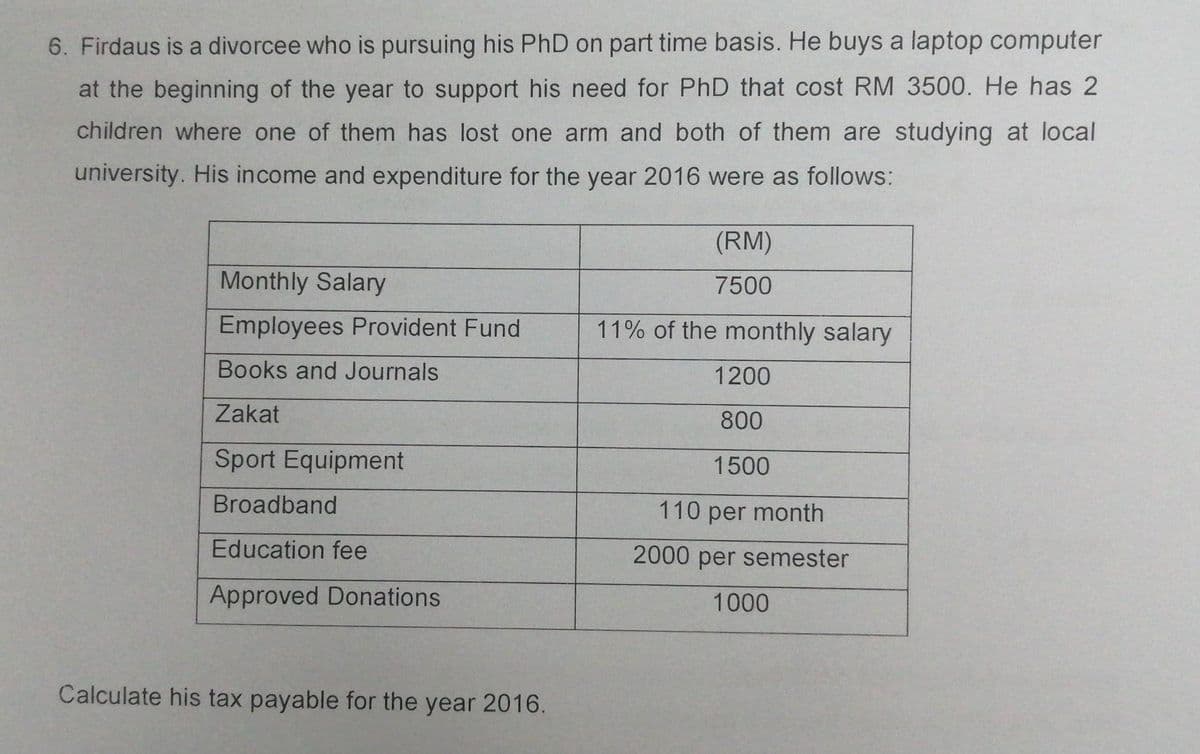

6. Firdaus is a divorcee who is pursuing his PhD on part time basis. He buys a laptop computer at the beginning of the year to support his need for PhD that cost RM 3500. He has 2 children where one of them has lost one arm and both of them are studying at local university. His income and expenditure for the year 2016 were as follows: (RM) Monthly Salary 7500 Employees Provident Fund 11% of the monthly salary Books and Journals 1200 Zakat 800 Sport Equipment 1500 Broadband 110 per month Education fee 2000 per semester Approved Donations 1000 Calculate his tax payable for the year 2016.

6. Firdaus is a divorcee who is pursuing his PhD on part time basis. He buys a laptop computer at the beginning of the year to support his need for PhD that cost RM 3500. He has 2 children where one of them has lost one arm and both of them are studying at local university. His income and expenditure for the year 2016 were as follows: (RM) Monthly Salary 7500 Employees Provident Fund 11% of the monthly salary Books and Journals 1200 Zakat 800 Sport Equipment 1500 Broadband 110 per month Education fee 2000 per semester Approved Donations 1000 Calculate his tax payable for the year 2016.

Chapter7: Tax Credits

Section: Chapter Questions

Problem 12MCQ

Related questions

Question

Transcribed Image Text:6. Firdaus is a divorcee who is pursuing his PhD on part time basis. He buys a laptop computer

at the beginning of the year to support his need for PhD that cost RM 3500. He has 2

children where one of them has lost one arm and both of them are studying at local

university. His income and expenditure for the year 2016 were as follows:

(RM)

Monthly Salary

7500

Employees Provident Fund

11% of the monthly salary

Books and Journals

1200

Zakat

800

Sport Equipment

1500

Broadband

110 per month

Education fee

2000 per semester

Approved Donations

1000

Calculate his tax payable for the year 2016.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you