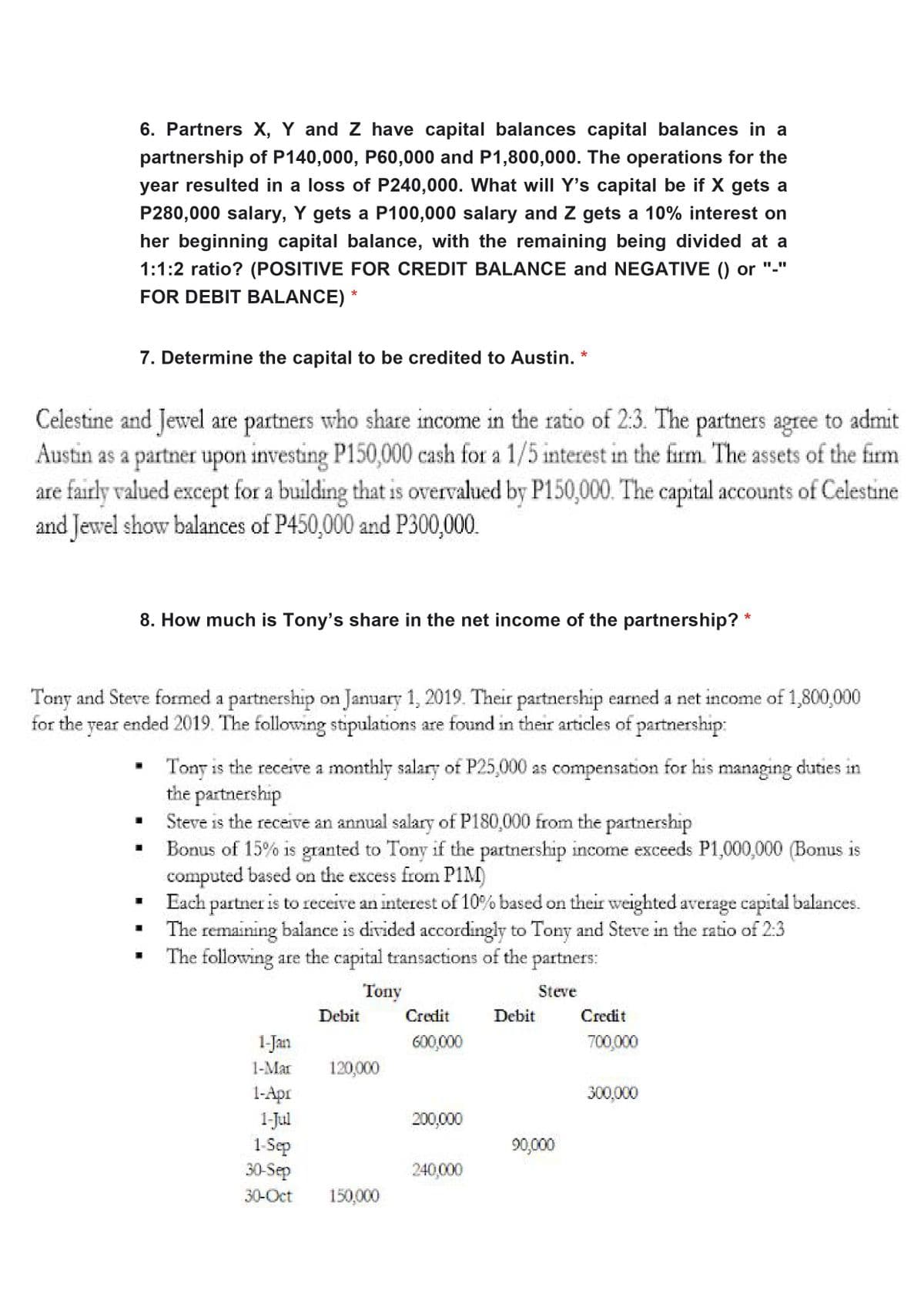

6. Partners X, Y and Z have capital balances capital balances in a partnership of P140,000, P60,000 and P1,800,000. The operations for the year resulted in a loss of P240,000. What will Y's capital be if X gets a P280,000 salary, Y gets a P100,000 salary and Z gets a 10% interest on her beginning capital balance, with the remaining being divided at a 1:1:2 ratio? (POSITIVE FOR CREDIT BALANCE and NEGATIVE () or "-" FOR DEBIT BALANCE)

6. Partners X, Y and Z have capital balances capital balances in a partnership of P140,000, P60,000 and P1,800,000. The operations for the year resulted in a loss of P240,000. What will Y's capital be if X gets a P280,000 salary, Y gets a P100,000 salary and Z gets a 10% interest on her beginning capital balance, with the remaining being divided at a 1:1:2 ratio? (POSITIVE FOR CREDIT BALANCE and NEGATIVE () or "-" FOR DEBIT BALANCE)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

Kindly answer all the problems number 6-10. Please. Thank you

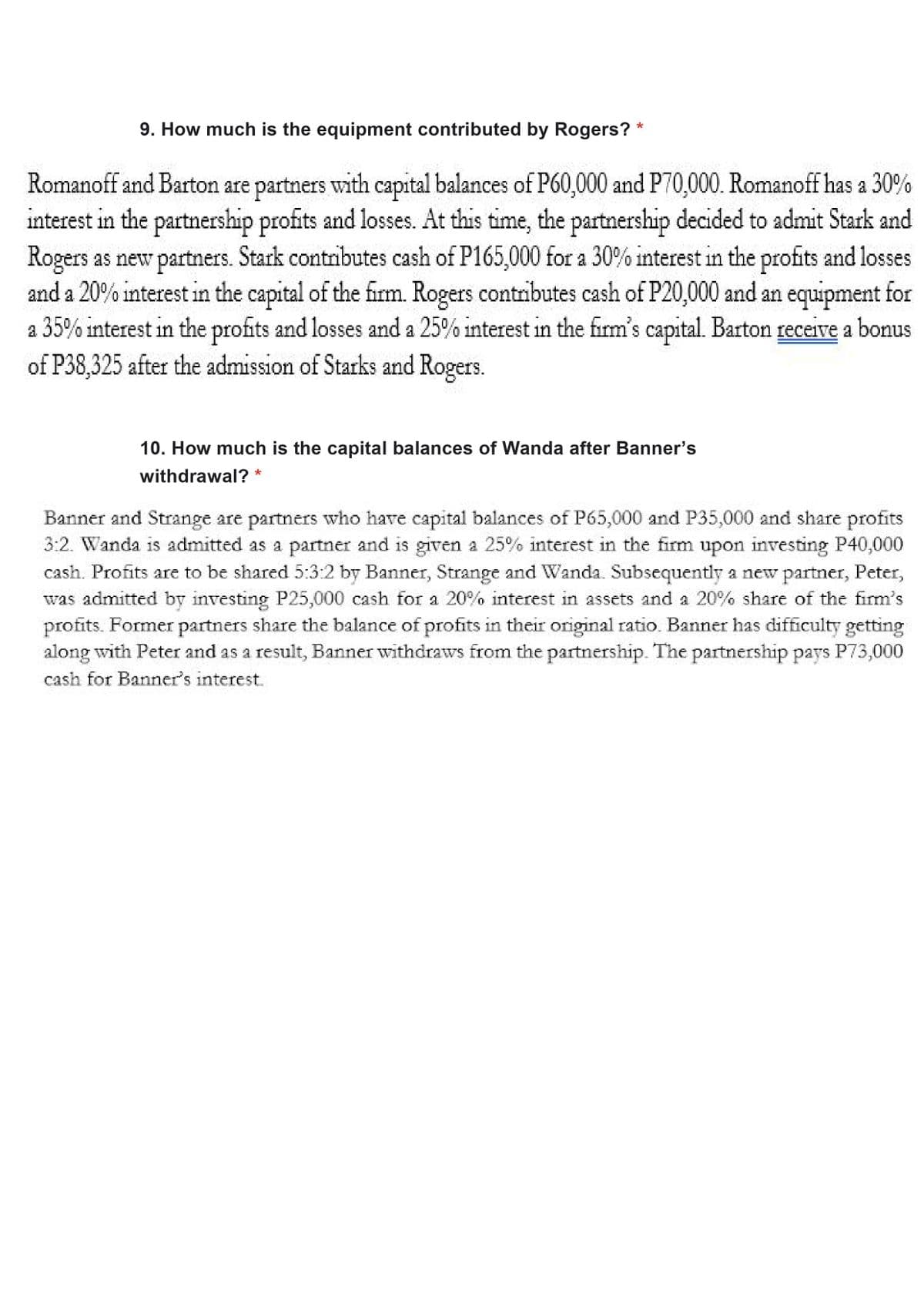

Transcribed Image Text:9. How much is the equipment contributed by Rogers?

Romanoff and Barton are partners with capital balances of P60,000 and P70,000. Romanoff has a 30%

interest in the partnership profits and losses. At this time, the partnership decided to admit Stark and

Rogers as new partners. Stark contributes cash of P165,000 for a 30% interest in the profits and losses

and a 20% interest in the capital of the firm. Rogers contributes cash of P20,000 and an equipment for

a 35% interest in the profits and losses and a 25% interest in the firm's capital. Barton receive a bonus

of P38,325 after the admission of Starks and Rogers.

10. How much is the capital balances of Wanda after Banner's

withdrawal? *

Banner and Strange are partners who have capital balances of P65,000 and P35,000 and share profits

3:2. Wanda is admitted as a partner and is given a 25% interest in the firm upon investing P40,000

cash. Profits are to be shared 5:3:2 by Banner, Strange and Wanda. Subsequently a new partner, Peter,

was admitted by investing P25,000 cash for a 20% interest in assets and a 20% share of the firm's

profits. Former partners share the balance of profits in their original ratio. Banner has difficulty getting

along with Peter and as a result, Banner withdraws from the partnership. The partnership pays P73,000

cash for Banner's interest.

Transcribed Image Text:6. Partners X, Y and Z have capital balances capital balances in a

partnership of P140,000, P60,000 and P1,800,000. The operations for the

year resulted in a loss of P240,000. What will Y's capital be if X gets a

P280,000 salary, Y gets a P100,000 salary and Z gets a 10% interest on

her beginning capital balance, with the remaining being divided at a

1:1:2 ratio? (POSITIVE FOR CREDIT BALANCE and NEGATIVE () or

II II

FOR DEBIT BALANCE)

7. Determine the capital to be credited to Austin. *

Celestine and Jewel are partners who share income in the ratio of 2:3. The partners agree to admit

Austin as a partner upon investing P150,000 cash for a 1/5 interest in the firm. The assets of the firm

are fairly valued except for a building that is overvalued by P150,000. The capital accounts of Celestine

and Jewel show balances of P450,000 and P300,000.

8. How much is Tony's share in the net income of the partnership? *

Tony and Steve formed a partnership on January 1, 2019. Their partnership earned a net income of 1,800,000

year ended 2019. The following stipulations are found in their articles of partnership:

for the

Tony is the receive a monthly salary of P25,000 as compensation for his managing duties in

the partnership

Steve is the receive an annual salary of P180,000 from the partnership

Bonus of 15% is granted to Tony if the partnership income exceeds P1,000,000 (Bonus is

computed based on the excess from P1M)

Each partner is to receive an interest of 10% based on their weighted average capital balances.

The remaining balance is divided accordingly to Tony and Steve in the ratio of 2:3

The following are the capital transactions of the partners:

111

Tony

Steve

Debit

Credit

Debit

Credit

1-Jan

G00,000

700,000

1-Mar

120,000

1-Apr

1-Jul

1-Sep

30-Sep

300,000

200,000

90,000

240,000

30-Oct

150,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT