 14 Fixed selling expenses 100,000 80,000 $30 $14 $2 $630,000 $100,000 A 15 - 16 Answer Section: 17 Income statement: Absorption costing 18 19 Sales FORMULA1 20 Cost of goods sold: 21 Variable manufacturing costs 22 Fixed manufacturing costs FORMULA2 FORMULA3 23 24 Total goods available for sale 25 Less ending inventory FORMULA4 26 27 Cost of goods sold 28 29 Gross profit 30 Fixed selling expenses 31 Variable selling expenses FORMULA5 FORMULA6 32 33 Operating income 34 === ==== === 35 Income statement: Variable costing 36 37 Sales $2,400,000 38 Cost of goods sold: 39 Variable manufacturing costs 40 Less ending inventory FORMULA7 FORMULA8 41 42 Variable cost of goods sold 43 44 Manufacturing margin 45 Variable selling expenses FORMULA9 46 47 Contribution margin 48 Fixed manufacturing costs 49 Fixed selling expenses FORMULA10 $100,000 50 51 Operating income 52

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 3BE: Variable costingsales exceed production The beginning inventory is 52,800 units. All of the units...

Related questions

Topic Video

Question

100%

- Sales

- Variable

manufacturing cost - Fixed manufacturing cost

- Less ending inventory

- Fixed selling expenses

- Variable Selling Expenses

- Variable manufacturing cost

- Less ending inventory

- Variable selling expenses

- Fixed manufacturing cost

From the information given in the sheet determine 1-10.

Transcribed Image Text:6 Data Section:

7

8 Actual production in units

9 Sales in units

10 Sales price per unit

11 Variable manufacturing costs per unit

12 Variable selling costs per unit

13 Fixed manufacturing costs

14 Fixed selling expenses

100,000

80,000

$30

$14

$2

$630,000

$100,000

A

15 -

16 Answer Section:

17 Income statement: Absorption costing

18

19 Sales

FORMULA1

20 Cost of goods sold:

21 Variable manufacturing costs

22 Fixed manufacturing costs

FORMULA2

FORMULA3

23

24 Total goods available for sale

25 Less ending inventory

FORMULA4

26

27

Cost of goods sold

28

29 Gross profit

30 Fixed selling expenses

31 Variable selling expenses

FORMULA5

FORMULA6

32

33 Operating income

34

=== ==== ===

35 Income statement: Variable costing

36

37 Sales

$2,400,000

38 Cost of goods sold:

39 Variable manufacturing costs

40 Less ending inventory

FORMULA7

FORMULA8

41

42

Variable cost of goods sold

43

44 Manufacturing margin

45 Variable selling expenses

FORMULA9

46

47 Contribution margin

48 Fixed manufacturing costs

49 Fixed selling expenses

FORMULA10

$100,000

50

51 Operating income

52

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning