6) The investment in bonds will be initially recorded at what amount?

Q: 32.3A show the journal entries needed to correct the following errors: (a) Purchases £1,410 on…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: During 2014, Canton Company's assets increased $97,500 and their liabilities decreased $37,300.…

A: As per accounting equation, assets equals to sum of liabilities and shareholders equity.

Q: A company purchased a patent on January 1, 2014, for $1,992,000. The patent's legal life is 20 years…

A: Patents- Cost incurred to legally protect product and process ideas resulting from R&D.…

Q: Statement of Realization and Liquidation has been prepared for Promise Fulfilled Company. The totals…

A: In order to find ending cash balance we should add all cash receipt and funds available with company…

Q: The following information was gathered from the books of Gorgeous Company which is currently…

A: The amount which is available from the sale undertaken of the assets of the company after the…

Q: Sheridan Corporation had net income of $470000 and paid dividends to common stockholders of $34780…

A: There are two methods of calculation of payout ratios 1) outstanding share method (DPS/EPS) *100 2)…

Q: Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual…

A: Formula: Interest amount = Borrowed amount x Interest rate x Time period

Q: Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y5. The accounting cycle…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: ABC Co. purchased goods with invoice price of P1,000 on account on Dec. 27, 2019. The related…

A: Lets understand the basics. FOB shipping point is a term in which goods ownership gets transfer once…

Q: What is the net adjustment to Net Income as a result of the audit?

A: The amount produced by an individual or company after deducting costs, allowances, and taxes is…

Q: ! Required information [The following information applies to the questions displayed below.] Rebecca…

A: In case of accrual basis of accounting revenue and expenses are recognised in books of accounts as…

Q: Deporte Company produces single-colored t-shirts. Materials for the shirts are dyed in large vats.…

A: Accountants meticulously record data in a specific order and format. This allows them to quickly…

Q: The shareholders’ equity of ILP Industries includes the items shown below. The board of directors of…

A: The preferred shareholders receives the dividend before any dividend is paid to common stockholders.…

Q: Bonds are a common long-term debt instrument. They are interesting because they are issued with a…

A: 1. If the bond is selling at a premium is that the value of a bond is more than its face value.…

Q: , fully payable on a

A: The Kelly Ltd. Journal entries are shown as,

Q: When Job 117 was completed, direct materials totaled $9,518; direct labor, $14,467; and factory…

A: Cost per unit is calculated by dividing the total cost of production by the no. of units produced.…

Q: Working With Variances From the following data, determine the total actual costs incurred for direct…

A: 1. Total direct material variance= price variance+ Quantity variance = -3000+4000 = 1000 F Actual…

Q: The following information is for BOUNTY Company for December 2015: 1. On December 1, purchased…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: How much is the franchise revenue for 2022?

A: Introduction: Revenue is earned by a corporation that lets a third party conduct a business…

Q: D, E, and F share partnership profits in the ratio of 2:3:5. On September 30, F opted to retire from…

A: Profit sharing ratio = D:E:F = 2:3:5 Capital D =P25,000 Capital E=P40,000 Capital F= P35,000 Value…

Q: What is the amount of current assets, assuming the accounts Accounts Payable $12,000 Buildings…

A: Introduction: Current Assets: The Assets which can be easily converted in to cash with in a year…

Q: Information related to Burns Iron Works appears below. What is the ending balance in the finished…

A: Cost of goods sold is calculated by following formula: Cost of goods sold = Beginning finished goods…

Q: ABC Corp purchased goods for P20,000. Terms: less 5%, 7%, 2/10, n/30. FOB Shipping Point, Freight…

A: The accounts payable includes the amount due to be paid to suppliers for credit purchases of…

Q: Compute the net profit if, Service Revenue OMR 110,000; Other income OMR12,000; salary Expenses OMR…

A: Introduction: Income statement: All revenue and expenses are to be shown in income statement. It…

Q: Dr. Cr. (GH₵) (GH₵) Stated capital 310 Income surplus at 1 January 2017 456 Inventory at 1 January…

A: In the context of the given question, we are required to prepare a comprehensive income statement,…

Q: Since employees do not pay for their food directly, what will Jennifer likely use as the “revenue”…

A: A budget is intended to anticipate an entity's future financial outcomes and position. It is used…

Q: Happy Selling's had the following accounts atyear end: Cash-250,000, Accounts Payable-70,000,…

A: The current assets are the assets which can be converted into cash within one year. For example,…

Q: On December 27, 20x1, XYZ received a sales order for a credit sale of goods with selling price of…

A: given that, Selling price of goods = P45,000 Shippment cost = P4,500 Goods received by buyer = 2…

Q: aria pieretti wants you to deliver the goods to the port of genova . however cataria pieretti will…

A: The answer has been mentioned below.

Q: How much is the value of the note that Mi will get from the partnership?

A: Capital balances on December 31, 2008- P200,000 Add:Revaluation Profit on Furniture Fixtures-…

Q: Calculate the depreciation expense in the year of 2014 by using Straight line method Asif Company…

A: Introduction: Depreciation: Depreciation is an expense to be shown in Income statement. Decreasing…

Q: How can a bank mitigate LIQUIDITY RISK? Hold a large percentage of its liabilities in Core Deposits…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Required information [The following information applies to the questions displayed below.] Danni is…

A: Kolt is a C corporation, and Danni is a Kolt employee that works 20 hours each week. A C…

Q: 32.2 Show the journal entries necessary to correct the following errors: (a) A sale of goods £412 to…

A: The question is related to rectification of error made at the time of passing of Journal Entries.

Q: Required information [The following information applies to the questions displayed below.] Finion…

A: Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured - ending…

Q: TRS Teleconcepts, Inc. manufactures and distributes three models of handheld devices: the Flame, the…

A: Inventory: Inventory is the raw materials used in production and available for sale. The inventory…

Q: Research & Development. Edwards Corporation purchases a building for $2,000,000 which is to be used…

A: Introduction: Cost Plus Profit basis: A contract for research to be completed on a cost-plus basis…

Q: a) XYZ Ltd. Produces three products A, B and C for which the standard costs and quantities per unit…

A: ABC method allocates the overhead cost on the basis of the actual consumption. Whereas, the…

Q: Of the following, which step is not a requirement during the accounting cycle? O a. An end-of-period…

A: Eight important steps of the accounting cycle: 1. Identify transaction. 2. Record Transaction 3.…

Q: The Lodi Sports Club was formed some years ago. The club has 150 members. The annual subscription is…

A: Lets understand the basics. Receipt and payment account is prepared to know the sources from which…

Q: The following trial balance was extracted from the books of R traders at the close of business on 28…

A: 1. Income Statement - The first statement shows the income earned and loss incurred by the…

Q: ! Required information [The following information applies to the questions displayed below.]…

A: As per IRS the short term loan invested in municipal bonds is not allowed as deduction.

Q: Balance per bank..... Balance per company records...... Bank service charges..... Deposit in…

A: Introduction: BRS: BRS stands for Bank Reconciliation statement. To reconcile the difference between…

Q: 34. ABC’s checkbook balance on December 31, 20x1 was P18,500. In addition, ABC held the following…

A: Bank Reconciliation Statement: It is the statement which is prepared to reconcile the balances of…

Q: An investor was presented with a production line project in which the investment volume is 285,000…

A: The question is related to the Return on Investment and Breakeven Point. The Return on Investment is…

Q: For taxable year 2018, the company's sixth year of operations, the records of Mega Specialties, a…

A: Lets understand the basics. For solving this question, we are require to use below formula. Net…

Q: Times interest earned A company reports the following: Income before income tax $2,227,800…

A: The time interest earned ratio indicates the ability of the company to pay out its debt obligation…

Q: WHAT DOES THE AMORTIZATION SCHEDULE LOOK LIKE FOR QUESSTION 3 AND QUESTION 5

A:

Q: Calculate work in process and finished goods from job cost sheets. E3.26 (LO 3, 5) Laubitz Company…

A: The work in process includes the cost of job which is not completed yet. The finished goods…

Q: 32. In the course of our audit of Ettedanreb Corporation’s cash in bank for the year ended December…

A: Inventory and buying provide you visibility and control over the inventory obligations you've…

Step by step

Solved in 2 steps with 1 images

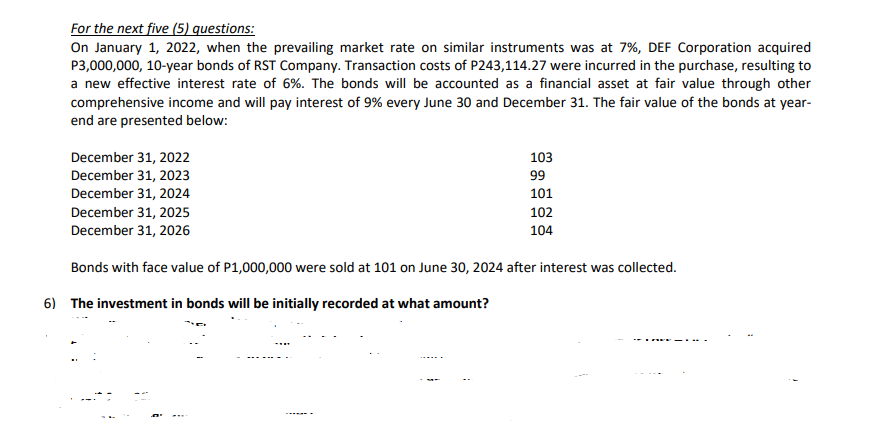

- On January 1, 2019, Brewster Company issued 2,000 of its 5-year, 1,000 face value, 11% bonds dated January 1 at an effective annual interest rate (yield) of 9%. Brewster uses the effective interest method of amortization. On December 31, 2023, Brewster extinguished the 2,000 bonds early through acquisition in the open market for 1,980,000. On July 1, 2022, Brewster issued 5,000 of its 6-year, 1,000 face value, 10% convertible bonds dated July 1 at an effective annual interest rate (yield) of 12%. The bonds are convertible at the option of the investor into Brewsters common stock at a ratio of 10 shares of common stock for each bond. Brewster uses the effective interest method of amortization. On July 1, 2023, an investor in Brewsters convertible bonds tendered 1,500 bonds for conversion into 15,000 shares of Brewsters common stock, which had a market value of 105 per share at the date of the conversion. Required: 1. Using the information about Brewster, answer the following questions: a. Were the 11% bonds issued at par, at a discount, or at a premium? Why? b. Is the amount of interest expense for the 11% bonds using the effective interest method of amortization higher in the first or second year of the life of the bond issue? Why? 2. Using the information about Brewster, explain the following: a. How is a gain or loss on early extinguishment of debt determined? Does the early extinguishment of the 11% bonds result in a gain or loss? Why? b. How does Brewster report the early extinguishment of the 11% bonds on the 2023 income statement? 3. Based on the information provided about Brewster, answer the following questions: a. Does recording the conversion of the 10% convertible bonds into common stock under the book value method affect net income? What is the rationale for the book value method? b. Does recording the conversion of the 10% convertible bonds into common stock under the market value method affect net income? What is the rationale for the market value method?Mills Company had five convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight-line method) and dividends on each security during 2019. Each convertible security is described in the following table. The corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which the securities would be included in the diluted earnings per share computations.Parilo Company acquired 170,000 of Makofske Co., 5% bonds on May 1, 2016, at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, 2016, Parilo Company sold 50,000 of the bonds for 96. Journalize entries to record the following: a. The initial acquisition of the bonds on May 1. b. The semiannual interest received on November 1. c. The sale of the bonds on November 1. d. The accrual of 1,000 interest on December 31, 2016.

- Refer to the information in RE13-5. Assume that on June 30, Aggie received interest on the Smith Corporation bonds. Prepare the June 30 journal entries to record the receipt of the interest. On April 30, 2019, Aggie Corporation purchased Smith Corporation 10%, 5-years bonds with a face value of 12,000 at par plus four months of accrued interest. Prepare the April 30 journal entry to record the purchase of these available-for-sale securities.Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.On January 1, 2015, when the prevailing effective rate on similar instruments was at 7%, INC Company acquired USD3,000,000, 10-year bonds of GHI Company. Transaction costs of USD243,114.27 were incurred in the purchase, resulting to a new effective interest rate of 6%. The bonds will be accounted as a financial asset at fair value through other comprehensive income and will pay interest of 9% every June 30 and December 31. Hence, the investments in bonds of INC Company will be initially recorded at what amount?

- On September 1, 2022, when the prevailing market rate on similar instruments was at 5%, ABC Corporation acquired P5,000,000 bonds from R Company. The bonds will be accounted as a financial asset at fair value through other comprehensive income. The bonds pay interest of 6% every March 1 and September 1 and will mature on September 1, 2027. The fair value of the bonds ( dirty price) at year end are presented below: Dec 31, 2022 107 Dec. 31,2023 105 Dec 31, 2024 103 Dec 31, 2025 104 Dec 31, 2026 101 a. what is the amount of adjustment to the unrealized gain or loss-other comprehensive income account to update the fair value of the investment on December 31, 2023? ( debit or credit?) b. prepare the journal entry to record the receipt of interest on march 1, 2024 c. what is the carrying value of the investment in bonds on december 31, 2024? d. If bonds with face value of P2,000,000 were sold at fair value on Decembe 31, 2025, ( after updating the…On January 1, 2022, BTS Company purchased 3,000, P1,000 face value term bons with a stated rate of 10% as at amortized cost. The bonds pay interest annually on December 31 and will be redeemed entirely by the issuer on December 31, 2025. The bond investment was purchased for P2,819,100 at an effective rate of 12%.On December 31, 2023, the entity changes business model for managing its financial assets and this investment as reclassified as debt investments at fair value through profit or loss. On this date, the bonds are quoted at 101. What is the carrying value of the debt investment on December 31, 2023 prior to reclassification?Lydio Company purchased P4,000,000 face value, 10%, 3-year Milo Co. bonds on January 1, 2021 whenthe prevailing market rate of interest was at 12%. Interests are collectible every December 31. Three-fourths of the Milo Co. bonds were sold on July 31, 2022 at total proceeds of P3,500,000. Yield rate at December 31, 2021 and 2022, respectively were 8% and 14%. Assuming that the company’s business model has an objective of holding the debt securities to collect contractual cash flows, what is the realizedgain on sale of Milo Co. bonds?QUESTION 1. Assuming that the company’s business model has an objective of holding the debt securities to collect contractual cash flows and to sell, how much is the interest income in its statement of comprehensive income for the period ending December 31, 2022?QUESTION 2. Assuming that the company’s business model has no objective of holding the debt securities to collect contractual cash flows, the investment is reported in the statement of financial…

- On January 1, 2020, CullumberCorporation purchased 335 of the $1,000 face value, 6%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2030, and pay interest annually beginning January 1, 2021. Cullumber purchased the bonds to yield 11%. How much did Cullumber pay for the bonds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Cullumber must pay for the bonds $enter a dollar amountOn Jan. 1, 2018, ABC acquired P5,000,000 face value bonds as aninvestment that will provide contractual cashflows. On acquisitiondate, it had a fair value of P5,400,000, transaction cost of P10,020,nominal interest rate of 9% payable every Jan. 1, a term of 5 years,and an effective interest rate of 7%. The bonds were valued asfollows: Date Fair Value Date Fair ValueDec. 31, 2018 5,300,000 Dec. 31, 2021 5,100,000Dec. 31, 2019 5,150,000 Dec. 31, 2022 5,050,000Dec. 31, 2020 5,200,000 Dec. 31, 2023 5,000,000 If on Dec. 15, 2021, there was change in the purpose ofholding the asset to trading only and it qualifies forreclassification, what is the journal entry for transfer theinvestment to the new account?On January 1, 2020 Chicken Wings Company purchased P3,000,000, 8% bonds of Fried Chicken Corporation for an amount that yields 10%. Interest is payable every June 30 and December 31 of the year. The bonds will mature on December 31, 2024. The business model of the entity is to collect the contractual cash flows which represent sole payment of principal and interest. On April 1, 2022, to pay maturing obligations, Chicken Wings Company sold P1,000,000 face value bonds for total proceeds of 104. Additionally, Fried Chicken Corporation is currently financially distressed and after paying the amount due on December 31, 2022 was unable to meet the original terms of the contract. Fried Chicken Corporation arrange for negotiation by lowering the interest rate from 8% to 4% for the remaining terms.How much is the total (net) impact in the profit or loss of the bond transactions for the year 2022?